Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Microgrids are especially effective in providing electricity in areas with limited or unreliable grid access, including remote villages, military installations, healthcare facilities, and academic campuses. By operating autonomously during power outages or grid disruptions, they enhance energy security and resilience.

In addition to improving reliability, microgrids enable greater use of renewable energy, contributing to emission reduction and sustainability objectives. Their modular design and advanced control capabilities allow for efficient energy use, reduced transmission losses, and real-time demand balancing. As India emphasizes rural electrification, energy independence, and green energy adoption, microgrids are emerging as a vital part of its decentralized power infrastructure.

Key Market Drivers

Energy Access in Remote and Rural Areas

The pressing need to provide reliable electricity to remote and underserved regions is a major driver for microgrid deployment in India. While electrification has reached nearly all households, the quality and consistency of power remain poor in several rural and difficult-to-access locations. The high cost of extending the main grid to these areas, coupled with geographic and demographic challenges, has made microgrids a more viable alternative.Microgrids, particularly those powered by solar energy, provide localized generation and distribution, offering reliable power to homes, schools, clinics, and small businesses. Their success in off-grid villages highlights their potential to transform rural livelihoods and reduce dependence on diesel generators.

Supportive government initiatives under programs like DDUGJY and Saubhagya have further accelerated microgrid adoption. These efforts, along with growing participation from private companies and NGOs, are helping address last-mile energy access. As quality and affordability become central to rural electrification, microgrids are positioned as a key solution to bridge energy gaps in India's vast and diverse terrain.

Key Market Challenges

High Initial Capital Cost and Financing Barriers

The high upfront cost associated with microgrid deployment is one of the most significant hurdles to market growth. These systems require investment in generation assets, storage technologies, control systems, and localized distribution networks - expenses that are difficult to justify in low-income or sparsely populated regions.Access to financing is limited, as financial institutions are often reluctant to support microgrid projects due to perceived risks such as uncertain revenue models and payment collection challenges. Developers, often small firms or startups, lack the financial strength to secure large loans or guarantees.

Even with partial subsidies or support from government schemes, regulatory uncertainties and delays can hinder deployment. Ambiguities regarding grid expansion, tariff structures, and asset ownership in future grid-connected scenarios add to the investment risk.

Innovative financing mechanisms and scalable business models, such as pay-as-you-go or community-based ownership, are emerging but need broader implementation. Addressing these financial and regulatory challenges is essential for enabling widespread microgrid adoption across India.

Key Market Trends

Rising Adoption of Solar-Dominant Microgrids

A growing trend in the Indian microgrid sector is the widespread shift toward solar-dominant configurations. Given the country’s ample solar resources, solar energy has become the preferred generation source for microgrids, particularly in rural and semi-urban areas. Declining costs of solar PV panels and batteries, coupled with improved efficiency, are making these systems more affordable and scalable.Government incentives and renewable energy targets are driving adoption across both public and private sectors. Numerous successful projects across states like Bihar, Jharkhand, and Odisha have demonstrated the viability of solar microgrids in powering entire villages and critical facilities. These systems offer cleaner alternatives to diesel and support environmental goals.

In urban and institutional settings, solar microgrids are being used to reduce energy costs and improve reliability. With advances in energy storage and smart controls, solar-based microgrids are expected to play an increasingly central role in India's transition to a decentralized, low-carbon energy system.

Key Players Profiled in this India Microgrid Market Report

- Tata Power Solar Systems Ltd.

- Sterlite Power Transmission Ltd.

- Suzlon Energy Ltd.

- Mahindra Susten Pvt. Ltd.

- L&T Power Development Ltd.

- ReNew Power Limited

- Adani Green Energy Ltd.

- BHEL (Bharat Heavy Electricals Limited)

Report Scope:

In this report, the India Microgrid Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Microgrid Market, by Connectivity:

- Grid Connectivity

- Off-Grid Connectivity

India Microgrid Market, by Type:

- AC Microgrids

- DC Microgrids

- Hybrid

India Microgrid Market, by End User:

- Government

- Utilities

- Military

- Healthcare

- Commercial & Industrial

- Others

India Microgrid Market, by Region:

- South India

- North India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Microgrid Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this India Microgrid market report include:- 1. Tata Power Solar Systems Ltd.

- 2. Sterlite Power Transmission Ltd.

- 3. Suzlon Energy Ltd.

- 4. Mahindra Susten Pvt. Ltd.

- 5. L&T Power Development Ltd.

- 6. ReNew Power Limited

- 7. Adani Green Energy Ltd.

- 8. BHEL (Bharat Heavy Electricals Limited)

Table Information

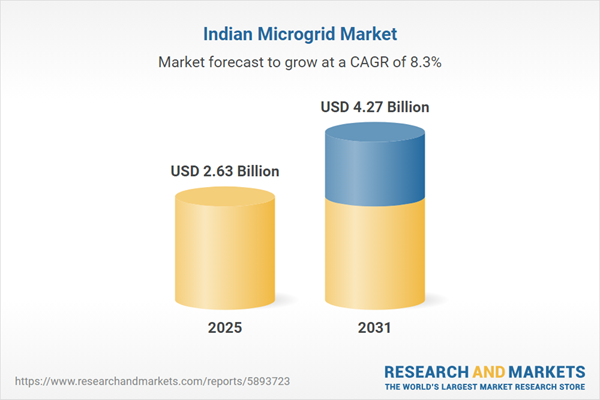

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | May 2025 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 2.63 Billion |

| Forecasted Market Value ( USD | $ 4.27 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 9 |