Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market expansion faces a substantial hurdle in the form of intensifying regulatory pressures resulting from global decarbonization directives. Rigorous environmental regulations compel operators to lower carbon intensity, a requirement that frequently shifts capital away from conventional exploration and reservoir assessment toward renewable energy initiatives. This transition introduces uncertainty regarding the feasibility of new fossil fuel projects and adds complexity to investment strategies, which may restrict reservoir analysis operations in regions enforcing strict climate goals.

Market Drivers

The swift adoption of artificial intelligence and advanced analytics within reservoir modeling is transforming the industry by automating intricate workflows and improving prediction precision. By utilizing machine learning algorithms to analyze extensive seismic and production data, operators can drastically cut the time needed for history matching and development planning. This shift toward digitalization facilitates a more accurate understanding of subsurface variations, resulting in better well positioning and higher recovery rates. The strong market uptake of these technologies is highlighted by SLB’s January 2025 financial report, which indicated a 20% year-over-year increase in digital revenue to $2.44 billion, demonstrating the sector's robust commitment to cloud-based and AI-enhanced reservoir tools.Simultaneously, the use of reservoir analysis for Carbon Capture, Utilization, and Storage (CCUS) initiatives has become a vital growth area as the industry moves toward decarbonization. Thorough subsurface evaluation is essential for confirming storage limits, maintaining caprock stability, and tracking CO2 movement to avoid leaks. This sector is experiencing significant growth; the Global CCS Institute’s October 2024 report revealed a 60% year-on-year rise in pipeline CCS facilities, totaling 628 projects. This increase is backed by a supportive investment environment, with the International Energy Agency noting in 2024 that global upstream oil and gas investment was projected to grow by 7% to $570 billion, supplying the required funding for both conventional and transition-oriented reservoir assessments.

Market Challenges

Mounting regulatory pressure resulting from global decarbonization mandates poses a major obstacle to the growth of the reservoir analysis sector. Governments around the globe are enforcing strict environmental standards that require energy companies to drastically lower their carbon intensity. This regulatory landscape often demands that capital expenditures be shifted from conventional exploration and reservoir evaluation toward renewable energy projects and compliance efforts. As a result, budgets for traditional subsurface assessments are squeezed, causing reservoir characterization projects to be postponed or canceled in areas with ambitious climate goals.This shift generates investment uncertainty concerning the long-term feasibility of new fossil fuel ventures. Reluctance to allocate capital to long-term hydrocarbon projects directly dampens the demand for technical assessment services. The International Energy Agency reported in 2024 that for every dollar spent on fossil fuels, roughly two dollars were directed toward clean energy technologies. This financial gap emphasizes the movement of funds away from the traditional oil and gas industry, restricting the capital available for thorough reservoir analysis and consequently constraining the overall growth of the market.

Market Trends

Subsurface hydrogen storage analysis is developing into a key trend, separating itself from conventional hydrocarbon or carbon sequestration studies. Operators are increasingly assessing salt caverns and porous media to balance intermittent renewable energy supplies, a process that necessitates specialized modeling of gas containment, fluid dynamics, and geochemical interactions. This niche demand for reservoir characterization is fueled by the fast-growing hydrogen economy; the International Energy Agency’s 'Global Hydrogen Review 2025' from September 2025 notes over 200 committed investments in low-emission hydrogen projects, establishing a pressing need for confirmed subsurface storage capacity to handle supply variations.Simultaneously, the deployment of real-time downhole monitoring systems is transforming reservoir management by delivering immediate insights into fracture growth and reservoir behavior. Utilizing advanced fiber-optic sensors and smart downhole gauges allows engineers to modify stimulation parameters instantly, thereby optimizing the stimulated reservoir volume and enhancing recovery rates in difficult fields. The enduring demand for these precise diagnostic tools is reflected in recent financial reports; Baker Hughes stated in its February 2025 '2024 Annual Report' that its Oilfield Services and Equipment segment secured orders totaling $15.2 billion in 2024, indicating strong operator spending on sophisticated subsurface technologies.

Key Players Profiled in the Reservoir Analysis Market

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Incorporated

- Weatherford International, PLC

- CGG SA

- Core Laboratories Inc.

- Tracerco Ltd.

- Geokinetics, Inc.

- National Oilwell Varco, Inc.

- Expro Group

Report Scope

In this report, the Global Reservoir Analysis Market has been segmented into the following categories:Reservoir Analysis Market, by Reservoir Type:

- Conventional

- Unconventional

Reservoir Analysis Market, by Service:

- Geo Modelling

- Reservoir Simulation

- Data Acquisition & Monitoring

- Reservoir Sampling

Reservoir Analysis Market, by Application:

- Onshore

- Offshore

Reservoir Analysis Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Reservoir Analysis Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Reservoir Analysis market report include:- Schlumberger Limited

- Halliburton Company

- Baker Hughes Incorporated

- Weatherford International, PLC

- CGG SA

- Core Laboratories Inc.

- Tracerco Ltd

- Geokinetics, Inc.

- National Oilwell Varco, Inc

- Expro Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

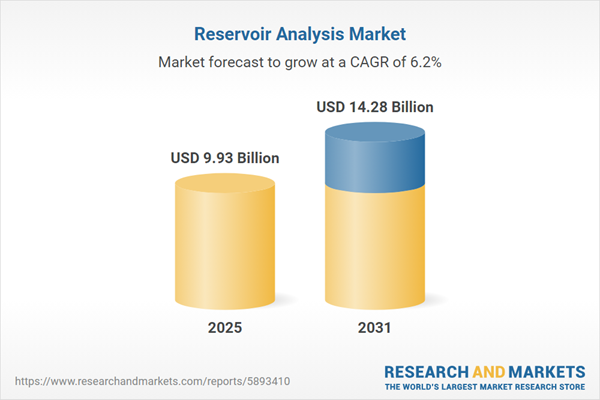

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 9.93 Billion |

| Forecasted Market Value ( USD | $ 14.28 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |