Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Prevalence of Eye Conditions

The rising prevalence of eye conditions, including refractive errors, corneal diseases, and age-related ocular disorders, is a significant factor fueling the growth of the Global Corneal Topographers Market. Globally, over 2.2 billion individuals experience near or distance vision impairment, with at least 1 billion cases being either preventable or currently unaddressed. The primary contributors to vision impairment and blindness worldwide are uncorrected refractive errors and cataracts, highlighting a substantial unmet demand for advanced diagnostic and treatment solutions in the ophthalmic industry.This presents a significant growth opportunity for businesses specializing in vision correction technologies, surgical equipment, and diagnostic tools, as healthcare providers and policymakers increasingly prioritize early intervention and accessible eye care solutions. This increase in eye health issues has led to a higher demand for advanced diagnostic technologies, such as corneal topography systems, which are essential for precise assessment and treatment planning. According to the World Health Organization (WHO, Geneva, Switzerland), approximately 45 million people worldwide suffer from bilateral blindness, with 6 to 8 million cases attributed specifically to corneal disease.

In certain regions of Africa, corneal pathology accounts for nearly 90% of all blindness cases, underscoring a critical demand for advanced corneal diagnostics, treatments, and transplantation solutions. Conditions such as myopia, hyperopia, astigmatism, and keratoconus have seen a significant rise globally, primarily due to factors like increased screen time, genetic predisposition, and environmental influences. Corneal topographers play a crucial role in diagnosing and managing these conditions by mapping the corneal surface with high precision. The growing need for accurate diagnostic tools in ophthalmology clinics, hospitals, and research institutions is driving the market expansion.

Key Market Challenges

Cost and Affordability

Corneal topographers are a relatively expensive piece of equipment. This can make them inaccessible to some eye care professionals and patients. In many countries, insurance companies do not cover the cost of corneal topography. This can make it difficult for patients to afford the procedure. Corneal topographers require regular maintenance and repairs. This can be a significant financial burden for eye care professionals.Key Market Trends

Sustainable and Eco-Friendly Solutions

The integration of Artificial Intelligence (AI) is a significant trend in the global corneal topographer’s market. AI technology is being harnessed to enhance various aspects of corneal topography, from data analysis and interpretation to improving diagnostic accuracy and treatment planning. AI algorithms can process large volumes of corneal topography data quickly and accurately. This automation helps reduce the time required for data analysis, allowing eye care professionals to focus more on patient care and treatment decisions. AI-powered corneal topography systems can detect subtle corneal irregularities that might be missed by traditional methods.By identifying patterns and anomalies, AI contributes to more accurate diagnoses of conditions like keratoconus, irregular astigmatism, and corneal dystrophies. AI algorithms can detect early signs of corneal pathologies that might not be evident through manual analysis. This early detection can lead to timely interventions and better treatment outcomes. AI can develop predictive models based on historical data to anticipate potential corneal changes over time.

This can aid in proactive management and preventive measures for conditions like keratoconus progression. AI-driven corneal topography can provide insights into personalized treatment plans. By analyzing corneal data and patient characteristics, AI can assist in designing custom contact lenses or optimizing refractive surgery procedures. AI-powered corneal topography can be integrated into telemedicine platforms, enabling remote consultations. AI algorithms can assist in analyzing corneal data and providing recommendations, expanding access to specialized eye care.

Key Market Players

- Carl Zeiss AG

- OCULUS Optikgeräte GmbH

- Cassini Technologies

- Nidek Co., Ltd

- Tomey Corporation

- EyeSys Vision

- Tracey Technologies

- Topcon Corporation

Report Scope:

In this report, the Global Corneal Topographers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Corneal Topographers Market, By Product Type:

- Placido Disc System

- Scheimpflug System

- Scanning Slit System

Corneal Topographers Market, By Application:

- Cataract Surgery Evaluation

- Corneal Disorder Diagnosis

- Refractive Surgery Evaluation

- Contact Lens Fitting

- Others

Corneal Topographers Market, By End User:

- Hospitals

- Ophthalmic Clinics

- Ambulatory Surgical Centers

Corneal Topographers Market, By region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Corneal Topographers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Carl Zeiss AG

- OCULUS Optikgeräte GmbH

- Cassini Technologies

- Nidek Co., Ltd

- Tomey Corporation

- EyeSys Vision

- Tracey Technologies

- Topcon Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | March 2025 |

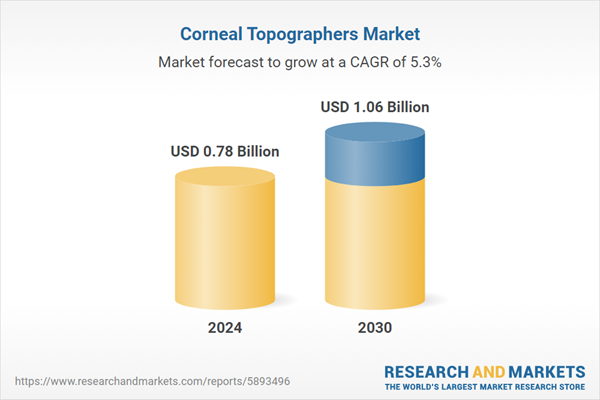

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.78 Billion |

| Forecasted Market Value ( USD | $ 1.06 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |