Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

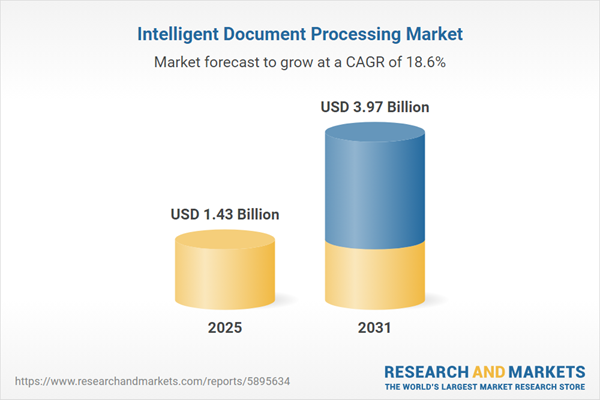

This growth is primarily underpinned by the corporate objective to improve operational efficiency and the necessity to cut costs linked to manual data entry. Furthermore, the rising demand for regulatory compliance fosters adoption, as organizations look for reliable methods to uphold accurate audit trails and adhere to strict legal standards regarding information management. Highlighting this robust demand, the Association for Intelligent Information Management notes that in 2025, 65 percent of enterprises are actively considering or implementing new Intelligent Document Processing initiatives.

Despite this expanding adoption, the market faces a significant hurdle regarding data privacy and security concerns which can complicate system deployment. The complexity of ensuring compliance with rigorous data protection regulations while handling sensitive information frequently necessitates extensive governance reviews. These requirements create a substantial barrier that can impede the speed of market expansion and solution integration.

Market Drivers

Advancements in Natural Language Processing and Machine Learning Technologies serve as a primary catalyst for the Global Intelligent Document Processing Market, particularly through the rapid emergence of agentic AI. This technological leap allows systems to not only extract data but also reason, plan, and execute complex workflows autonomously, significantly widening the scope of automatable document-centric tasks beyond simple classification. The fast-paced integration of these capabilities is evident in the technical workforce; according to UiPath's December 2025 'State of the Agentic Automation Professional 2025' report, 75 percent of automation professionals are already using or experimenting with agentic automation to optimize operational processes.The rising demand for operational efficiency and cost optimization further accelerates market momentum as enterprises seek to maximize data value while minimizing manual intervention. By deploying intelligent solutions that augment human decision-making with high-accuracy extraction, organizations achieve measurable improvements in processing speed and resource utilization. This drive for performance is substantiated by recent data; according to ABBYY's September 2025 'State of Intelligent Automation: GenAI Confessions 2025' report, 98 percent of businesses utilizing complementary AI technologies reported improved outcomes, including greater accuracy and cost savings. Such tangible benefits are driving broader market penetration, where SS&C Blue Prism notes that in 2025, 29 percent of organizations stated they are already using agentic AI for autonomous automation.

Market Challenges

Data privacy and security concerns constitute a substantial barrier directly impeding the growth of the Global Intelligent Document Processing Market. Because these solutions utilize artificial intelligence to process vast volumes of sensitive unstructured information, such as financial statements and personally identifiable data, they are subject to rigorous data protection regulations. The critical requirement to ensure that automated extraction and classification processes comply with strict legal standards necessitates prolonged security audits and comprehensive risk assessments. These mandatory governance reviews significantly extend deployment timelines and often result in the drastic reduction of project scopes to minimize exposure to potential breaches.Furthermore, the integration of advanced algorithms within document processing introduces complex vulnerabilities that many enterprises are currently ill-equipped to manage. This lack of organizational readiness regarding AI governance leads to hesitation in adopting cloud-based processing platforms, which are essential for market scalability. Highlighting this widespread lack of preparedness, ISACA reported that in 2024, only 15 percent of organizations had formally established policies for artificial intelligence use. This absence of defined security frameworks compels corporate decision-makers to pause or limit their investment in intelligent document technologies, thereby stalling broader market expansion.

Market Trends

The widespread adoption of Low-Code and No-Code IDP platforms is fundamentally altering the deployment landscape by shifting development capabilities from specialized data scientists to business subject matter experts. This democratization allows enterprises to rapidly configure custom extraction models for niche document types without incurring the delays traditionally associated with extensive coding cycles or IT bottlenecks. By leveraging intuitive drag-and-drop interfaces, organizations are accelerating time-to-value and ensuring that automation strategies align more closely with immediate operational needs. This shift towards accessibility is substantiated by industry data; according to MuleSoft's January 2025 'Connectivity Benchmark Report', 65 percent of organizations report having complete or near-complete strategies for supporting non-technical users to build automation via low-code and no-code platforms.A strategic convergence with Robotic Process Automation and Hyperautomation ecosystems represents a critical evolution where document processing is no longer treated as a standalone silo but as a fully integrated component of end-to-end digital workflows. Modern IDP solutions are increasingly embedding directly within broader automation architectures, ensuring that extracted data flows seamlessly into downstream ERP, CRM, and legacy systems to trigger subsequent actions without friction. This holistic approach addresses the persistent challenge of fragmented technology stacks that isolate valuable unstructured data from the business logic required to act upon it. The necessity for this architectural unity is highlighted by recent market feedback; according to UiPath's January 2025 'Agentic AI Report', 87 percent of IT executives stated that interoperability between different AI technologies is essential or significant to their organizations to improve business processes.

Key Players Profiled in the Intelligent Document Processing Market

- Interrnational Business Machines Corporation

- WorkFusion Inc.

- UiPath Inc.

- HCL Technologies Limited

- Appian Corporation Inc.

- Tungsten Corporation

- Adobe Inc.

- Open Text Corporation

- ABBYY Solutions

- Hyland Software, Inc.

Report Scope

In this report, the Global Intelligent Document Processing Market has been segmented into the following categories:Intelligent Document Processing Market, by Component:

- Solution

- Services

Intelligent Document Processing Market, by Organization Size:

- SMEs

- Large Enterprises

Intelligent Document Processing Market, by Deployment Model:

- Cloud

- On Premise

Intelligent Document Processing Market, by Technology:

- Natural Language Processing

- Optical Character Recognition

- Machine Learning

- Artificial Intelligence

- Others

Intelligent Document Processing Market, by End Use Vertical:

- BFSI

- Government

- Healthcare

- Retail

- Manufacturing

- Others

Intelligent Document Processing Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Intelligent Document Processing Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Intelligent Document Processing market report include:- Interrnational Business Machines Corporation

- WorkFusion Inc.

- UiPath Inc

- HCL Technologies Limited

- Appian Corporation Inc

- Tungsten Corporation

- Adobe Inc.

- Open Text Corporation

- ABBYY Solutions

- Hyland Software, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.43 Billion |

| Forecasted Market Value ( USD | $ 3.97 Billion |

| Compound Annual Growth Rate | 18.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |