Hemodialysis Vascular Grafts: Introduction

Arteriovenous (AV) graft is widely used for hemodialysis. The usual placement of graft is in the arm, but it can also be placed in the leg depending upon the situation. An AV graft is the connection of a vein and an artery that utilizes a hollow, synthetic tube (the actual “graft”). This connection enables high blood flow, high pressure artery through the graft and into the low flow, low pressure vein. Due to which, blood flow through the graft provides a flow rate delivering sufficient blood to provide an appropriate hemodialysis treatment.Global Hemodialysis Vascular Grafts Market Analysis

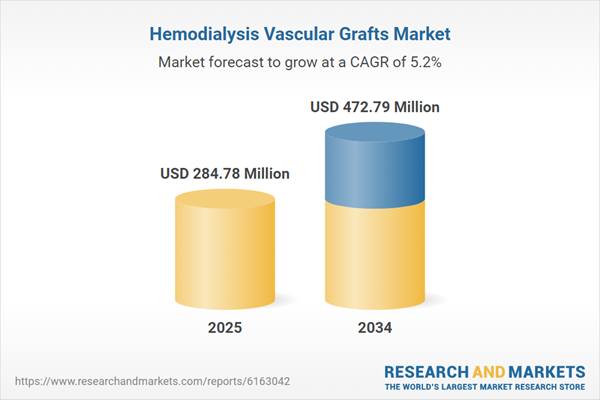

The market for hemodialysis vascular grafts has been experiencing significant growth supported by various factors and is expected to steadily grow in coming years as well. The factors such as increasing technological advancement in hemodialysis therapy are majorly influencing the market growth. The advancements such as bioartificial kidneys, hemodiafiltration, wearable artificial kidneys, and portable machines are influencing the market and hemodialysis adoption by patients and healthcare professionals.The key players are heavily investing in the research and development activities that are inclined towards creating more advanced technological equipment, medicinal drugs and therapies to treat chronic kidney diseases which is expected to further propel the global hemodialysis vascular grafts market growth. For example, Kidney Health Initiative and Kidney X: The Kidney Innovation Accelerator, as well as The Advancing American Kidney Health Initiative are collaborating to develop new therapies which could potentially customize the treatment of end-stage renal disease ESRD. The continuous research and development activities by key players in the market are directly contributing to the market expansion as well. For example, Xeltis is a key player targeted towards developing transformative implants to provide solutions to the patients of such chronic diseases has presented highly encouraging six-month data from its first-in-human (FIH) aXess vascular graft trial (NCT04898153). The data exhibited high patency rates (80% primary patency, 95% primary assisted patency, 100% secondary patency). A 0% infection rate and low re-intervention rates were encountered at the six months duration, resulting in a highly favorable safety profile.

Global Hemodialysis Vascular Grafts Market Segmentations

Hemodialysis Vascular Grafts Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Synthetic Grafts

- Expanded Polytetrafluoroethylene (ePTFE)

- Polyethylene Terephthalate (PET)

- Biological Grafts

- Human Saphenous and Umbilical Veins

- Autologous Vein Grafts

- Bovine Grafts

- Porcine Grafts

- Others

Market Breakup by Diameters

- Small Diameter Grafts (4 to 6 mm)

- Large Diameter Grafts (6 to 10 mm)

Market Breakup by Configuration

- Straight Grafts

- Loop Grafts

Market Breakup by End Use

- Hospitals

- Dialysis Centers

- Ambulatory Surgical Centers (ASCs)

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Hemodialysis Vascular Grafts Market Overview

The increasing prevalence of chronic kidney diseases worldwide is propelling the market growth. According to the National Kidney Foundation, nearly 10% of the global population is affected by chronic kidney disease (CKD) accounting for millions of deaths yearly. The increase in geriatric population globally is also a major factor, adding further growth to the global hemodialysis vascular grafts market share. With increasing age, people get more susceptible to kidney diseases due to various factors, such as cardiovascular diseases, hypertension, and diabetes, among others.North America has been leading the global market and is expected to lead the global market for the forecast period as well. This growth of the region is expected to be driven by the presence of geriatric population, large patient pool suffering from chronic kidney diseases due to factors such as adoption of sedentary lifestyle, including alcohol consumption, and unhealthy dietary habits, among others.

Hemodialysis Vascular Grafts Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- W. L. Gore & Associates, Inc.,

- C. R. Bard, Inc.

- Vascudyne, Inc.

- LeMaitre

- Getinge AB,

- VASCULAR GENESIS,

- InnAVasc Medical, Inc.

- CryoLife, Inc.

- Merit Medical Systems

- BIOVIC Sdn Bhd.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- W. L. Gore & Associates, Inc.

- C. R. Bard, Inc.

- Vascudyne, Inc.

- LeMaitre

- Getinge AB

- VASCULAR GENESIS

- InnAVasc Medical, Inc.

- CryoLife, Inc.

- Merit Medical Systems

- BIOVIC Sdn Bhd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 284.78 Million |

| Forecasted Market Value ( USD | $ 472.79 Million |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |