Antiseptics and Disinfectants: Introduction

Antiseptics and disinfectants are typically used to take precautions against infections. These products can kill microorganisms such as bacteria, viruses, and fungi using chemicals called biocides. Disinfectants are used to kill germs on non-living surfaces such as furniture, doorknobs, and floors, among others.On the contrary, antiseptics are used to kill microorganisms on human skin. They are also used in health care to kill or stop the growth of microbes on the skin and mucous membranes. With wider applications, antiseptics are also used to treat wounds and sanitizing hands in various public and home settings. Healthcare practitioners use these things in places like hospitals, nursing homes, doctor's offices, and clinics. Before medical treatments, they are commonly employed. Because they use antiseptics more frequently than consumers, health care personnel are exposed to more of it.

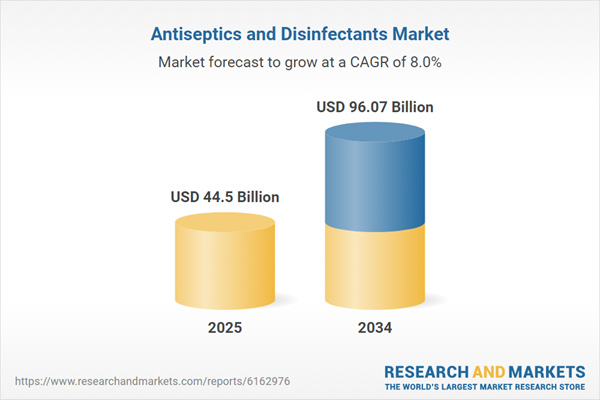

Global Antiseptics and Disinfectants Market Analysis

The rising geriatric population and increasing prevalence of chronic diseases are dramatically increasing the market growth. The rising number of surgical procedures is also contributing to the market growth. The rising incidence of hospital-acquired infections across the globe is also expected to escalate the market growth. The rising awareness among people and healthcare professionals about the advantages of hygiene in hospital facilities and around the patients especially is a major factor aiding the global antiseptic and disinfectants market growth.Post COVID-19, the use of these products has emerged in the market creating opportunities for the key players to collaborate and even individually put their products in the market in bulk due to the high demand surge, further propelling the market growth. Additionally, due to the antiviral properties against severe acute respiratory syndrome, the demand for antiseptics and disinfectants is significantly growing.

Global Antiseptics and Disinfectants Market Segmentations

Antiseptics and Disinfectants Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- Hand Sanitizers

- Disinfectant Wipes

- Disinfectant Liquids

- Disinfectant Sprays

- Antiseptic Liquids

- Others

Market Breakup by Active Ingredients

- Quaternary Ammonium Compounds

- Chlorine Compounds

- Alcohols and Aldehyde Products

- Hydrogen Peroxide

- Enzyme

- Others

Market Breakup by Applications

- Enzymatic Cleaners

- Medical Device Disinfectants

- Surface Disinfectants

- Hand Hygiene

- Instrument Disinfection

- Water Treatment

- Wound Care

- Air Disinfection

- Others

Market Breakup by Distribution Channels

- B2B

- FMCG

Market Breakup by End User

- Healthcare Facilities

- Food and Beverage Industry

- Residential Settings

- Commercial Buildings

- Manufacturing and Industrial Facilities

- Schools and Educational Institutions

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Antiseptics and Disinfectants Market Overview

The increasing prevalence of infectious diseases such as typhoid, cholera, hepatitis A, food poisoning, and dengue, that are caused primarily due to bad hygiene maintenance is a major factor contributing to the market growth. The increasing incidence of healthcare associated infections due to lack of precaution and sanitation is one of the leading factors escalating the antiseptics and disinfectants market globally. Additionally, due to increasing surgery procedures and increasing accident rates, and hospital acquired infections, the demand and utilization of antiseptics and disinfectants market is growing rapidly and contributing to the global antiseptics and disinfectants market share. The rising demand for endoscopy is also expected to contribute to the rising demand for antiseptics and disinfectants as the chances of getting healthcare associated infections (HAIs) are very high while getting an endoscopy.The number of surgical procedures has also increased across the global directly contributing to the market growth. The antiseptics & disinfectant products are majorly required in hospitals, clinics, and ambulatory surgery centres to protect themselves and the patient from various infections that they may be susceptible to while inside the facility. Therefore, driving the antiseptics & disinfectants market growth.

Antiseptics and Disinfectants Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- 3M

- Reckitt Benckiser

- Steris Plc

- Kimberly-Clark Corporation

- Bio-Cide International, Inc.

- Cardinal Health

- BD

- Johnson & Johnson

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- 3M

- Reckitt Benckiser

- Steris Plc

- Kimberly-Clark Corporation

- Bio-Cide International, Inc.

- Cardinal Health

- BD

- Johnson & Johnson

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 44.5 Billion |

| Forecasted Market Value ( USD | $ 96.07 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |