Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

These technologies support the creation of diagnostic kits and high-throughput platforms, including biosensors and microfluidics, which are increasingly used in point-of-care and laboratory settings. The sector plays a critical role in enabling rapid virus detection and measurement, supporting global health systems in their surveillance, diagnosis, and response efforts. Key areas include molecular diagnostics, immunodiagnostics, biosensor technologies, and cell-based assays - all of which contribute to the timely identification and management of viral threats.

Key Market Drivers

Increasing Incidence of Viral Diseases

The growing prevalence of viral diseases is a primary driver accelerating the demand for advanced viral detection and quantification tools. As of 2024, the World Health Organization reported over 4.2 million dengue cases globally and more than 95,000 mpox (formerly monkeypox) cases since its outbreak in 2022. These figures reflect the increasing urgency for effective diagnostic tools to identify and contain viral infections early.Biomanufactured products such as PCR kits, ELISA tests, and CRISPR-based diagnostics are vital for fast and accurate virus detection from clinical and environmental samples. These tools facilitate early diagnosis, rapid treatment initiation, and containment of infectious diseases. In settings where diseases like dengue are endemic, early quantification of viral load is essential to assess disease severity and determine appropriate clinical interventions. As new viral threats emerge, the need for deployable, high-performance diagnostic solutions continues to grow.

Key Market Challenges

Rapidly Evolving Viruses

One of the major challenges in the market is the ability of viruses to mutate rapidly, which can compromise the accuracy and reliability of diagnostic assays. Genetic mutations can affect the regions targeted by primers, probes, or antibodies, resulting in false negatives or decreased assay sensitivity.To maintain diagnostic accuracy, biomanufacturers must continually update assay formulations to account for emerging variants. This requires ongoing investment in R&D and flexible production systems that can respond to evolving viral genomes. Ensuring optimal binding affinity and specificity under these conditions is complex and resource-intensive, posing a challenge to sustained product performance in the face of dynamic viral evolution.

Key Market Trends

Emerging Infectious Diseases Preparedness

Preparedness for emerging infectious diseases (EIDs) is shaping the future of the biomanufacturing viral detection and quantification market. This trend emphasizes the need for agile and responsive diagnostic capabilities that can be deployed during novel outbreaks.Manufacturers are prioritizing the development of flexible diagnostic platforms that can quickly adapt to new pathogens. Scalable production and modular assay designs enable rapid shifts in manufacturing focus during global health emergencies. Fast-track regulatory approvals, collaborative efforts with public health agencies, and real-time surveillance capabilities are further reinforcing this trend.

Biomanufactured viral detection tools are not only crucial for diagnostics but also for tracking disease spread, evaluating vaccine effectiveness, and informing public health strategies during outbreaks. The growing emphasis on global health security is driving investment in platforms that support EID surveillance, detection, and response.

Key Market Players

- Danaher Corporation

- Merck KGaA

- New England Biolabs

- TAKARA HOLDINGS INC.

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Sartorius AG

- Charles River Laboratories

- Bio-Rad Laboratories, Inc.

- PerkinElmer, Inc

Report Scope:

In this report, the Global Biomanufacturing Viral Detection and Quantifications Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Biomanufacturing Viral Detection and Quantifications Market, By Offering Type:

- Consumables

- Instruments

- Services

Biomanufacturing Viral Detection and Quantifications Market, By Technology:

- PCR

- ELISA

- Flow Cytometry

- Plaque Assay

- Others

Biomanufacturing Viral Detection and Quantifications Market, By Application:

- Blood and Blood Products Manufacturing

- Vaccines and Therapeutics Manufacturing

- Cellular and Gene Therapy Products Manufacturing

- Stem Cell Products Manufacturing

- Tissue and Tissue Products Manufacturing

Biomanufacturing Viral Detection and Quantifications Market, By End User:

- Life Science Companies

- Testing Laboratories

- CROs and CDMOs

Biomanufacturing Viral Detection and Quantifications Market, By Region:

North America

- United States

- Canada

- Mexico

Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

South America

- Brazil

- Argentina

- Colombia

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Biomanufacturing Viral Detection and Quantifications Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Danaher Corporation

- Merck KGaA

- New England Biolabs

- TAKARA HOLDINGS INC.

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Sartorius AG

- Charles River Laboratories

- Bio-Rad Laboratories, Inc.

- PerkinElmer, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | July 2025 |

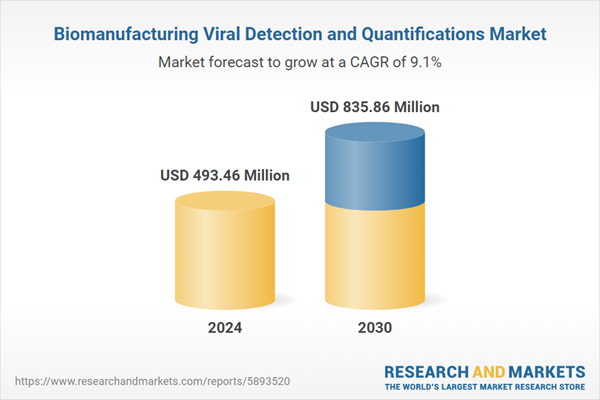

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 493.46 Million |

| Forecasted Market Value ( USD | $ 835.86 Million |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |