Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Nevertheless, a major obstacle hindering widespread market growth is the high cost and technical complexity involved in ensuring consistent sensor functionality across varying environmental conditions. Issues such as fluctuating lighting or intricate hand movements can result in unreliable recognition, leading to user dissatisfaction and prompting manufacturers to restrict these systems to luxury vehicle segments. This combination of economic and functional hurdles limits adoption in the mass market, preventing the technology from establishing itself as a standard offering in entry-level and mid-range automobiles.

Market Drivers

Stringent government mandates aimed at enhancing driver safety and mitigating distraction serve as a major impetus for the uptake of automotive gesture recognition systems. Regulatory authorities are increasingly urging manufacturers to adopt contactless interfaces that minimize the visual-manual interference typically associated with physical touchscreens. By enabling drivers to operate navigation and communication features via simple hand gestures, these technologies help maintain focus on the road. The necessity of this transition is highlighted by recent crash statistics; according to the National Highway Traffic Safety Administration's April 2024 'Traffic Safety Facts Research Note', distraction-related accidents caused 3,308 deaths in the United States in 2022, prompting automakers to prioritize gesture controls as a strategy to comply with safety standards and boost vehicle safety ratings.Concurrently, the rise of smart cabin technologies is transforming interior designs to prioritize intuitive, touchless interactions. As vehicles evolve into software-defined platforms, there is growing demand for human-machine interfaces that offer responsiveness comparable to consumer electronics. This trend is evident in supplier achievements; LG Electronics reported in January 2024 that its Vehicle component Solutions Company reached an annual revenue of KRW 10.1 trillion for 2023, largely fueled by demand for in-vehicle infotainment. This integration is further accelerated by the shift toward electrification, where advanced interiors are a primary selling point. As per the International Energy Agency in 2024, almost 14 million new electric cars were registered globally in 2023, providing a substantial ecosystem for the implementation of these sophisticated recognition systems.

Market Challenges

The main obstacle restraining the Global Automotive Gesture Recognition Market is the significant expense and technical intricacy needed to guarantee reliable sensor operation. Engineering systems capable of accurately translating complicated hand movements amidst variable environmental factors, such as changing lighting or shadows, necessitates substantial research and development investment. This technical instability frequently leads to user dissatisfaction when commands are not recognized, forcing manufacturers to limit these features to luxury models where higher price tags can offset development expenditures. As a result, this prevents the achievement of economies of scale required for mass-market integration within entry-level and mid-range vehicle categories.The financial strain associated with surmounting these technical difficulties is immense, slowing the pace at which affordable solutions can be introduced to the wider market. The magnitude of this capital requirement is reflected in the industry's broad spending on digital advancement. According to the German Association of the Automotive Industry (VDA) in 2024, manufacturers and suppliers planned to invest roughly €280 billion in research and development globally between 2024 and 2028, with a major emphasis on digitalization and automation. This colossal expenditure highlights the economic hurdle that restricts advanced interface technologies like gesture recognition to high-end vehicles, thereby impeding the market's potential for extensive volumetric expansion.

Market Trends

The shift toward multimodal human-machine interfaces is transforming user interaction by integrating gesture control with voice commands and gaze tracking to decrease ambiguity. Instead of depending exclusively on hand movements, these unified systems use contextual cues from eye direction or verbal instructions to verify driver intent, significantly reducing the false positives often found in single-modality setups. This level of complexity necessitates robust computing platforms, as seen in the growing need for advanced digital chassis solutions capable of processing simultaneous inputs. For instance, Qualcomm reported in its July 2024 earnings release that it generated $811 million in automotive revenue, indicating a surge in the adoption of integrated digital cockpit technologies that sustain these multi-layered interaction frameworks.At the same time, the implementation of radar-based sensing, specifically millimeter-wave technology, is gaining traction as a practical substitute for optical cameras in detecting micro-motions. Unlike camera systems that may falter in low light or raise privacy issues, radar sensors offer precise detection of subtle finger gestures and vital signs across diverse materials and environmental settings. This move toward non-optical monitoring is fueling substantial demand for specialized automotive semiconductors designed to handle high-frequency sensor data. Highlighting this industrial shift, Infineon Technologies announced in August 2024 that its Automotive segment reached €2.11 billion in revenue for the third quarter, supported by strong sales of the microcontrollers and sensors required for these cutting-edge interior monitoring architectures.

Key Players Profiled in the Automotive Gesture Recognition Market

- Cipia Vision Ltd.

- Cognitec Systems GmbH

- Continental AG

- NXP Semiconductors

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Synaptics Incorporated

- Usens Inc.

- Visteon Corporation.

Report Scope

In this report, the Global Automotive Gesture Recognition Market has been segmented into the following categories:Automotive Gesture Recognition Market, by Technology:

- Touch-based Gesture Recognition

- Touchless Gesture Recognition

Automotive Gesture Recognition Market, by Application:

- Multimedia/Infotainment/Navigation

- Lighting Systems

- Others

Automotive Gesture Recognition Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Gesture Recognition Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Gesture Recognition market report include:- Cipia Vision Ltd.

- Cognitec Systems GmbH

- Continental AG

- NXP Semiconductors

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd

- Sony Corporation

- Synaptics Incorporated

- Usens Inc

- Visteon Corporation.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

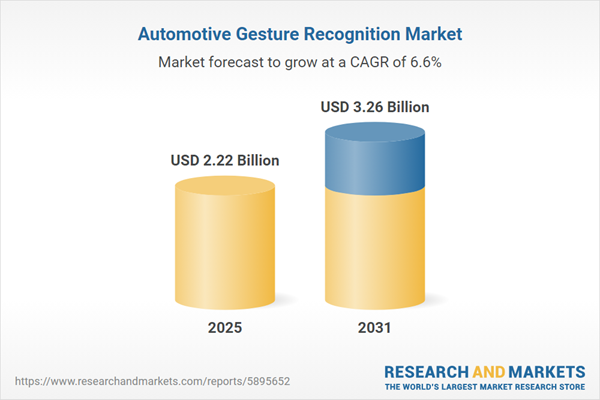

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 2.22 Billion |

| Forecasted Market Value ( USD | $ 3.26 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |