Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Software that can regulate and keep an eye on power sources and power-consuming appliances is known as an energy management system. For instance, a hotel's HVAC system in each guest room can be managed by an energy management system. Energy management systems provide insight into energy use and maximize comfort and functionality, while reducing energy consumption and operating costs. Additionally, an EMS typically has three parts, metre sensors that measure energy consumption, control systems that transmit commands via an EMS interface, and actual controlled devices such as air conditioners, fans, and lights. A home thermostat is a nice illustration of an extremely basic EMS.

A commercial or residential location that uses an energy management system enjoys a number of outstanding advantages, including less energy usage and more effective operations. These technologies can also provide information that would not be accessible without a system that carefully tracks energy usage. The ability of the energy management systems is to track and optimize energy use for lighting, heating and cooling, ventilation in order to reduce electricity costs. Administrators are better able to estimate energy demand and plan for it by gathering data. This information can also be used to save extra work, such as making sure all lights are turned off after office hours.

Company staff must constantly monitor energy consumption and address anomalies and incidents that result in energy waste. This benefits the company by enabling sizable, long-lasting energy savings. Organizations that choose to execute ISO 50001 make a specific kind of energy administration framework known as an energy management system (EnMS). The purpose of ISO 50001 standard is to empower associations to set up frameworks and forms fundamental to move forward vitality execution. The standard applies to all variables influencing vitality utilize that can be observed and affected by an association. ISO 50001 standard does not indicate energy execution criteria. It gives a general-purpose framework that permits associations to select execution benchmarks that they regard best meet their requirements.

Increasing Green Building Awareness

The energy management system is one of the most recent systems that collects real-time data on energy usage. This is made possible by monitoring, analyzing, and visualizing energy use. Energy management systems improve business operations and financial judgement. Companies have begun green construction in recent years and have put in place policies for managing waste, water, and energy. Although Saudi Arabia is one of the top five countries in the world for spearheading and has over 2,380 registered green building projects, the demand for energy management systems in Saudi Arabia is rising quickly.Digital Transformation of EMS is Reshaping the Energy Management Infrastructure

The digitalization of numerous industrial and commercial activities, as well as energy management, has ostensibly contributed to this transformation. Energy models are increasingly becoming digitalized, which increases their efficiency and raises their worth. Greater efficiency gains are largely dependent on the ability to connect and coordinate all of the network's devices and equipment due to the modernization of energy management processes. Moreover, a building's digital connectivity may enable communication with smart power grids. As a result of the energy management system's digital revolution, users can also combine operational data with energy data to offer valuable perspectives on the energy used. Thus, the infrastructure of energy management can be redesigned as a result of the digitalization of energy processes. These factors have increased the demand for energy management systems in Saudi Arabia. For instance, in December 2021, General Electric acquired Opus One Solutions Energy Corporation. The planning and management of energy are optimized with the aid of this software vendor. The purchase will help General Electric plan, optimize, and engage in trading for the distributed and renewable energy resources (DERs) necessary to power a modern system.Non-Fossil Fuel-Based Energy Goal

Due to the escalating environmental problems such as climate change and global warming, energy organizations are being pushed to establish severe policies for energy efficiency. As an example, to demonstrate their commitment for clean energy, numerous cities in Saudi Arabia have raised the standards for their renewable energy portfolios. For instance, Saudi Arabia has established a non-fossil fuel-based energy consumption goal for the 26th Session of the COP (Conference of the Parties) in 2023This has been a key pledge made under the Panchamrit. This is the largest renewable energy expansion strategy in the world. The government makes an effort to increase effective energy management and consumption. Such factors are anticipated to fuel the growth of the market during the forecast period.Projects and Advantages propelling the Growth of the Saudi Arabia Energy Management System Market

The main driver of social and economic advancement is energy. Energy is necessary for all economic sectors to operate, and as markets become more competitive and technology advances, energy consumption rises. Electricity is especially needed in the industrial sector. Additionally, there is a growing understanding of the necessity of reducing and optimizing energy use. In addition, businesses have tried to use energy more wisely in response to market demands and public conceptions of environmental sustainability. It is anticipated that one of the main market drivers will be the aim to minimize and minimize energy use.For the purpose of exploring the company's EMS products and services in the Middle Eastern nations of Kuwait, Yemen, and Oman, Rockwell Automation signed a partnership agreement with three distributors in June 2021. These distributors are Zubair Electric, Naming Dome Trading and Contracting, and Automatic Systems Company.

To demonstrate its "Buildings as a Grid" approach to the energy transition, which aims to assist customers in increasing resilience, accelerating decarbonization, generating new revenue streams, and reducing energy costs, Eaton Corporation introduced its Energy management solution (which combines hardware, software, and services) in March 2021.

As supply and demand change, so do energy prices. Extreme weather, the state of the economy, and supply availability are just a few of the variables that affect energy prices. The World Energy Outlook predicts that during the next 25 years, global energy consumption will rise by 60%, with developing nations accounting for the majority of this rise. In emerging markets, fossil fuels such as coal and thermal power plants currently supply a sizable quantity of energy. This is the least expensive non-renewable method of producing energy. Higher energy prices are anticipated because of rising energy demand and the depletion of natural resources, which will stimulate the use of other, more expensive forms of energy production.

Market Segmentation

The Saudi Arabia energy management system market is divided into type, component, deployment type, end user, and region. Based on type, the market is bifurcated into building energy management systems, industrial energy management systems, home energy management systems. Based on component, the market is further bifurcated into hardware and software. Based on deployment type, the market is bifurcated into cloud based and on premise. Based on end user, the market is further bifurcated into manufacturing, power & energy, IT & Telecom, and others.Market Players

Major market players in the Saudi Arabia energy management system market are Rockwell Automation Inc., Honeywell International Inc., Schneider Electric SE, Cisco Systems, Inc., ABB Ltd., Eaton Corporation, IBM Corporation, Siemens AG, Mitsubishi Electric Corporation, and Wrtsil Oyj Abp.Report Scope:

In this report, the Saudi Arabia energy management system market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Energy Management System Market, By Type:

- Building Energy Management Systems

- Industrial Energy Management Systems

- Home Energy Management Systems

Saudi Arabia Energy Management System Market, By Component:

- Hardware

- Software

Saudi Arabia Energy Management System Market, By Deployment Type:

- Cloud Based

- On Premise

Saudi Arabia Energy Management System Market, By End User:

- Manufacturing

- Power & Energy

- IT & Telecom

- Others

Saudi Arabia Energy Management System Market, By Region:

- Northern & Central

- Western

- Eastern

- Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia energy management system market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Rockwell Automation Inc.

- Honeywell International Inc.

- Schneider Electric SE

- Cisco Systems, Inc

- ABB Ltd.

- Eaton Corporation

- Wrtsil Oyj Abp

- IBM Corporation

- Siemens AG

- Mitsubishi Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | October 2023 |

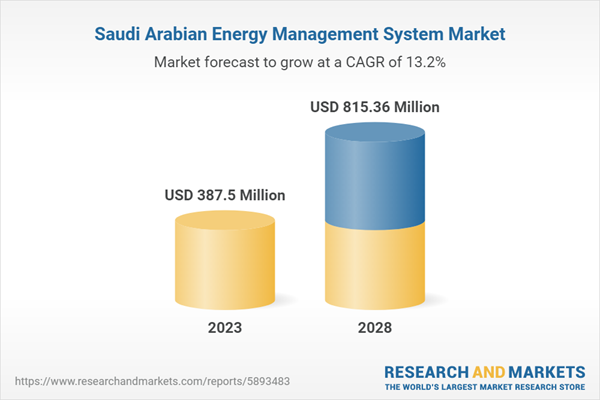

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 387.5 Million |

| Forecasted Market Value ( USD | $ 815.36 Million |

| Compound Annual Growth Rate | 13.1% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |