Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

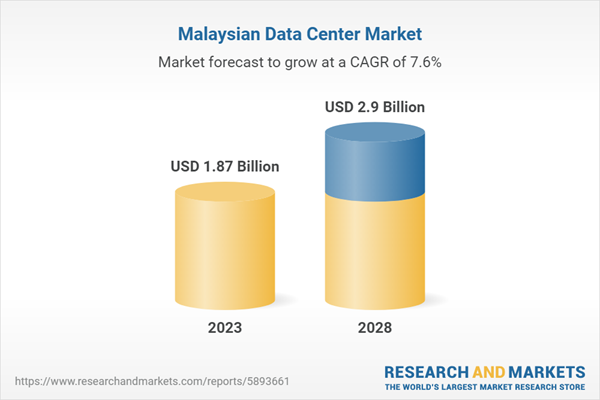

The Malaysia data center market is growing owing to the increase in data consumption spurring the need for storage and processing data efficiently, along with rising government investment to provide the physical data center space. 5G infrastructure investments for faster internet connectivity has proliferated and the adoption of several advanced technologies have further boosted the demand for data centers. The increasing availability of skilled workforce and operational and development cost advantage across various end-use industries have led to an increased focus on data center to overcome the situation of high data consumption. Companies are highly dependent on computer systems due to the increasing number of internet users and digital services that drive their business operations. Additionally, the growing demand for data and high bandwidth capacity, especially due to increasing smartphone users promotes the development of the data center market of Malaysia throughout the forecast period.

A data centre is a physical location with networked computers, storage systems, and computational infrastructure that businesses utilize to store, gather, analyses, and disseminate massive quantities of data. It provides dependable storage without the drawbacks of portable technology, reducing expenses, managing data, and safeguarding future technological investments while eradicating certain losses. Data centers are an essential part of every business since they enable corporate applications and provide services like productivity software, high-volume e-commerce, data management, backup, and recovery. To improve overall application performance and user experience, edge data centers can help reduce latency for real-time, data-intensive applications like, big data analytics, artificial intelligence (AI), and content delivery apps. Managed data centers and colocation facilities are options for businesses that do not have the room, people, or expertise to deploy and run all or a portion of their IT infrastructure on-site.

Rapid Adoption of Cloud and Digital Transformation by Companies

Malaysia’s digital journey across the globe is growing at a remarkable pace since the adoption of cloud computing in the country. Due to the rapid pace of technological advancement, Malaysia is trying harnessing digital technologies to reap significant economic benefits in the long run. Several cloud service providers across the world have revealed their availability zones and the data scrubbing center in Malaysia, particularly in locations like Johor, Cyberjaya, Kuala Lumpur, and multiple regions since they have strong fiber connection, lower land, and submarine. Availability zones (AZs) are being built by BDx Malaysia, Amazon Web Services (AWS), Huawei Cloud and many more to support high availability (HA), while maintaining low latency. Large enterprises such as Google, Alibaba Group, Amazon Web Services (AWS) and Microsoft Corporation has announced their plans to setup cloud region in Malaysia which has attracted many new data center such as Equinix, AirTrunk, Yondr Group, and GDS Holdings to maiden facilities in Malaysia’s southern state of Johor. While most of the large enterprises already accelerated cloud adoption, medium-sized companies and small companies have embarked on their cloud journey. The private sector and government, both are aiming to accelerate cloud adoption in the region.

Moreover, in an effort to keep ahead of the curve, government organizations have provided several grants and incentives to assist and guide the rise of digitalization. For instance, according to SME Corporation Malaysia, few initiatives offered by various entities, such as the SME Digitalization Grant offered by the Malaysia Digital Economy Corporation (MDEC), offering SME’s RM5,000 (USD1082.86) each to acquire or subscribe to digital systems. Recently Bank Negara Malaysia (BNM) has offered an additional allocation of RM700 million (USD151.60 million) for the SME Automation and Digitalization Facility (ADF), bringing the facility’s total size to RM1 billion (USD0.22 billion). This seeks to motivate SMEs from various industries to automate procedures and digitalize business operations to boost output and efficiency. Moreover, the ADF is available to all SMEs in Malaysia, with a maximum funding sum of RM3 million (USD 0.22 million) and a maximum financing term of 10 years have all enjoyed full support of the Malaysian government. With the adoption of cloud technologies and digital technologies, all these industries produce massive volumes of data, the majority of which requires some sort of data center. Furthermore, many enterprises are facilitating remote working, which is driving the demand for cloud computing as cloud-managed services are a vital part of digital transformation, their demand will further expand in the recent years. Therefore, the rapid adoption of cloud and digital transformation by companies are attributing the growth of Malaysia

The Increasing Number of Internet Users and Digital Services Proliferating Growth

The significant increase in the number of internet users and the advancement of online technologies has driven many companies to offer their products through the internet. The country “Malaysia” is heavily reliant on data centers due to its high internet penetration. This has brought large-scale processing and digital application development which requires large data centers and cloud technologies. For instance, according to the Malaysian Digital 2023 Global Overview Report, there are 29.55 million internet users in January 2022 out of 32.6 million total population in Malaysian, accounting for a penetration rate of 89.6 percent as of the first quarter of 2022. Moreover, the country’s added 1.2 million new digital consumers between the end of 2021 and the last quarter of 2022. 79% of respondents use the internet for online transactions, while 72% accessed financial services. The growth in internet users and digital applications for various services are proliferating the digital transformation, smart phone adoption in the country. According to data from GSMA Intelligence, Malaysia had 42.11 million mobile connections in the beginning of 2022, and this figure increased by 1.6 million (4%) between 2021 and 2022. Therefore, enterprises are more relying on establishing data centers as digital advancement creates huge amount of data, which is required to be stored and processed. Thus, the increasing number of internet users and digital services has proliferated the demand for data center in the Malaysia market.

