Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Dissolution testing simulates the release of a drug in the body, helping manufacturers ensure consistency, safety, and therapeutic effectiveness. Increasingly stringent global regulatory frameworks have made dissolution testing a mandatory standard, further driving market demand. Through continuous monitoring of drug dissolution profiles, pharmaceutical firms can refine formulations and manufacturing processes, contributing to enhanced product reliability. As more complex and innovative drug formulations enter development, dissolution testing services are becoming indispensable in supporting regulatory submissions and batch-to-batch consistency, making them a critical component of pharmaceutical R&D and quality assurance.

Key Market Drivers

Rising Pharmaceutical R&D

The growth of pharmaceutical research and development is a key factor propelling the Global Pharmaceutical Dissolution Testing Services Market. With increasing investment in novel drug development and therapeutic innovation, the role of dissolution testing has become integral to optimizing formulations, assessing drug bioavailability, and ensuring production consistency.The surge in new drug candidates across therapeutic areas demands robust testing solutions to meet regulatory and clinical standards. According to the OECD, global pharmaceutical R&D expenditure reached USD 129 billion in 2021, with the United States contributing the majority share. This upward trend is reinforced by rapid R&D expansion in countries like China, which recorded a 189% increase in pharmaceutical research spending between 2010 and 2019. As R&D activity accelerates globally, the need for specialized testing services, particularly in dissolution studies, is rising, ensuring compliance, safety, and therapeutic performance in increasingly complex drug products.

Key Market Challenges

Regulatory Compliance

Regulatory compliance remains a significant challenge for the pharmaceutical dissolution testing services market. With evolving guidelines from global authorities such as the U.S. FDA and EMA, testing laboratories must stay updated with the latest requirements for drug evaluation. Adhering to these standards necessitates significant investment in training, advanced instrumentation, and meticulous documentation.Non-compliance can result in regulatory penalties, delays in product approvals, or product recalls, affecting a company’s market standing and operational costs. As compliance expectations grow more stringent, service providers must continuously adapt their processes, ensuring accuracy, traceability, and alignment with international regulatory frameworks. The constant evolution of compliance benchmarks places a considerable operational and financial burden on testing organizations, making regulatory alignment a critical success factor in the dissolution testing services market.

Key Market Trends

Increasing Drug Development Activities

The escalating pace of drug development is driving increased demand for pharmaceutical dissolution testing services. With the pharmaceutical industry expanding its focus on targeted therapies, biologics, and controlled-release formulations, the need for precise and reliable dissolution testing is more crucial than ever. These tests play a vital role in formulation development, quality control, and regulatory approval.Modern formulations, including nanoparticles and extended-release systems, require specialized dissolution assessments to ensure accurate drug performance analysis. Regulatory agencies demand rigorous documentation of dissolution profiles during the drug approval process, reinforcing the value of expert testing services. Additionally, outsourcing testing to specialized providers offers pharmaceutical companies cost efficiency, flexibility, and access to technical expertise. This growing trend, fueled by a focus on time and resource optimization, is expected to support the sustained expansion of the dissolution testing services market.

Key Players Profiled in this Pharmaceutical Dissolution Testing Services Market Report

- Intertek Group Plc

- Avivia BV

- Almac Group

- Agilent Technologies, Inc.

- Catalent, Inc.

- Thermo Fisher Scientific Inc

- Charles River Laboratories

- Cambrex

- Boston Analytical

- Pace Analytical Life Sciences

Report Scope:

In this report, the Global Pharmaceutical Dissolution Testing Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Pharmaceutical Dissolution Testing Services Market, by Services Method:

- In vitro

- In vivo

Pharmaceutical Dissolution Testing Services Market, by Dosage Form:

- Capsule

- Tablets

- Others

Pharmaceutical Dissolution Testing Services Market, by Dissolution Apparatus:

- Basket

- Paddle

- Others

Pharmaceutical Dissolution Testing Services Market, by Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Pharmaceutical Dissolution Testing Services Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Pharmaceutical Dissolution Testing Services market report include:- Intertek Group Plc

- Avivia BV

- Almac Group

- Agilent Technologies, Inc.

- Catalent, Inc.

- Thermofisher Scientific Inc

- Charles River Laboratories

- Cambrex

- Boston Analytical

- Pace Analytical Life Sciences

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | May 2025 |

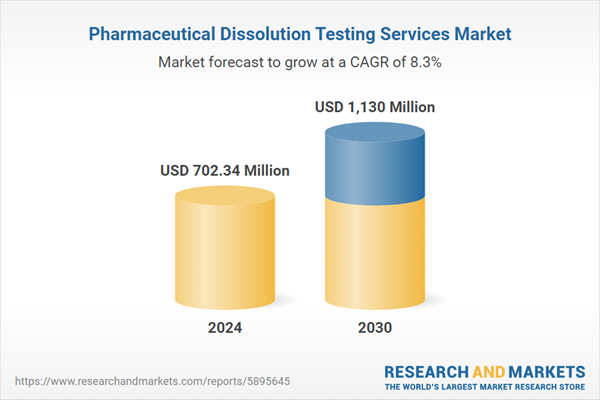

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 702.34 Million |

| Forecasted Market Value ( USD | $ 1130 Million |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |