Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Demand of Carbon Fiber Composites in Aerospace Industry

The aerospace industry has always been at the forefront of innovation, constantly pushing the boundaries of technology and materials to improve performance, reduce weight, and enhance fuel efficiency. In recent years, carbon fiber composites have emerged as a game-changer in this industry. These lightweight, high-strength materials have revolutionized aircraft design and manufacturing, leading to improved aircraft performance, reduced emissions, and enhanced passenger safety. One of the paramount challenges faced by the aerospace industry is the need to reduce aircraft weight without compromising structural integrity and safety. Carbon fiber composites have become instrumental in achieving this goal.Traditional aluminum structures are being replaced by carbon fiber-reinforced composites in critical components such as wings, fuselages, and empennages. These composites are significantly lighter than their metal counterparts, resulting in fuel savings, extended range, and reduced operating costs. The demand for fuel-efficient aircraft, driven by environmental concerns and the desire to cut operational expenses, has fueled the rapid adoption of carbon fiber composites.

Aircraft components are subjected to extreme conditions, including fluctuating temperatures, high-pressure altitudes, and intense vibrations. Carbon fiber composites offer exceptional strength-to-weight ratios, making them ideal for withstanding these harsh operational environments. The high tensile strength and durability of carbon fiber composites ensure that critical structures can withstand stress and fatigue, increasing the safety and reliability of aircraft. As a result, aircraft manufacturers are increasingly turning to these materials to enhance the structural integrity and longevity of their products.

The aerospace sector is increasingly adopting carbon fiber composites, which now constitute over 50% of structural components in modern aircraft designs. These advanced materials offer significant advantages, notably in reducing aircraft weight and fuel consumption, both of which are critical to operational efficiency and cost-effectiveness. Affordability and performance optimization remain top priorities in aerospace manufacturing, and carbon composites enable the production of lighter, more fuel-efficient civil, cargo, and military aircraft.

The aerospace industry launched two aircraft, Boeing 787 Dreamliner and Airbus A350 XWB which have incorporated carbon fiber composites in more than 50-53% of their airframes, showcasing a pivotal shift toward composite-intensive designs. This transition has directly contributed to enhanced fuel efficiency, lower emissions, and extended aircraft lifespan. Amid growing pressure from global net-zero emissions targets including the IATA’s commitment to achieving net-zero by 2050, airlines and original equipment manufacturers (OEMs) are accelerating the adoption of lightweight materials to support sustainable aviation strategies. This regulatory push is reinforcing demand for carbon fiber composites across the aerospace value chain.

Key Market Challenges

High Production Costs and Supply Chain Vulnerabilities Poses a Significant Obstacle to Market Expansion

One of the most prominent challenges in the carbon fiber composites market is the high cost of production. Carbon fiber-reinforced composites are manufactured through intricate and energy-intensive processes, involving precursor materials, high-temperature treatments, and specialized equipment like autoclaves. The expense of raw materials, such as carbon fibers and epoxy resins, further contributes to the high production costs. To remain competitive, the industry must find innovative ways to reduce manufacturing expenses without compromising product quality. This includes exploring alternative precursor materials, optimizing manufacturing processes, and adopting cost-effective curing methods like out-of-autoclave (OOA) techniques.Moreover, the carbon fiber composites supply chain is susceptible to disruptions, including fluctuations in raw material availability and geopolitical factors affecting trade. Carbon fibers, a key component, are sourced from a limited number of suppliers globally, which can lead to supply chain vulnerabilities. Manufacturers should establish robust supply chain management strategies, diversify suppliers where possible, and invest in inventory management to mitigate potential disruptions. Furthermore, exploring alternative sources of precursor materials and carbon fibers can enhance supply chain resilience.

Key Market Trends

Advancements in Manufacturing Technologies

Continuous advancements in manufacturing technologies are revolutionizing the carbon fiber composites market. Traditional methods of producing carbon fiber composites, such as autoclave curing, are being complemented by emerging techniques like out-of-autoclave (OOA) curing and automated fiber placement (AFP). OOA curing methods offer cost savings and shorter production cycles, making carbon fiber composites more accessible to various industries. Automated manufacturing processes, including 3D printing and robotic lay-up, are improving production efficiency, and reducing material wastage.Moreover, the automotive industry is undergoing a significant transformation driven by the pursuit of lightweighting, improved fuel efficiency, and reduced emissions. Carbon fiber composites are playing a pivotal role in achieving these objectives. Automakers are increasingly incorporating carbon fiber-reinforced composites in vehicle structures, chassis, and interior components to reduce overall weight without compromising safety or performance. This trend is particularly evident in high-performance and electric vehicles where the lightweight properties of carbon fiber composites help extend the driving range and enhance handling.

Key Market Players

- Toray Industries Inc

- SGL Carbon SE

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Hexcel Corporation

- Rock West Composites, Inc.

- Teijin Limited

- Solvay S.A.

- DowAksa Advanced Composites Holdings BV

- Nippon Graphite Fiber Co., Ltd.

- Hyosung Advanced Materials

Report Scope:

In this report, the Global Carbon Fiber Composites Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Carbon Fiber Composites Market, By Matrix Material:

- Polymer

- Carbon

- Ceramics

- Metal

- Hybrid

Carbon Fiber Composites Market, By End Use:

- Aerospace

- Automotive

- Wind Turbines

- Sport & Leisure

- Civil Engineering

- Marine

- Others

Carbon Fiber Composites Market, By Region:

- Asia-Pacific

- China

- India

- Australia

- Japan

- South Korea

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- North America

- United States

- Mexico

- Canada

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Carbon Fiber Composites Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Toray Industries Inc

- SGL Carbon SE

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Hexcel Corporation

- Rock West Composites, Inc.

- Teijin Limited

- Solvay S.A.

- DowAksa Advanced Composites Holdings BV

- Nippon Graphite Fiber Co., Ltd.

- Hyosung Advanced Materials

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | August 2025 |

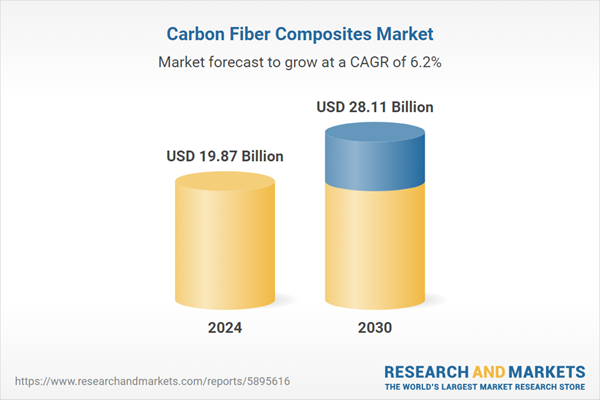

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19.87 Billion |

| Forecasted Market Value ( USD | $ 28.11 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |