Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This sector plays a critical role in supporting digital infrastructure, automating business operations, and enabling smart technologies across industries including healthcare, finance, education, and oil & gas. IT services in Saudi Arabia are often delivered by both global tech firms and local providers, making the market highly dynamic and competitive.

The market is witnessing rapid growth due to multiple driving forces. A key factor is the Saudi government’s Vision 2030 initiative, which aims to diversify the economy beyond oil by investing heavily in digital transformation and smart city projects like NEOM. Public and private sectors are increasingly adopting advanced technologies such as AI, IoT, and cloud platforms to enhance operational efficiency and customer experience. The growing awareness of cybersecurity threats has also led to increased spending on IT security services, further propelling market growth.

The Saudi IT Services Market is expected to expand significantly due to rising internet penetration, a youthful tech-savvy population, and proactive regulatory support for digital innovation. The government’s focus on local talent development in IT and initiatives like the National Digital Transformation Unit will boost domestic capabilities and attract foreign investment. As businesses modernize their IT infrastructure, the demand for managed services, cloud migration, and data-driven solutions will continue to rise, positioning Saudi Arabia as a leading tech hub in the Middle East.

Key Market Drivers

Vision 2030 and Government-led Digital Transformation Initiatives

Saudi Arabia’s Vision 2030 serves as the cornerstone for the nation’s digital revolution and is a primary catalyst for the expansion of its Information Technology Services Market. This ambitious strategic framework, launched by the Kingdom’s leadership, aims to diversify the economy away from oil dependency and establish a knowledge-based society through the modernization of infrastructure, smart governance, and national digitization. As part of this initiative, the government is rapidly digitizing public services, healthcare, education, and law enforcement systems, creating an unprecedented demand for enterprise-grade Information Technology services and solutions. Key programs such as the e-Government initiative, the Smart Government Strategy, and the National Transformation Program are injecting significant investments into building scalable, secure, and citizen-centric digital platforms.The rollout of next-generation technologies - including blockchain for public records, artificial intelligence-driven services for urban planning, and cloud computing for government data - has required specialized Information Technology service providers to design, implement, and manage complex digital ecosystems. The government is also actively encouraging private sector collaboration through partnerships, outsourcing, and incentive schemes to drive innovation in the Information Technology space.

These actions are not only fostering a high-velocity environment for technological adoption but are also strengthening the regulatory frameworks to support digital compliance, privacy, and data sovereignty, thereby building confidence in the digital economy. As Vision 2030 accelerates, the need for end-to-end Information Technology services across architecture, integration, and managed operations continues to rise. According to the Saudi Data and Artificial Intelligence Authority (SDAIA), over 130 digital government services were rolled out across 24 ministries by 2023. This rapid digitization effort reflects the government's firm commitment to streamlining public service delivery and reducing bureaucratic friction, thereby creating sustained demand for Information Technology service providers to manage, upgrade, and secure these evolving digital platforms.

Key Market Challenges

Talent Shortage and Skills Gap in Emerging Technologies

One of the most critical challenges hindering the sustainable growth of the Saudi Arabia Information Technology Services Market is the persistent shortage of skilled professionals in advanced and emerging technologies. While the government has made significant strides in promoting digital literacy and education, there remains a pronounced gap between the industry’s talent needs and the capabilities of the current workforce. Areas such as cloud architecture, cybersecurity, artificial intelligence, and data science require highly specialized skill sets, many of which are still underdeveloped or underrepresented within the local labor market. As a result, businesses and government entities frequently rely on expatriate professionals or outsource expertise from abroad, which can lead to higher operational costs, cultural misalignment, and compliance challenges.This skills gap not only restricts the domestic industry's ability to scale but also undermines the Vision 2030 objective of building a knowledge-based economy with strong local participation. Although government-led programs such as the Future Skills initiative and partnerships with international technology companies aim to cultivate national talent, the pace of transformation often outstrips the rate of upskilling.

Information Technology service providers operating in the country face limitations in project delivery timelines, cost competitiveness, and innovation capability due to the shortage of experienced professionals. Bridging this gap will require long-term investment in education reform, hands-on training programs, and incentives for private sector participation in workforce development. Without a robust talent ecosystem, the Information Technology Services Market may struggle to keep pace with rising demand and evolving technological complexity.

Key Market Trends

Expansion of Local Data Centers to Support Sovereign Cloud Infrastructure

The establishment of local data centers is emerging as a pivotal trend in the Saudi Arabia Information Technology Services Market. With increasing regulatory emphasis on data sovereignty and the localization of digital assets, global technology firms and regional service providers are investing heavily in building in-country data infrastructure. These data centers are critical for supporting sovereign cloud environments that comply with the Kingdom’s data residency laws, particularly in sectors such as finance, healthcare, and public administration. The presence of localized cloud facilities not only enhances data security and latency but also builds confidence among government agencies and regulated industries to adopt cloud-based services.This shift is unlocking new opportunities for Information Technology service vendors offering cloud consulting, migration, management, and cybersecurity services tailored to local regulatory frameworks. Additionally, the expansion of localized data infrastructure enables hybrid cloud adoption and edge computing models, supporting digital transformation initiatives at scale. Technology leaders such as Oracle, Google Cloud, and Microsoft are already establishing partnerships and infrastructure investments within Saudi Arabia, signaling strong market commitment. This trend is expected to accelerate in the coming years, reinforcing the country's ambition to become a regional digital hub and fostering greater demand for specialized Information Technology services.

Key Market Players

- Saudi Telecom Company

- Etihad Etisalat Company (Mobily)

- Mobile Telecommunications Company Saudi Arabia (Zain KSA)

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- IBM Corporation

- Alphabet Inc.

Report Scope:

In this report, the Saudi Arabia IT Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia IT Services Market, By Service Type:

- Managed Services

- Professional Services

Saudi Arabia IT Services Market, By Deployment Type:

- On-Premises

- Cloud-Based

Saudi Arabia IT Services Market, By End-User Industry:

- BFSI

- IT & Telecom

- Government & Defense

- Healthcare

- Manufacturing

- Retail

- Others

Saudi Arabia IT Services Market, By Region:

- Northern & Central

- Southern

- Eastern

- Western

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia IT Services Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Saudi Telecom Company

- Etihad Etisalat Company (Mobily)

- Mobile Telecommunications Company Saudi Arabia (Zain KSA)

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- IBM Corporation

- Alphabet Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | July 2025 |

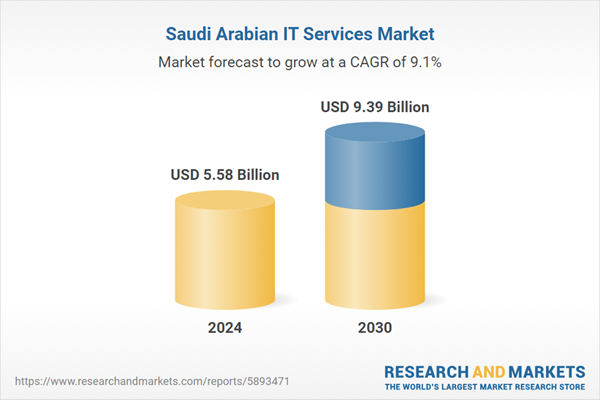

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.58 Billion |

| Forecasted Market Value ( USD | $ 9.39 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 8 |