The third-party logistics (3PL) market is segmented by mode of transport into railways, roadways, waterways and airways. The roadways market was the largest segment of the third-party logistics (3PL) market segmented by mode of transport, accounting for 40.24% or $486.74 billion of the total in 2024. Going forward, the railways segment is expected to be the fastest growing segment in the third-party logistics (3PL) market segmented by mode of transport, at a CAGR of 10.76% during 2024-2029.

The third-party logistics (3PL) market is segmented by end-use industry into manufacturing, retail, healthcare, automotive and other industries. The manufacturing market was the largest segment of the third-party logistics (3PL) market segmented by end-use industry, accounting for 24.80% or $299.97 billion of the total in 2024. Going forward, the retail segment is expected to be the fastest growing segment in the third-party logistics (3PL) market segmented by end-use industry, at a CAGR of 11.22% during 2024-2029.

North America was the largest region in the third-party logistics (3PL) market, accounting for 34.41% or $416.2 billion of the total in 2024. It was followed by Asia Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the third-party logistics (3PL) market will be Asia Pacific and North America where growth will be at CAGRs of 11,24% and 10.79% respectively. These will be followed by Western Europe and Eastern Europe where the markets are expected to grow at CAGRs of 9.61% and 9.59% respectively.

The global third-party logistics (3PL) market is fragmented, with a large number of small players operating in the market. The top ten competitors in the market made up to 6.11% of the total market in 2023. Amazon.com Inc. was the largest competitor with a 2.02% share of the market, followed by C.H. Robinson Worldwide Inc. with 0.78%, Maersk AS with 0.69%, DHL Supply Chain & Global Forwarding with 0.63%, Kuehne+Nagel International AG with 0.54%, CEVA Logistics SA with 0.49%, Nippon Express Co. Ltd. with 0.41%, United Parcel Service of America Inc. with 0.24%, Sinotrans Ltd. with 0.16% and Uber Technologies Inc. with 0.14%.

The top opportunities in the third-party logistics (3PL) market segmented by service type will arise in the domestic transportation management segment, which will gain $277.8 billion of global annual sales by 2029. The top opportunities in the third-party logistics (3PL) market segmented by mode of transport will arise in the roadways segment, which will gain $314.92 billion of global annual sales by 2029. The top opportunities in the third-party logistics (3PL) market segmented by end-use industry will arise in the retail segment, which will gain $200.18 billion of global annual sales by 2029. The third-party logistics (3PL) market size will gain the most in the USA at $268.63 billion.

To take advantage of the opportunities, the analyst recommends the third-party logistics (3PL) market companies to focus on AI-driven order allocation and optimization, focus on AI-powered platforms for operational and strategic optimization, focus on transportation management system integration to improve efficiency, focus on scalable storage solutions to optimize inventory management, focus on expanding domestic transportation management capabilities, focus on roadways to maximize growth and operational efficiency, expand in emerging markets, focus on strategic expansion and sector-specific partnerships, focus on tiered pricing models linked to service value, focus on value-based messaging across channels, prioritize education-driven promotion to build trust, focus on the retail segment to capture the fastest growth in 3PL.

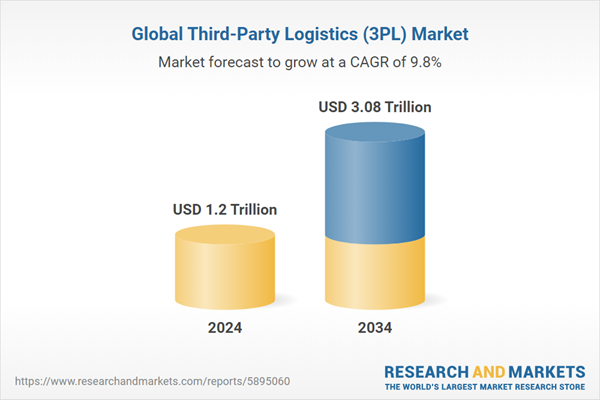

This report describes and explains the third-party logistics (3PL) market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

The global third-party logistics (3PL) market reached a value of nearly $1.2 trillion in 2024, having grown at a compound annual growth rate (CAGR) of 6.04% since 2019. The market is expected to grow from $1.2 trillion in 2024 to $1.97 trillion in 2029 at a rate of 10.34%. The market is then expected to grow at a CAGR of 9.27% from 2029 and reach $3.08 trillion in 2034.

Growth in the historic period resulted from the rising fuel prices and transportation costs, growth in demand for real-time tracking, rising expectations for fast and flexible delivery and rise in investment in small and medium-sized enterprises (SMEs). Factors that negatively affected growth in the historic period were supply chain disruptions and increase in the cybersecurity threats.

Going forward, rise in cross-border trade, expansion of the e-commerce industry, favorable government initiatives and expansion of the retail sector will drive the growth. Factor that could hinder the growth of the third-party logistics (3PL) market in the future include shortage of skilled personnel and drivers and trade wars and geopolitical unrest.

Market-trend-based strategies for the third-party logistics (3PL) market include focus on developing advanced products, such as AI-driven order allocation and optimization, focus on developing technologically advanced products, such as AI-powered platforms, focus on expanding their business to enhance global supply chain networks, focus on innovative logistic management systems, such as transportation management systems (TMS) and developing innovative storage services for sellers to optimize inventory management.

Player-adopted strategies in the third-party logistics (3PL) market include focus on expanding its business capabilities through lunching innovative products to expand its operational capabilities.

To take advantage of the opportunities, the analyst recommends the third-party logistics (3PL) market companies to focus on AI-driven order allocation and optimization, focus on AI-powered platforms for operational and strategic optimization, focus on transportation management system integration to improve efficiency, focus on scalable storage solutions to optimize inventory management, focus on expanding domestic transportation management capabilities, focus on roadways to maximize growth and operational efficiency, expand in emerging markets, focus on strategic expansion and sector-specific partnerships, focus on tiered pricing models linked to service value, focus on value-based messaging across channels, prioritize education-driven promotion to build trust, focus on the retail segment to capture the fastest growth in 3PL.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Third-Party Logistics (3PL) Global Market Opportunities And Strategies To 2034 provides the strategists; marketers and senior management with the critical information they need to assess the global third-party logistics (3PL) market as it emerges from the COVID-19 shut down.Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description

Where is the largest and fastest-growing market for third-party logistics (3PL)? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The third-party logistics (3PL) market global report answers all these questions and many more.The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider third-party logistics (3PL) market; and compares it with other markets.

The report covers the following chapters

- Introduction And Market Characteristics- Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by service type, by mode of transport and by end-user industries.

- Key Trends- Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Growth Analysis And Strategic Analysis Framework- Analysis on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Global Market Size And Growth- Global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional And Country Analysis- Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation- Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by service type, by mode of transport and by end-user industries in the market.Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size And Growth- Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies- Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers And Acquisitions- Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

- Recent Developments- Information on recent developments in the market covered in the report.

- Market Opportunities And Strategies - Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to third-party logistics (3PL) be followed in those markets.

- Conclusions And Recommendations - This section includes recommendations for third-party logistics (3PL) market providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix - This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

1) By Service Type: Dedicated Contract Carriage; Domestic Transportation Management; International Transportation Management; Warehousing And Distribution; Other Service Types2) By Mode Of Transport: Railways; Roadways; Waterways; Airways

3) By End-Use Industry: Manufacturing; Retail; Healthcare; Automotive; Other Industries

Key Companies Profiled: Amazon.com Inc.; C.H. Robinson Worldwide Inc.; Maersk AS; DHL Supply Chain & Global Forwarding; Kuehne+Nagel International AG

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; third-party logistics (3PL) indicators comparison.

Data segmentations:country and regional historic and forecast data; market share of competitors; market segments.

Sourcing and Referencing:Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

- Amazon.com Inc.

- C.H. Robinson Worldwide Inc.

- Maersk AS

- DHL Supply Chain & Global Forwarding

- Kuehne+Nagel International AG

- CEVA Logistics SA.

- Nippon Express Co. Ltd.

- United Parcel Service of America Inc.

- Sinotrans Ltd.

- Uber Technologies Inc.

- SF Express

- JD Logistics

- Alibaba Cainiao Network

- Sinotrans Limited

- YTO Express

- Kintetsu World Express

- Yusen Logistics

- Sagawa Express

- Hitachi Transport System

- Techtaka

- LG Uplus

- CJ Logistics

- Hanjin Logistics

- Lotte Global Logistics

- Pantos Logistics

- Samsung SDS

- BlueYonder

- Doddle Parcel Services Ltd.

- Bertelsmann

- Traxall International

- Fleet Logistics Group

- DB Schenker

- XPO Logistics

- DSV

- Geodis

- UPS Supply Chain Solutions

- LPP Logistics

- GLP

- Raben Group

- FM Logistic

- Union Pacific Corporation

- ePost Global

- Metro Supply Chain Inc.

- eShipping

- Ryder System, Inc.

- NFI Industries

- Echo Global Logistics

- WWEX Group

- Red Arts Capital

- Weber Logistics

- FedEx Corporation

- JB Hunt

- American Eagle Outfitters Inc

- TA Services Yusen Logistics Co. Ltd.

- BDP International Inc

- Mactrans Logistics

- TSI Group Inc

- Polaris Worldwide Logistics

- Canadian Alliance Terminals

- MacMillan SCG

- SBS Expedited Services Ltd

- Burris Logistics

- Pronto Cargo Logistics & Supply Chain

- Scan Global Logistics (SGL)

- Fox Brazil

- Rodo Vitor Transport

- Vehicle Rental

- Imexlog Logistica Aduaneira Perfect Solutions

- Maxi trans Brazil Logistics Company

- Leo de Juda Logistics Company

- Kuwait logistics & freight co.

- ADQ

- Move One Logistics

- Phoenix International Co

- Glaube Logistics

- TA Logistics Services

- Uni world Freight Services

- Crown logistics Company

- Imperial Logistics

- APG Logistics

- Value Logistics

- Jumia

- Transnova Africa

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 352 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.2 Trillion |

| Forecasted Market Value ( USD | $ 3.08 Trillion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 83 |