Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A data center is a reserved space within a building block, or a group of rooms used to establish computer systems and associated components, such as telecommunications and storage devices. Throughout the forecast period, server farms have changed from being exclusive to stringently directed on-premises offices.

Market Drivers

Increasing Adoption of Cloud and Digital Transformation by Companies

Asia-Pacific is observing a steady rise in the use of smart technologies, such as IoT and big data in different industry sectors. For instance, numerous startup companies use big data analytics solutions in the agricultural industry. Utilizing big data analytics solutions in the healthcare sector, among other things, to store patient health detailed records and disease records. Nowadays Australia has a well-organized healthcare system and spends about the OECD average of 10% of GDP on healthcare. Since the healthcare sector is growing in Australia the overall demand for data centers to handle large-size data is growing rapidly. As a result of this rise in demand, the data center market in Asia-Pacific is likely to proliferate in the coming years.In addition, Amazon Web Services (AWS), a major U.S. e-commerce company's cloud arm, recently 2023, announced a USD 5 billion investment in Indonesia over the next 15 years to accelerate cloud adoption and digital transformation, including the construction of additional data centers. Therefore, the Indonesian government and authorities have entirely supported the growth of data-intensive industries like edge computing and the Internet of Things (IoT), AI, robots, and 5G infrastructure. Most of the data generated by all these industries should pass through a data center. As cloud-managed services are an essential component of digital transformation, their requirement will continue to grow in the upcoming years, due to the trend toward remote working that many businesses are moving toward. Various regulations and reforms have provided the essential framework for this expansion as a result of the government's efforts to make Indonesia a global data hub, and more new businesses will enter the market in the coming years. As a result, the expansion of the Asia-Pacific Data Center Market is credited with the rapid adoption of cloud computing and digital transformation by businesses.

Rise in Renewable Energy & Infrastructure

One of the most valuable infrastructures that use a lot of energy is data centers. Due to their high energy consumption, establishing data centers may extant challenge for many companies. Even though the Asia-Pacific region is the exporter of fuel and one of the largest coal producers in the world, the government has been supporting renewable energy to reduce its reliance on fossil fuels and meet the energy demand.In addition, renewable energy sources like geothermal, solar, wind, hydropower facilities, biomass, and others have a lot of potential in Asia-Pacific. Hydropower and solar power are the region’s primary uses of renewable natural resources now. For an illusion, Malaysia's Ministry of Energy and Natural Resources (KeTSA) plans to use renewable energy for 31% of the country's installed capacity by 2025. By 2035, this goal was to reduce GHG emissions from the power sector & reduce economy-wide carbon intensity. New union power & on-grid NRE capacity has been created through the Net Energy Metering 3.0 (NEM) scheme/plan, additionally, the Smart Automation Grants (SAG), the Green Investment Tax (Gita), the Large-Scale Solar program (LSS), and other government initiatives are gaining traction. The service provider has been able to install data centers for the expanding digital economy due to these initiatives under the Sustainable Energy Development Authority (SEDA) Malaysia and an increase in the establishment of facilities and the installation of renewable energy infrastructure. As a result, the Asia-Pacific data center market is benefiting from the expansion of renewable energy and infrastructure.

Surging Investment in Data Centers by Enterprises

The region is an emerging data center hub, with supportive pro-business policies attracting and retaining data center investors. The governments are committed to further accelerating digital adoption in the region. Cloud service providers like Google, Facebook, Alibaba, Tencent Cloud, AWS, Microsoft, and others will make significant investments in the Asia-Pacific data center market. Business and government organizations' demand for cloud shifts is expected to accelerate investment growth from cloud service providers. In addition, the region has a significant pool of knowledgeable and qualified workers, which promises well for its competitive advantage in attracting additional direct investments from outside, which are crucial to the data center market. To construct the largest hyper-scale campuses in the Asia-Pacific region, numerous domestic and international businesses are expanding their presence in the Asia-Pacific countries. For instance, in 2023 at an event Vantage Data Centers recently, announced the construction of new grounds in Cyberjaya, Malaysia. The company has signed a contract with Cyberview Sdn Bhd and plans to invest approximately USD 3 billion in the construction of a second campus for data centers in the city. In addition, a statement from RHB Investment Bank states that over the next 5 years, a total of 800 MW of brand-new and future investments in data centers are anticipated to begin operating in phases, resulting in lower costs for land and energy. As a result, the expansion of data centers in the Asia-Pacific market can be attributed to businesses' increasing investments in them.Market Segmentation

The Asia-Pacific data center market can be segmented by solution, Enterprise Size, end user, and country. Based on Solution, the market is segmented into IT Infrastructure, general infrastructure, electrical infrastructure, mechanical infrastructure, and others. Based on enterprise size, the market is segmented into large enterprises and small & medium enterprises (SMEs). Based on end user, the market is divided into Information technology & telecom, government, BFSI, healthcare, and others. Based on country, the market is segmented into China, Japan, India, South Korea, Australia, Vietnam, Indonesia, Singapore, Philippines, and Malaysia.Market Players

Key players in the Asia-Pacific data center market are AirTrunk Operating Pty Ltd., Canberra Data Centers, Chindata Group Holdings Ltd., Digital Realty Trust, Inc., Equinix, Inc., Keppel DC REIT Management Pte. Ltd., KT Corporation, NEXTDC Ltd, NTT Ltd., and Princeton Digital Group.Report Scope:

In this report, the Asia-Pacific data center market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:- Asia-Pacific Data Center, By Solutions:

- IT Infrastructure

- General Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- Others

- Asia-Pacific Data Center, By Enterprise Size:

- Large Enterprises

- Small & Medium Enterprises (SMEs)

- Asia-Pacific Data Center, By End User:

- Information Technology & Telecom

- Government

- BFSI

- Healthcare

- Others

Asia-Pacific Data Center Market, By Country:

- China

- Japan

- India

- South Korea

- Australia

- Vietnam

- Indonesia

- Singapore

- Philippines

- Malaysia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia-Pacific data center market.Available Customizations:

With the given market data on the Asia-Pacific data center market, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AirTrunk Operating Pty Ltd.

- Canberra Data Centers

- Chindata Group Holdings Ltd.

- Digital Realty Trust, Inc.

- Equinix, Inc.

- Keppel DC REIT Management Pte. Ltd.

- KT Corporation

- NEXTDC Ltd

- NTT Ltd.

- Princeton Digital Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | October 2023 |

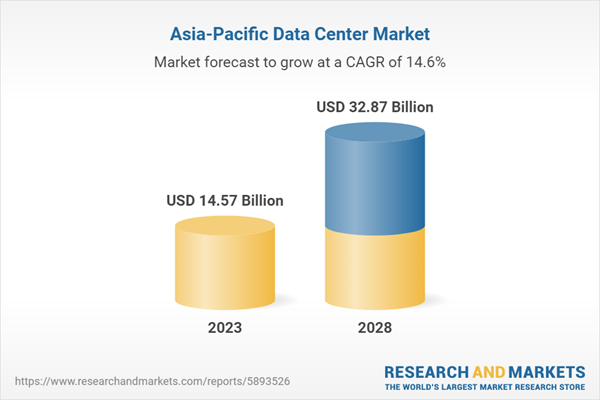

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 14.57 Billion |

| Forecasted Market Value ( USD | $ 32.87 Billion |

| Compound Annual Growth Rate | 14.6% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |