Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Industry data underscores the critical influence of risk mitigation on this growing demand. According to the Association for Unmanned Vehicle Systems International, in 2024, 64 percent of industry respondents cited improving workplace safety as a very important factor, establishing it as the primary driver for drone adoption. This focus directly supports the need for advanced stability and collision-avoidance hardware. However, despite this progress, the market encounters significant obstacles regarding regulatory integration, particularly the complex approval processes for Beyond Visual Line of Sight operations, which continue to limit the widespread commercial scalability of sensor-equipped fleets.

Market Drivers

The expansion of autonomous operations within defense and border security is reshaping the sensor landscape by emphasizing "attritable" unmanned systems that utilize advanced optical and thermal payloads for navigation in contested environments. This strategic shift toward mass-produced, autonomous fleets has generated a surge in government funding for sensor-integrated platforms, confirming the sector's movement away from legacy hardware toward scalable, sensor-dense solutions. As reported by USNI News in March 2024, the U.S. Defense Department has allocated approximately $1 billion over two years to field thousands of autonomous systems, effectively expanding the addressable market for component manufacturers.Concurrently, the increasing adoption of precision agriculture and crop monitoring systems is driving the commercial commoditization of multispectral and hyperspectral imaging technologies. Farmers are leveraging these sensors to optimize input application and monitor crop health with millimeter-level precision, marking a transition from experimental pilots to a reliance on sensor-equipped aerial platforms. According to a July 2024 report by DJI Agriculture, over 300,000 agricultural drones were operating globally by the end of 2023, treating more than 500 million hectares of farmland. This demand reflects a broader trend in commercial scalability; the Federal Aviation Administration noted that there were 390,027 commercial drones registered in the United States in 2024, highlighting the substantial baseline of platforms requiring sophisticated detection hardware.

Market Challenges

The complex regulatory environment governing Beyond Visual Line of Sight (BVLOS) operations represents a major barrier to the growth of the Global Drone Sensor Market. Although detection components have matured sufficiently to support autonomous navigation, the absence of a standardized approval framework confines most operators to Visual Line of Sight (VLOS) flights. This restriction directly suppresses demand for high-value components, such as long-range LiDAR and multispectral cameras, which are designed specifically to enable autonomy over vast distances that remain legally inaccessible for many commercial entities. Without the capacity to deploy fleets over extensive infrastructure or agricultural zones without human spotters, the return on investment for outfitting drones with comprehensive sensor suites is significantly reduced.Industry data emphasizes the severity of this operational bottleneck, as the Association for Unmanned Vehicle Systems International reported an estimated BVLOS waiver approval rate of only 19 percent in 2024. This low authorization figure suggests that the vast majority of commercial operators are unable to leverage the full capabilities of autonomous sensor systems. Consequently, manufacturers encounter a capped addressable market, as regulatory friction hinders the widespread adoption of the hardware necessary for fully autonomous, long-endurance missions.

Market Trends

The integration of artificial intelligence for real-time edge analytics is fundamentally transforming the Global Drone Sensor Market by moving data processing from centralized cloud servers to onboard computational modules. This technological evolution mitigates the critical latency and bandwidth constraints associated with remote operations, allowing unmanned systems to execute complex decision-making loops, such as dynamic obstacle avoidance and subject tracking, without depending on continuous communication links. The operational validity of this edge-centric autonomy is demonstrated by the rapid scaling of AI-defined platforms; according to Skydio in September 2025, the company’s AI-driven X10 platform successfully completed over 500,000 customer missions, proving the industrial reliance on autonomous, edge-processed intelligence for high-stakes public safety and infrastructure tasks.Simultaneously, the shift toward solid-state LiDAR technology for compact drone integration is surmounting historical barriers regarding the fragility and high cost of mechanical scanning systems. By adopting chip-based architectures, manufacturers are producing ruggedized, lightweight LiDAR solutions that can endure flight vibrations while adhering to the stringent Size, Weight, and Power (SWaP) requirements of smaller commercial fleets. This structural transition is propelling mass adoption beyond niche surveying applications into broader robotics and autonomous inspection fields. As announced by Hesai Technology in December 2024, the company delivered over 20,000 LiDAR units for the robotics market in a single month, highlighting the significant commercial scalability of durable sensing components for next-generation autonomous systems.

Key Players Profiled in the Drone Sensor Market

- TE Connectivity

- Trimble Inc.

- TDK Corporation

- Robert Bosch GmbH

- ams-OSRAM AG

- Teledyne FLIR LLC

- KVH Industries, Inc.

- Sparton Corporation

- Garmin Ltd.

- u-blox AG

Report Scope

In this report, the Global Drone Sensor Market has been segmented into the following categories:Drone Sensor Market, by Sensor Type:

- Inertial Sensors

- Flow Sensors

Drone Sensor Market, by Platform:

- VTOL

- Fixed Wing

- Hybrid

Drone Sensor Market, by Application:

- Navigation

- Data Acquisition

- Motion Detection

- Power Monitoring

- Others

Drone Sensor Market, by Industry Vertical:

- Precision Agriculture

- Commercial

- Defense

- Personal

- Law Enforcement

- Others

Drone Sensor Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Drone Sensor Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Drone Sensor market report include:- TE Connectivity

- Trimble Inc.

- TDK Corporation

- Robert Bosch GmbH

- ams-OSRAM AG

- Teledyne FLIR LLC

- KVH Industries, Inc.

- Sparton Corporation

- Garmin Ltd.

- u-blox AG

Table Information

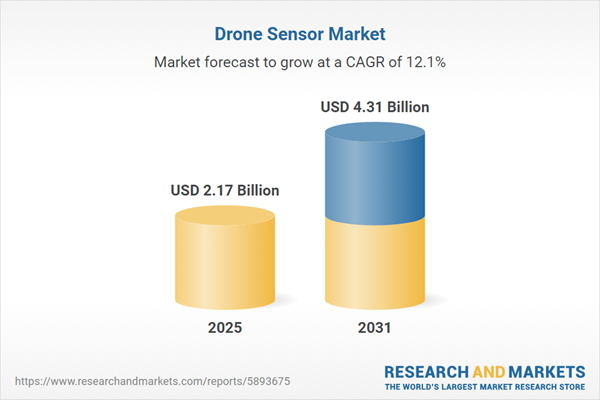

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 2.17 Billion |

| Forecasted Market Value ( USD | $ 4.31 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |