Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Grid-scale batteries, also known as large-scale energy storage, is a technology that allows utilities and grid operators to store energy for later use. An electrochemical device called a battery energy storage system (BESS) charges (or gathers) energy from a power plant or a grid. When electricity or other grid services are required, it then releases that energy.

Electrical energy is stored during periods of high supply and low cost (especially from intermittent power sources like renewable electricity from wind, tidal, and solar power) or low demand, and then released back into the grid during periods of low supply and generally higher cost of electricity.

Moreover, by storing any extra generated energy and smoothing the energy output through a process known as capacity firming, utility-scale battery storage devices can permit higher penetration of fluctuating renewable energy into the grid. Battery storage solutions, when used in conjunction with renewable energy generators like wind, hydro, or solar (PV), can unleash the full potential of renewable energy by delivering more dependable and significantly less expensive electricity in remote grids and off-grid communities that would otherwise have to rely on costly imported diesel for their electricity generation. The rise of the grid-scale battery business is being driven by the move towards renewable energy.

The utilization of technology significantly contributes to time and resource efficiency. Renewable energy sources such as solar and wind power enable the production, storage, and consumption of electricity. By integrating the Internet of Things (IoT) with energy-saving equipment, electricity providers can reduce costs and minimize their environmental impact. They gain a deeper understanding of energy usage through IoT device data, which can be leveraged for load balancing, demand forecasting, and strategic planning. Energy storage solutions also offer backup power during unexpected grid interruptions, ensuring uninterrupted operations.

Increase in Renewable Energy Production Supporting the Growth of the Global Grid-Scale Battery Market

Battery Energy Storage System (BESS) has been able to play a significant role in the energy industry due to the rise in the demand for system flexibility and the quick decline in the cost of battery technology. Energy storage system is being adopted by several regulators, utilities, and policymakers, which is fostering the expansion of the grid-scale battery market.The demand for grid-scale batteries is anticipated to increase over the next several years because of the depletion of fossil fuels and the accelerated adoption of government legislation to promote renewable energy. Through power equipment, microgrids are connected to power produced by renewable sources. Later, this energy is made available to buildings, commercial spaces, and electrical grid locations.

For instance, according to International Energy Agency (IEA), the demand for all other fuels declined in 2020 while renewable energy’s demand increased by 3%. The increased use of renewable energy is largely due to solar PVs and wind energy. In 2021, China alone was responsible for almost half of the increase in renewable electricity globally, with the U.S., the EU, and India following closely behind. As a result, the global grid-scale battery market is expected to rise due to the spike in the use of renewable energy.

Rise in Demand for Energy

Globally, energy demand has increased dramatically because of rapid industrialization and urbanization. Additionally, Asia-Pacific's high energy consumption is a result of rising infrastructure spending. According to the International Energy Agency (IEA), Asia Pacific's power demand rose from 2% in 2020 to about 8% in 2021. China and India, both saw a growth in energy demand of 10% in 2021.Moreover, in areas with extra capacity for coal plants, natural gas is replacing coal for the generation of electricity. Due to rising gas prices and supply issues, many nations are working to cut back on its dependency on Russian gas supplies. With a rise in population and rapid industrial development, the world's energy consumption is shifting proportionally to developing economies. This is expected to drive the market growth of global grid-scale battery during the forecast period.

R&D in Grid-scale Energy Storage Technologies driving the market for Grid-scale Battery

Manufacturers are now creating improved power devices. Technologies for long-term energy storage are becoming more popular in the market. Mechanical energy storage and thermal energy storage are two more forms of storage technologies that are in significant demand in the market.In the upcoming years, it is anticipated that grid-scale battery storage businesses would invest in technological breakthroughs. These improvements mainly consist of simulation and computing tools, which are used in the design stage to satisfy client needs and handle varied power system difficulties. The use of automated manufacturing techniques has increased as a means of producing high-quality storage systems faster. As a result, it is projected that this would open significant growth potential for industry participants.

Technological Advancements in Grid-scaler Battery to Drive Market Growth

Numerous benefits of energy storage include the integration of various resources and increased dependability and resilience. Grid-scale batteries also offer the benefit of arbitrage. Arbitrage involves recharging the battery during cheaper off-peak periods and charging it during more expensive peak periods. By taking advantage of the fluctuating daily electricity costs, this practice can generate income for the battery energy storage systems (BESS) operator. Moreover, the decrease of renewable energy curtailment is a further development of the energy arbitrage service. Utilizing as much affordable and emission-free renewable energy generation as possible is of importance to plant operators. However, the limited flexibility of conventional generators and timing differences between the supply of renewable energy and the demand for electricity might force renewable generators to throttle their output in systems with an increasing share of variable renewable energy (VRE) but, It turns out to be profitable for plant operators to charge the battery with inexpensive energy during periods of excess renewable generation and discharge it during periods of high demand.Market Segmentation

The global grid scale battery market is segmented based on battery type, ownership, application, and region. Based on battery type, the market is bifurcated into lead-acid, sodium-based, redox flow, lithium-ion, and others. Based on ownership, the market is further bifurcated into third-party owned and utility owned. Based on application, the market is bifurcated into renewables, peak shifting, ancillary services, backup power, and others. Based on region, the market is further bifurcated into North America, Asia-Pacific, Europe, South America, and Middle East & Africa.Market Players

The main market players in the global grid scale battery market are Panasonic Corporation, LG Chem Ltd., Contemporary Amperex Technology Co Ltd, Samsung SDI Co. Ltd., BYD Co Ltd, East Penn Manufacturing Company, GS Yuasa Corporation, NGK Insulators, Ltd., Toshiba Corporation, and Redflow Limited.Report Scope:

In this report, the global grid scale battery market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Grid Scale Battery Market, By Battery Type:

- Lead-acid

- Sodium-based

- Redox Flow

- Lithium-ion

- Others

Grid Scale Battery Market, By Ownership:

- Third-party Owned

- Utility Owned

Grid Scale Battery Market, By Application:

- Renewables

- Peak Shifting

- Ancillary Services

- Backup Power

- Others

Grid Scale Battery Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- India

- Japan

- South Korea

- Australia

- China

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Middle East

- Saudi Arabia

- South Africa

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global grid scale battery market.Available Customizations:

Global grid scale battery market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Panasonic Corporation

- LG Chem Ltd.

- Contemporary Amperex Technology Co Ltd

- Samsung SDI Co. Ltd.

- BYD Co Ltd

- East Penn Manufacturing Company

- GS Yuasa Corporation

- NGK Insulators, Ltd.

- Toshiba Corporation

- Redflow Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | October 2023 |

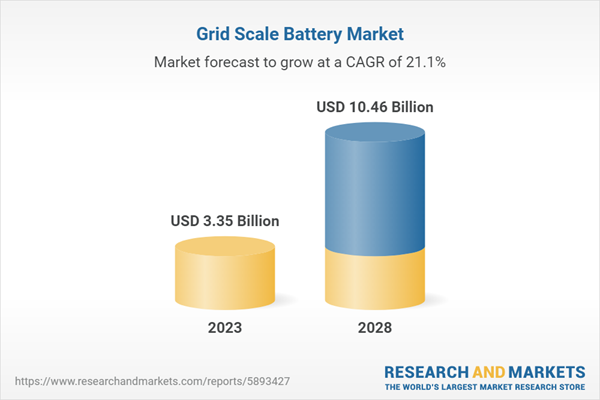

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 3.35 Billion |

| Forecasted Market Value ( USD | $ 10.46 Billion |

| Compound Annual Growth Rate | 21.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |