Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market expansion faces a significant hurdle due to the elevated integration costs of modern LED fog lighting, which limits their adoption in economy-class vehicles. Supply chain instability also poses a persistent threat to consistent market performance. Highlighting the industry's dependence on manufacturing output, the International Organization of Motor Vehicle Manufacturers (OICA) reported that the global automotive sector produced 92.5 million motor vehicles in 2024. This massive production volume underscores how heavily the market relies on the stability of the broader automotive manufacturing sector to maintain demand for lighting components.

Market Drivers

The Global Anti Fog Lights Market is being fundamentally reshaped by the growth of electric and premium vehicle sectors, which emphasize energy efficiency and advanced design aesthetics. To protect battery range in electric vehicles (EVs) and meet the refined standards of luxury models, manufacturers are increasingly adopting low-power fog lighting systems. This pivot toward electrification demands high-performance visibility components compatible with modern vehicle architectures. According to the European Automobile Manufacturers' Association (ACEA), battery-electric cars secured a 16.4% share of year-to-date new car registrations in October 2025, highlighting the rapid expansion of a vehicle fleet that requires specialized, power-efficient lighting solutions.Additionally, the shift toward LED technology acts as a significant value multiplier, driving the transition from traditional halogen bulbs to units that offer superior durability and precise beam control. This technological evolution is reflected in the financial results of major suppliers; for instance, ams OSRAM reported in February 2025 that its Lamps & Systems segment achieved 275 million euros in revenue during the fourth quarter of 2024 alone, bolstered by seasonal aftermarket demand. The commercial sector further supports this trend, as the European Automobile Manufacturers' Association (ACEA) noted in January 2025 that new EU van sales rose by 8.3% in 2024, demonstrating a sustained need for reliable visibility systems across various utility vehicle classes.

Market Challenges

The substantial integration costs linked to modern LED anti-fog lighting create a major obstacle to market growth, especially within the economy vehicle sector. Unlike standard halogen bulbs, LED systems necessitate complex electronic control units, precise optical engineering, and advanced thermal management, all of which raise the bill of materials. In price-sensitive markets, manufacturers operating on narrow profit margins often omit these advanced systems from standard equipment to keep prices competitive. As a result, mass-market adoption is hindered, confining advanced fog lighting largely to premium or luxury trims rather than establishing it as a universal standard.This economic barrier is further aggravated by an inflationary environment impacting automotive component production. According to the European Association of Automotive Suppliers (CLEPA), 77% of automotive suppliers reported in 2024 that they faced significant challenges managing rising production costs which could not be fully passed on to automakers. This financial strain compels original equipment manufacturers to maintain strict cost discipline, thereby reducing the probability of installing expensive LED fog light modules in entry-level vehicles. Consequently, the market faces difficulties in expanding volumes within the high-quantity economy tier, restricting overall growth potential despite the clear safety advantages these systems provide.

Market Trends

The integration of Fog Lights with Advanced Driver Assistance Systems (ADAS) is transforming the market by converting passive lighting devices into essential sensor hubs. To improve obstacle detection in poor weather, manufacturers are redesigning fog light housings and lower bumpers to accommodate radar sensors and LiDAR units, effectively utilizing this low-positioned architecture. This convergence enables "smart corner" modules that combine autonomous sensing with visibility functions, streamlining production and reducing aerodynamic drag. Highlighting the financial viability of this shift, Koito Manufacturing Co., Ltd. reported in its April 2025 Consolidated Earnings Report for Fiscal 2024 that the consolidation of LiDAR specialist Cepton Technologies contributed 3.8 billion yen to its profits, validating the merger of advanced sensing with traditional lighting.Concurrently, the adoption of Adaptive and Matrix Intelligent Beam functionalities is driving value by providing precise, glare-free illumination. This trend entails the broad deployment of matrix LED arrays capable of individually dimming or activating pixels to optimize road visibility without blinding oncoming drivers, a feature that is increasingly moving from luxury to mass-market segments. This technological upgrade ensures sustained revenue for suppliers despite fluctuations in vehicle production volumes. The strong demand for such solutions is illustrated by HELLA GmbH & Co. KGaA, which reported in March 2025 that it achieved currency- and portfolio-adjusted sales of 8.06 billion euros in its Annual Report 2024, a performance driven by robust interest in high-performance lighting and vehicle electronics.

Key Players Profiled in the Anti Fog Lights Market

- Koito Manufacturing Co., Ltd.

- Valeo SA

- Hella GmbH and Co. KGaA

- Magneti Marelli S.p.A.

- Stanley Electric Co., Ltd.

- ZKW Group GmbH

- OSRAM GmbH

- Hyundai Mobis Co., Ltd.

- SL Corporation

- Robert Bosch GmbH

- General Electric Company

- Phoenix Lamps Limited

Report Scope

In this report, the Global Anti Fog Lights Market has been segmented into the following categories:Anti Fog Lights Market, by Material Type:

- Xenon

- Halogen

- LED (Light Emitting Diode)

Anti Fog Lights Market, by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Anti Fog Lights Market, by Sales Channel Type:

- OEM (Original Equipment Manufacturers)

- Aftermarket

Anti Fog Lights Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Anti Fog Lights Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Anti Fog Lights market report include:- Koito Manufacturing Co., Ltd.

- Valeo SA

- Hella GmbH and Co. KGaA

- Magneti Marelli S.p.A.

- Stanley Electric Co., Ltd.

- ZKW Group GmbH

- OSRAM GmbH

- Hyundai Mobis Co., Ltd.

- SL Corporation

- Robert Bosch GmbH

- General Electric Company

- Phoenix Lamps Limited

Table Information

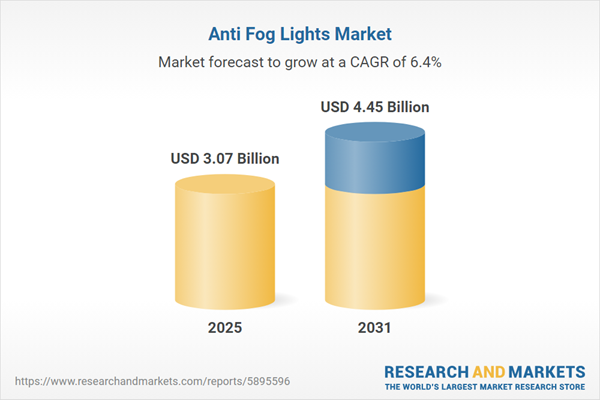

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.07 Billion |

| Forecasted Market Value ( USD | $ 4.45 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |