Speak directly to the analyst to clarify any post sales queries you may have.

IMPACT OF US & CHINA TRADE WAR

The US-China trade war escalated in January 2025, which resulted in higher tariffs on Pro AV imports, including displays, projectors, audio processors, and networking components. This raised procurement costs for integrators and end-users relying on Chinese and Taiwanese suppliers. Many manufacturers started shifting sourcing to Southeast Asia and Latin America, but these adjustments created moderate shipment delays that disrupted delivery schedules for large venue installations and enterprise AV projects across key US markets.In addition, US-India trade tensions intensified after tariffs on Indian exports were raised to 50% in August 2025, directly impacting specialized cabling, accessory components, and metal enclosures such as racks, chassis, and protective casings used in AV systems. Companies are either absorbing these extra costs or moving their sourcing to other regions, which complicates inventory planning and affects project timelines. Overall, the pro AV market is dealing with ongoing cost pressures and supply chain changes in 2025. These factors are influencing pricing strategies, procurement cycles, and the availability of professional-grade equipment.

PRO AV MARKET TRENDS & DRIVERS

- Smart and connected learning environments are accelerating the adoption of interactive displays, lecture capture, and AV-over-IP systems in schools and universities. These solutions improve hybrid teaching, expand digital classrooms, and support education sectors that are investing heavily in modernization. Such factors are projected to impact the pro AV market positively.

- Next-generation digital signage and experiential AV are changing retail, airports, and entertainment venues with immersive projection, LED walls, and interactive displays. They drive customer engagement, efficient advertising, and seamless wayfinding across high-traffic commercial environments.

- AI and automation-powered AV systems simplify meeting-room experiences with automatic camera tracking, voice recognition, and touchless controls. These capabilities help businesses reduce setup time, minimize IT intervention, and enable smoother collaboration between remote and in-office teams.

- Cloud-driven Pro AV platforms enable centralized monitoring, remote troubleshooting, and scalable content delivery across distributed sites. Institutions and corporations adopt them for cost savings, higher functioning time, and flexible integration with IT-led infrastructures.

- Rising demand for event-driven AV is boosting rental services, staging solutions, and live production technologies for concerts, sports, and exhibitions. Large-scale events need immersive displays, real-time broadcasting, and reliable sound reinforcement.

- Adoption of AV-as-a-Service and subscription-based models is growing among enterprises seeking flexible procurement in the pro AV market. This change reduces upfront costs, offers predictable operating expenses, and ensures ongoing access to the latest AV technologies.

INDUSTRY RESTRAINTS

High capital and operational costs limit the growth of the pro AV market, especially for small businesses and schools with tight budgets. The expenses for installation, integration, and frequent upgrades discourage long-term investment, even as demand for modern AV solutions grows. Moreover, a lack of skilled AV professionals and certified integrators slows down deployment and impacts system reliability. Many areas experience training gaps, resulting in delays for large installations and higher costs for specialized labor.Interoperability issues and vendor lock-in complicate multi-vendor system integration across enterprises, educational institutions, and event venues. Vendor-specific platforms often limit flexibility, increasing dependence on single suppliers and driving up long-term maintenance costs. Furthermore, cybersecurity risks in networked and cloud-based AV systems are increasing as companies move to AV-over-IP and remote management platforms. Vulnerabilities in conferencing, streaming, and data-sharing channels expose organizations to potential breaches and compliance challenges.

SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT

The global pro AV market by product segment covers professional video and professional audio systems, which form the two main pillars of Pro AV technology adoption across end-users. Professional video segments make up the dominant segmental share, due to strong reliance on video solutions for communication, broadcasting, and events. The demand for LED walls, UHD displays, and IP-based workflows supports this leadership, while integration with AV-over-IP improves scalability and encourages long-term use in corporate and entertainment settings.Segmentation by Product

- Professional Video

- Professional Audio

INSIGHTS BY PROFESSIONAL VIDEO

The professional video category is segmented into video displays, capture and production, video projection, and others, which include video conferencing systems, digital signage players, AV-over-IP encoders and decoders, matrix switchers, media servers, and multi-viewers. The video display market is expected to grow at a rate of 6.76% during the forecast period and holds the largest segmental share, fueled by the increasing use of LED walls and flat panels in boardrooms, control centers, and venues. Lower costs for LEDs are encouraging more installations in retail and transport hubs. Furthermore, the capture and production segment accounted for over40% of professional video revenue in 2024. Broadcast cameras, studio switchers, and editing systems lead as OTT platforms, esports, and businesses increase their content production.Segmentation by Professional Video

- Video Displays

- Capture and Production

- Video Projection

- Others

INSIGHTS BY CAPTURE AND PRODUCTION

The capture and production segment is further divided into application-based subsegments, including broadcast & video production, enterprise-Fortune 500, government bodies, higher education, healthcare, sports, worship & non-profit, K-12 education, museums, themed entertainment, and others such as retail, hospitality, tourism, and small business events. Broadcast & video production is forecast to record the highest CAGR of 7.54% during the forecast period. Investments in 4K/8K cameras, IP-based workflows, and cloud editing tools sustain this demand. Sports broadcasting and OTT services drive constant upgrades, making this the most rapidly expanding capture and production application across global Pro AV.Furthermore, the themed entertainment held the lowest share in 2024; this adoption is limited by high system costs and project-based spending in theme parks and attractions. Although niche, immersive AV projects in Asia-Pacific and the Middle East maintain relevance.

Segmentation by Capture And Production

- Broadcast & Video Production

- Enterprise - Fortune 500

- Government Bodies

- Higher Education

- Healthcare

- Sports

- Worship & Non-Profit

- K-12 Education

- Museums

- Themed Entertainment

- Others

INSIGHTS BY PROFESSIONAL AUDIO

The professional audio segment includes microphones, pro speakers, sound mixers, signal processors, power amplifiers, and others, such as studio interfaces, podcast consoles, DI boxes, IEM systems, and monitor controllers. Microphones held the largest share at over 34% in 2024, supported by widespread deployment in conferencing, hybrid classrooms, and live venues. Scalable wireless and network-ready microphones remain essential for corporate and broadcast environments.Sound mixers are expected to have the highest growth rate of 5.91%. Digital and software-based mixers are becoming more popular in studios, education, and live events. These mixers focus on integration with networked audio and compact, remotely operated setups. These qualities make mixers the most flexible and growing part of professional audio systems.

Segmentation by Professional Audio

- Microphones

- Pro Speakers

- Sound Mixers

- Signal Processors

- Power Amplifiers

- Others

INSIGHTS BY APPLICATION

The global pro AV market by application includes corporates, media & entertainment, venues & events, educational institutions, government & military, retail, transportation, hospitality, and others, such as healthcare, energy and utility sectors, houses of worship, museums, and other public or non-commercial venues. The corporates segment holds the most significant segmental share in 2024. Corporate AV helps communication, teamwork, and content sharing across offices with integrated systems like conference rooms, training centers, digital signs, and audio support. Moreover, common setups include UC platforms, networked conferencing bars, ceiling microphones, DSPs, control panels, and wireless sharing tools that create a consistent experience in different meeting spaces.Furthermore, the venues & events segment holds a significant share of the global pro AV market in 2024 and is forecasted as the fastest-growing application. Recovery of concerts, exhibitions, and conventions fuels large-scale investment in immersive video walls, high-power projection, and audio reinforcement, strengthening the role of venues and events. Also, transportation applications are projected to expand at the second-fastest CAGR of 6.81%. Airports, metros, and intercity hubs are deploying digital signage, information systems, and AV-linked monitoring to improve passenger flow and engagement. Smart mobility initiatives sustain adoption, making transport one of the strongest emerging verticals within Pro AV infrastructure.

Segmentation by Application

- Corporates

- Media & Entertainment

- Venues & Events

- Educational Institutions

- Government & Military

- Retail

- Transportation

- Hospitality

- Others

INSIGHTS BY DISTRIBUTION CHANNEL

The global pro AV market by distribution segmentation distinguishes between offline and online channels, reflecting the way integrators, enterprises, and end-users source professional AV equipment. Online channels, though smaller in 2024, are forecasted to grow at a CAGR of 7.17%. SMEs and independent consumers increasingly procure standardized AV systems through e-commerce, while integrators rely on digital platforms for components. Improved support and bundled delivery accelerate adoption, making online sourcing a key future growth vector.Segmentation by Distribution Channel

- Offline

- Online

PRO AV MARKET GEOGRAPHICAL ANALYSIS

APAC dominated the global pro AV market, accounting for a share of over 37% in 2024. Growing demand for immersive digital experiences in education, retail, and corporate sectors across India, China, and Southeast Asia drives the integration of interactive displays, video walls, and hybrid conferencing systems. Also, expanding infrastructure in transportation, hospitality, and government facilities increases the use of large-scale public address systems, control room AV, and digital signage solutions. Furthermore, the rapid growth of smart cities and 5G networks helps with the deployment of networked AV systems, remote monitoring tools, and cloud-connected AV control platforms in urban and industrial areas.North America holds a significant share of the global pro AV market. Rapid growth of hybrid workspaces and smart learning environments in the U.S. and Canada increases the need for unified communication systems, interactive flat panels, and high-quality conferencing AV solutions. Also, growing investments in AI-driven automation and cloud-managed AV platforms speed up the integration of intelligent AV systems in corporate, education, and public sector settings.

In 2024, Europe recorded the second-highest growth in the global pro AV market with a CAGR of 6.35%. Germany contributed 22.76% of regional revenue, supported by its strong trade-show ecosystem, corporate base, and integrator networks. Europe’s pro AV market growth is further reinforced by corporate and education upgrade cycles, demand from exhibitions such as Messe Frankfurt and IFA Berlin, and broadcaster investments in studio and OB-truck modernization, ensuring consistent adoption across its major submarkets.

In the Middle East and Africa, expansion is driven by luxury hospitality, stadium upgrades, and smart city projects in Saudi Arabia, the UAE, and Turkey. Within the region, South Africa's pro AV market leads with a 6.53% CAGR, supported by convention centres, broadcasting, and event rentals. Also, regional adoption in MEA is strengthened by infrastructure upgrades and telecom improvements that enable cloud conferencing and managed AV services. Combined with Saudi, UAE, and Turkish projects, South Africa’s diverse demand profile reinforces strong market momentum.

In 2024, Latin America accounted for a lower market share of the global pro AV market, with growth centred in Brazil and Mexico. Convention centres, live events, and sports venue upgrades fuel activity, though overall share remains limited by import costs.

Segmentation by Geography

- APAC

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Vietnam

- Malaysia

- North America

- U.S.

- Canada

- Europe

- Germany

- Russia

- UK

- France

- Italy

- Spain

- Poland

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Turkey

VENDOR LANDSCAPE

The global pro AV market is highly fragmented, with strong competition from leaders like LG Electronics, Crestron Electronics, Samsung, and Sony. These companies dominate with varied product lines, well-known brands, and wide distribution networks. Furthermore, technological innovation and specific industry needs drive competition. Video walls for control centers, AV-over-IP for corporate boardrooms, and immersive sound systems for entertainment venues push vendors to keep up with changing standards like HDMI 2.1 and IPMX.Established manufacturers in the pro AV market like Barco, Harman (part of Samsung), and Panasonic integrate IoT, cloud-based control systems, and AI-based automation that enable them to propose distinct solutions to high-end commercial applications.

Regional companies in emerging markets like India and Southeast Asia provide affordable AV integration services, quick installations, and local customization. However, they often struggle against international brands that have better financial and technical resources. Furthermore, the rise of live events, hybrid workplaces, and smart classrooms is speeding up global adoption, especially in APAC and Latin America, and boosting the pro AV market growth. There, increased investment in infrastructure and urbanization is creating new demand for enhanced AV setups.

Recent Developments in the Global Pro AV Market

- In June 2025, QSC launched the Core 24f processor Server Core X10 X20r and VSA-100 VisionSuite AI Accelerator, enhancing processing power and AI automation for Pro AV systems. These products improve signal management analytics integration and overall efficiency in enterprise and large venue environments.

- In April 2025, Blackmagic Design introduced the DeckLink IP 100G capture card supporting eight Ultra HD channels over 100G Ethernet. At NAB 2025, they also unveiled the PYXIS 12K camera, Videohub Mini routers, streaming encoders, decoders, and 2110 IP converters, providing advanced routing and efficient IP-based workflows.

- In June 2025, Sony enhanced its Spatial Reality Display with Twinmotion support, offering immersive real-time 3D visualization for designers, architects, and content creators. In January 2025, the company also partnered with Exertis AV to expand distribution of professional displays and signage in the UK and Ireland, accelerating adoption in commercial markets.

Key Company Profiles

- Sony Group Corporation

- Samsung

- LG Electronics

- Panasonic Corporation

- Crestron Electronics, Inc.

- Legrand AV Inc.

- Shure Incorporated

- Yamaha Corporation

- QSC, LLC

- Extron

- Christie Digital Systems, Inc.

- Biamp

- Sennheiser Electronic SE & Co. KG

- Blackmagic Design Pty. Ltd.

- NEC Corporation

Other Prominent Company Profiles

- Bose Corporation

- Poly Inc. (Part of HP Development Company)

- Logitech

- Hitachi, Ltd.

- Koninklijke Philips N.V.

- BenQ Corporation

- Sharp Corporation

- TCL Technology Group

- Toshiba Corporation

- Audio-Technica

- d&b audiotechnik GmbH & Co. KG.

- L-Acoustics

- Hisense Group

- InFocus Corporation

- Optoma Corporation

- TOA Corporation

- Boxlight Corporation

- Peerless AV

- AtlasIED

- ClearOne

- Kramer Electronics

- RTI (Remote Technologies Inc.)

- Altinex

- Hall Technologies

- RGB Spectrum

- Aurora Multimedia

- Lightware Visual Engineering

- Audinate

- Matrox

- Bang & Olufsen

- Leyard

- Semtech Corporation

- ViewSonic Corporation

- AVI SPL

- TD SYNNEX

- Barco Electronic Systems Pvt Ltd

KEY QUESTIONS ANSWERED:

1. What is the growth rate of the global pro AV market?2. What are the significant trends in the pro AV industry?

3. Which region dominates the global pro AV market share?

4. How big is the global pro AV market?

5. Who are the key players in the global pro AV market?

Table of Contents

Companies Mentioned

- Sony Group Corporation

- Samsung

- LG Electronics

- Panasonic Corporation

- Crestron Electronics, Inc.

- Legrand AV Inc.

- Shure Incorporated

- Yamaha Corporation

- QSC, LLC

- Extron

- Christie Digital Systems, Inc.

- Biamp

- Sennheiser Electronic SE & Co. KG

- Blackmagic Design Pty. Ltd.

- NEC Corporation

- Bose Corporation

- Poly Inc. (Part of HP Development Company)

- Logitech

- Hitachi, Ltd.

- Koninklijke Philips N.V.

- BenQ Corporation

- Sharp Corporation

- TCL Technology Group

- Toshiba Corporation

- Audio-Technica

- d&b audiotechnik GmbH & Co. KG.

- L-Acoustics

- Hisense Group

- InFocus Corporation

- Optoma Corporation

- TOA Corporation

- Boxlight Corporation

- Peerless AV

- AtlasIED

- ClearOne

- Kramer Electronics

- RTI (Remote Technologies Inc.)

- Altinex

- Hall Technologies

- RGB Spectrum

- Aurora Multimedia

- Lightware Visual Engineering

- Audinate

- Matrox

- Bang & Olufsen

- Leyard

- Semtech Corporation

- ViewSonic Corporation

- AVI SPL

- TD SYNNEX

- Barco Electronic Systems Pvt Ltd

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

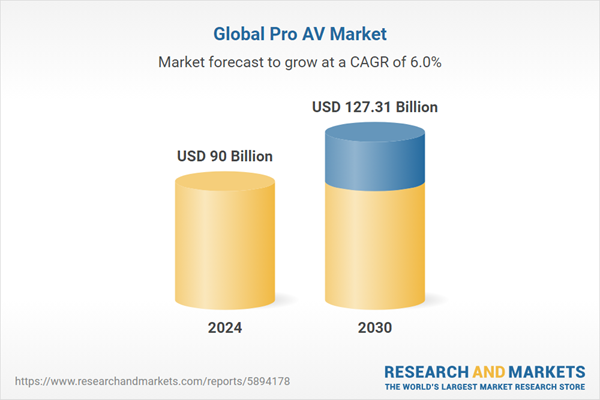

| Report Attribute | Details |

|---|---|

| No. of Pages | 230 |

| Published | October 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 90 Billion |

| Forecasted Market Value ( USD | $ 127.31 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 51 |