Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Furthermore, a growing shift toward eco-friendly, water-based products - driven by environmental awareness, stricter regulations, and the adoption of green building norms - is reshaping product innovation and formulation strategies. Governments in the region are introducing VOC emission regulations, prompting manufacturers to focus on sustainable and high-performance coatings. This regulatory push, combined with smart city initiatives and infrastructure modernization, is driving advancements in product durability, environmental safety, and functional performance, supporting robust growth in the regional paints and coatings industry.

Key Market Drivers

Rapid Urbanization and Infrastructure Growth

The Asia-Pacific region is undergoing swift urban development, especially in countries like China, India, Indonesia, and Vietnam, which is significantly boosting demand for paints and coatings across both new construction and refurbishment projects. As of 2024, over 55% of the population resides in urban areas - a figure expected to climb to nearly 65% by 2030. Governments are actively investing in smart city development and infrastructure enhancements, including housing, commercial buildings, bridges, airports, and metro systems. In India, for example, more than 100 smart city projects are progressing, stimulating the need for protective coatings on steel, concrete, and wooden surfaces.Around 20 million new residential units are also being constructed annually, contributing to increased consumption of both interior and exterior coatings. Maintenance activities for public infrastructure, growing at an estimated 10% per year, are also driving recurring demand. Paints and coatings are now essential not only for aesthetic purposes but also for protecting structures against environmental damage. This rising need has prompted manufacturers to scale up production capacities across Southeast Asia, establishing urban and infrastructure growth as a key market driver.

Key Market Challenges

Fluctuating Raw Material Prices

The volatility in raw material costs remains a major challenge for the Asia-Pacific paints and coatings market. Essential inputs such as titanium dioxide, resins, acrylics, and solvents are subject to frequent price fluctuations driven by crude oil market dynamics, geopolitical instability, and global supply chain constraints. As many countries in the region, including India and Vietnam, rely on imports for these materials, any disruption significantly impacts production costs.Titanium dioxide alone can constitute up to a quarter of the cost in decorative coatings, and its price has seen considerable variability due to mining and refining issues worldwide. These unpredictable costs compress profit margins, especially for smaller manufacturers who struggle to pass on increases to price-sensitive consumers. Even larger companies, constrained by long-term contracts, face challenges in adjusting pricing rapidly. Consequently, the instability in raw material pricing adds complexity to production planning, procurement, and competitive positioning within the market.

Key Market Trends

Surge in Demand from Infrastructure and Smart City Projects

Infrastructure development and smart city initiatives are emerging as dominant trends influencing the paints and coatings market across Asia-Pacific. Countries such as India, China, and Indonesia are investing heavily in public infrastructure, including transport systems, urban housing, and civic amenities. Projects like India’s Smart Cities Mission and China’s Belt and Road Initiative are contributing to large-scale demand for specialty coatings used in tunnels, bridges, high-rises, and public facilities. These infrastructure-related coatings require advanced properties such as self-cleaning, heat reflectivity, anti-graffiti, and corrosion resistance to withstand environmental stress and ensure long-term durability. As a result, manufacturers are innovating to develop products that offer both functional performance and regulatory compliance. These coatings are becoming integral to modern infrastructure, reinforcing this trend as a major growth catalyst for the industry.Key Market Players

- Kansai Paint Co. Ltd

- Nippon Paint Holdings Co. Ltd

- Asian Paints Ltd

- Avian Brands

- Shalimar Paints Limited

- Berger Paints India Limited

- Chugoku Marine Paints Ltd

- PPG Industries, Inc.

- Akzo Nobel N.V

Report Scope:

In this report, the Asia-Pacific Paints & Coating Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia-Pacific Paints & Coating Market, By Technology:

- Water-borne

- Solvent-borne

- Powder

- Others

Asia-Pacific Paints & Coating Market, By Resin Type:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

Asia-Pacific Paints & Coating Market, By End-User Industry:

- Architectural/Decorative

- Automotive

- Wood

- Protective

- General Industrial

- Transportation

- Packaging

Asia-Pacific Paints & Coating Market, By Country:

- China

- Japan

- India

- South Korea

- Australia

- Singapore

- Thailand

- Malaysia

- Rest of Asia-Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia-Pacific Paints & Coating Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Kansai Paint Co. Ltd

- Nippon Paint Holdings Co. Ltd

- Asian Paints Ltd

- Avian Brands

- Shalimar Paints Limited

- Berger Paints India Limited

- Chugoku Marine Paints Ltd

- PPG Industries, Inc.

- Akzo Nobel N.V

Table Information

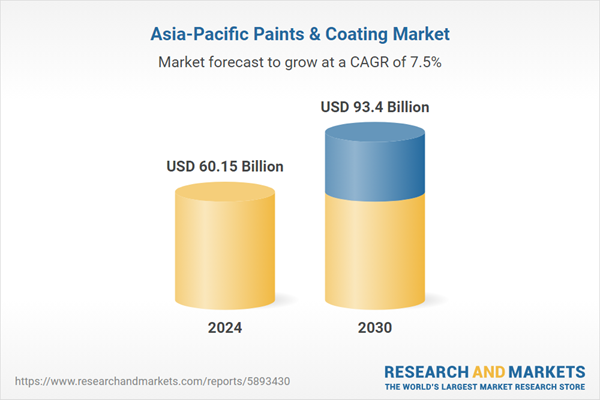

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 60.15 Billion |

| Forecasted Market Value ( USD | $ 93.4 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 9 |