Growth in Renewable Energy & Infrastructure

Data centers are one of the major infrastructures which requires huge amount of energy consumptions. Many enterprises may feel challenges before establishing data centers due to their high energy consumption. Although, Malaysia is the second largest oil and natural gas producer in Southeast Asia and the fifth largest exporter of liquefied natural gas (LNG) in the world. In addition, being a part of one of the fastest growing economies, the Malaysian government has been supporting renewable energy to reduce its reliance on fossil fuels and overcome the demand of energy requirement. In Malaysia, there is a growing need and potential for renewable energy. Moreover, as Malaysia accounts for 23% of the region's energy consumption, the country's demand for energy is predicted to increase as the Malaysian government is targeting a 31% of the total installed capacity of sustainable energy by 2025, which is the highest pace of growth in the world. Moreover, Malaysia has a lot of potential for renewable energy sources including geothermal, solar, wind, hydropower facilities, biomass, and more.

Currently, the country consumes hydropower and solar energy as a major type of renewable natural resources. By 2025, Malaysia's Ministry of Energy and Natural Resources (KeTSA) intends to have 31% of the country's installed capacity come from renewable sources. This goal was set to minimize economy-wide carbon intensity and reduce GHG emission in the power sector by the year 2035. The Net Energy Metering (NEM) 3.0, Smart Automation Grants (SAG), and Green Investment Tax (Gita), Large-Scale Solar program (LSS), the Net Energy Metering 3.0 (NEM) scheme and other government initiatives have helped to build new on-grid NRE capacity. These initiatives under Sustainable Energy Development Authority (SEDA) Malaysia, combined with an increase in the setup facilities and installations of renewable energy infrastructure, have allowed the service provider to install the data centers for growing digital economy. Hence, the growth in renewable energy & infrastructure is offering robust opportunities in the Malaysia data center market.

Growth in Investment in the Data Center by the Enterprises

Malaysia as an emerging data center hub in Asia, with supportive pro-business policies for attracting and retaining data centers investors. The new government is committed to further accelerate digital adoption in the country, which augurs well for the domestic data center industry. In addition, in October 2022, the Ministry of Investment, Trade and Industry (MITI) announced the New Investment Policy that enables the boost in the economic complexity to spur high-value job opportunities. Moreover, the country encompasses a sizable pool of knowledgeable and qualified personnel, which indicates favorably for its competitive advantage in enticing more foreign direct investments, which are crucial to the data center industry. Several domestic as well as international enterprises are expanding their footprint in the country to expand the digital infrastructure by building the largest hyperscale campuses in the region. For instance, Vantage Data Centers in a recent event announced the development of new campus in Cyberjaya, Malaysia. The company signed an agreement with Cyberview Sdn Bhd and is planning to invest around USD 3 billion in developing a second data center campus in the city. Furthermore, according to RHB Investment Bank report, around 800MW of new and future data center investments with reduced land and energy costs are anticipated to come operational in phases over the next five years. Therefore, the growing investment in the data center by the enterprises are attributing the growth of data center in the Malaysian Market.

Market Segmentation

Malaysia data center market is divided into solution, type, end user industry. Based on solution, the market is divided into IT infrastructure, general infrastructure, electrical infrastructure, mechanical infrastructure, and others. Based on type, the market is segmented into corporate and web hosting. Based on end user industry, the market is divided into information technology & telecom, government, BFSI, healthcare, and others.

Company Profiles

NTT Communications Corporation, Telekom Malaysia Berhad (TM), PLTPRO Data Centre Sdn Bhd, AIMS Data Centre Sdn Bhd, Bridge Data Centres Malaysia Sdn. Bhd., IP ServerOne Solutions Sdn. Bhd., Keppel Data Centres Holdings Pte Ltd, GDS Services Ltd, and Cisco Systems Inc. are among the major players that are driving the growth of the Malaysia data center market.

Report Scope:

In this report, the Malaysia Data Center Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Malaysia Data Center Market, By Solution:

- IT Infrastructure

- General Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- Others

Malaysia Data Center Market, By Type:

- Corporate

- Web Hosting

Malaysia Data Center Market, By End User:

- Information Technology & Telecom

- Government

- BFSI

- Healthcare

- Others

Malaysia Data Center Market, By Region:

- East Malaysia

- West Malaysia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Malaysia Data Center market.

Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- NTT Communications Corporation

- Telekom Malaysia Berhad (TM)

- PLTPRO Data Centre Sdn Bhd

- AIMS Data Centre Sdn Bhd

- Bridge Data Centres Malaysia Sdn. Bhd.

- IP ServerOne Solutions Sdn. Bhd.

- Keppel Data Centres Holdings Pte Ltd

- GDS Services Ltd

- Cisco Systems Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 84 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1.87 Billion |

| Forecasted Market Value ( USD | $ 2.9 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Malaysia |