Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, the market encounters significant challenges regarding the complexity and high costs associated with retrofitting existing substations. Implementing modern protection solutions in legacy systems often necessitates substantial engineering modifications and risks service interruptions, which can discourage utility operators from initiating upgrades. These technical and financial constraints complicate project execution and tend to slow the adoption rate of advanced busbar safety measures, particularly in cost-sensitive regions.

Market Drivers

The modernization of aging transmission and distribution infrastructure serves as a primary catalyst for the global busbar protection market. As legacy grid assets approach the end of their operational lifecycles, utilities are prioritizing the retrofit of substations with advanced digital relaying systems to ensure personnel safety and network reliability.This overhaul is critical to mitigate the risks associated with electromechanical device failures and to accommodate increasing load densities in urban centers. Demonstrating the magnitude of this structural upgrade, the Edison Electric Institute (EEI) noted in its July 2025 '2024 Financial Review' that U.S. investor-owned electric companies invested a record $178.2 billion in 2024 to make the energy grid smarter, stronger, and more secure. This substantial capital deployment directly drives demand for modern busbar protection schemes that facilitate rapid fault isolation and minimize outage durations during complex grid disturbances.

Concurrently, the accelerating integration of renewable energy sources is fundamentally reshaping protection requirements, thereby fueling market expansion. The transition from centralized fossil-fuel generation to distributed resources like wind and solar introduces variable fault current levels and bidirectional power flows, which challenge the sensitivity and selectivity of traditional protection logic.

To manage these dynamics, operators are increasingly adopting numerical relays capable of adaptive settings and high-speed communication. According to the International Renewable Energy Agency (IRENA) in its 'Renewable Capacity Statistics 2025' released in March 2025, the global power sector added a record 585 GW of renewable capacity in 2024, creating an urgent need for grid reinforcement. Reflecting this surge in demand for grid stability solutions, Siemens Energy reported a 25.8% revenue increase in its Grid Technologies business unit during the third quarter of fiscal year 2025, underscoring the vital role of advanced protection infrastructure in the energy transition.

Market Challenges

The complexity and high cost associated with retrofitting existing substations present a formidable barrier to the growth of the global busbar protection market. Utility operators often hesitate to replace legacy protection schemes because these older systems are deeply integrated into the substation's physical and electrical architecture. Upgrading these assets necessitates extensive engineering re-evaluations and physical modifications, which inevitably lead to planned service interruptions. In an industry where grid availability is paramount, the operational risk of downtime combined with the financial burden of complex engineering labor causes significant delays in project approval and execution.These logistical hurdles are compounded by the immense capital pressure already placed on transmission network operators. Financial resources are often stretched thin across general infrastructure maintenance and mandatory capacity expansions, forcing utilities to scrutinize every additional expense. According to the Edison Electric Institute, in 2024, investor-owned electric companies in the United States were projected to invest USD 34.3 billion specifically in transmission infrastructure. When faced with such substantial baseline capital expenditures, decision-makers are compelled to deprioritize difficult retrofit projects that carry high execution risks, thereby directly slowing the adoption rate of modern busbar protection technologies in established markets.

Market Trends

The rapid digitalization of substation protection systems is fundamentally transforming the market by replacing traditional hardwired copper connections with fiber-optic communication networks. This transition enables the deployment of process bus architectures and digital twins, which significantly reduce physical infrastructure costs while enhancing data granularity for fault analysis. Utilities are aggressively adopting these digital solutions to manage the increasing complexity of grid operations and to facilitate seamless interoperability between devices from different vendors. Underscoring this accelerating demand for modernized grid infrastructure, Siemens Energy reported in its November 2024 'Earnings Release Q4 FY 2024' that the Grid Technologies business unit achieved a comparable revenue growth of 32.2% for the fiscal year, driven largely by the global surge in transmission system upgrades and digital substations.Simultaneously, the utilization of predictive maintenance capabilities is emerging as a critical trend, shifting protection strategies from time-based schedules to condition-based monitoring. Advanced sensors and analytics platforms now continuously assess the health of busbar protection units, identifying potential failures before they lead to catastrophic outages. This proactive approach optimizes asset lifecycles and reduces operational expenditures by eliminating unnecessary manual inspections. Reflecting the industry's focus on these intelligent technologies, Hitachi Energy announced in a June 2024 press release, 'Hitachi Energy to invest additional $4.5 billion by 2027,' that digitally enabled transformers and platforms like Lumada Asset Performance Management are becoming critical for ensuring a sustainable and flexible energy system, prompting their massive capital expansion in manufacturing capacity.

Key Players Profiled in the Busbar Protection Market

- Hitachi Energy Ltd.

- ABB Ltd.

- Schneider Electric Global

- GE Grid Solution

- Siemens AG

- Mitsubishi Electric Corporation

- NR Electric Co., Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Eaton Corporation

- ZIV Automation

Report Scope

In this report, the Global Busbar Protection Market has been segmented into the following categories:Busbar Protection Market, by Type:

- Low (Up To 125 A)

- Medium (126 A to 800 A)

- High (above 801 A)

Busbar Protection Market, by Impedance:

- High Impedance

- Low Impedance

Busbar Protection Market, by End User:

- Utilities

- Industrial

- Residential

- Others

Busbar Protection Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Busbar Protection Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Busbar Protection market report include:- Hitachi Energy Ltd.

- ABB Ltd.

- Schneider Electric Global

- GE Grid Solution

- Siemens AG

- Mitsubishi Electric Corporation

- NR Electric Co., Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Eaton Corporation

- ZIV Automation

Table Information

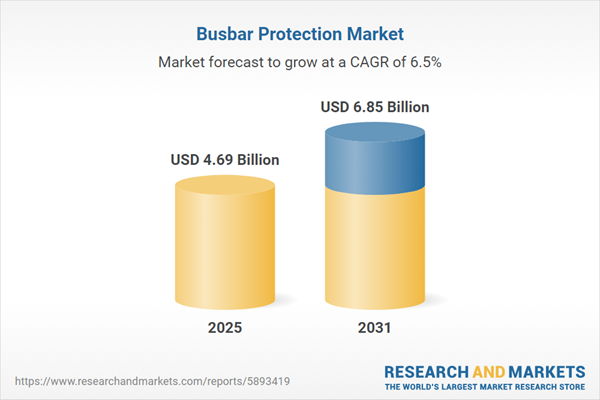

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 4.69 Billion |

| Forecasted Market Value ( USD | $ 6.85 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |