Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this positive growth trajectory, the market faces a notable challenge due to prevailing economic volatility, characterized by high interest rates and rising construction costs. These financial pressures often compel developers to delay new commercial building starts or reduce the scope of renovation projects, which temporarily suppresses the volume of orders for new fenestration installations.

Market Drivers

The expansion of Green Building Certifications and Sustainability Standards is fundamentally altering procurement strategies in the fenestration sector, urging developers to select materials that reduce thermal transfer and carbon footprints. As regulatory bodies and environmental organizations establish stricter benchmarks for operational energy performance, commercial UPVC systems are increasingly chosen for their low thermal conductivity and contribution to rating systems like LEED and BREEAM. This shift is highlighted by the U.S. Green Building Council’s February 2025 announcement, which noted that the top 10 states certified 1,437 commercial LEED projects in 2024, covering over 414 million gross square feet of environmentally rated real estate. This momentum in certification directly benefits the UPVC market, as these units are essential for achieving the envelope efficiency required by such rigorous standards.Additionally, accelerated urbanization and commercial infrastructure development serve as a primary engine for market demand, fueling the construction of mixed-use developments, retail complexes, and institutional facilities that need durable yet cost-effective glazing solutions. Increasing urban density drives the need for high-volume installations of windows and doors capable of withstanding heavy use while providing thermal and acoustic isolation. This robust development pipeline is reflected in data from the Dodge Construction Network, which reported in November 2025 that commercial building starts rose by 26.9 percent for the year ending October 2025. Furthermore, the National Bureau of Statistics of China reported in August 2025 that 250.34 million square meters of floor space were completed between January and July 2025, signaling sustained demand in rapidly urbanizing regions.

Market Challenges

The Global Commercial UPVC Doors & Windows Market currently encounters significant headwinds due to economic volatility, particularly elevated interest rates and escalating construction costs. These financial barriers directly impede market expansion by affecting the feasibility of large-scale commercial developments. As the cost of borrowing capital rises and material prices surge, developers are forced to reassess the return on investment for new retail spaces, office complexes, and institutional buildings. Consequently, many projects are either delayed indefinitely or scaled down, leading to a direct reduction in the procurement of fenestration systems.This contraction in activity is evident in recent industry data. According to Associated Builders and Contractors, the construction backlog for the commercial and institutional sector declined by 0.4 months in October 2025 compared to the previous year. This reduction in backlog acts as a tangible indicator that financial pressures are causing hesitation among project owners, thereby dampening the immediate demand for commercial UPVC installations as the pipeline for new construction work shrinks.

Market Trends

The integration of Smart Automation and IoT Connectivity is fundamentally upgrading commercial fenestration, transforming static building elements into dynamic, responsive components. Architects are increasingly specifying UPVC systems embedded with motorized sensors and actuators that adjust transparency and opening aperture based on climatic conditions, thereby optimizing internal thermal comfort without manual intervention. This demand for intelligent building envelopes is driving revenue growth for technology providers; for instance, Somfy’s March 2025 press release reported that group revenue reached €1.5 billion in 2024, a 4.8 percent increase largely attributed to robust sales of connected solar shading and smart management solutions.Simultaneously, the adoption of Recycled and Bio-Attributed UPVC Materials is gaining traction as manufacturers aim to decouple production from fossil fuel dependency and close the material loop. This trend involves co-extruding virgin polymer with post-consumer recycled content to reduce the embodied carbon of profiles while maintaining structural integrity, a practice becoming standard for meeting circular economy goals. The scale of this shift is measurable; according to VinylPlus, its June 2025 Progress Report indicated that 724,638 tonnes of PVC waste were recycled within the framework in 2024, demonstrating a resilient commitment to sustainability despite broader economic pressures on the construction sector.

Key Players Profiled in the Commercial UPVC Doors & Windows Market

- VEKA Group

- Deceuninck NV

- Profine Group

- REHAU

- Jeld-Wen

- LX Hausys

- Aluplast

- Pella Corporation

- Corialis Group

- Crystal Window & Door Systems

Report Scope

In this report, the Global Commercial UPVC Doors & Windows Market has been segmented into the following categories:Commercial UPVC Doors & Windows Market, by Product Type:

- UPVC Doors

- UPVC Windows

Commercial UPVC Doors & Windows Market, by Distribution Channel:

- Offline Stores

- Online Stores

Commercial UPVC Doors & Windows Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Commercial UPVC Doors & Windows Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Commercial UPVC Doors & Windows market report include:- VEKA Group

- Deceuninck NV

- Profine Group

- REHAU

- Jeld-Wen

- LX Hausys

- Aluplast

- Pella Corporation

- Corialis Group

- Crystal Window & Door Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

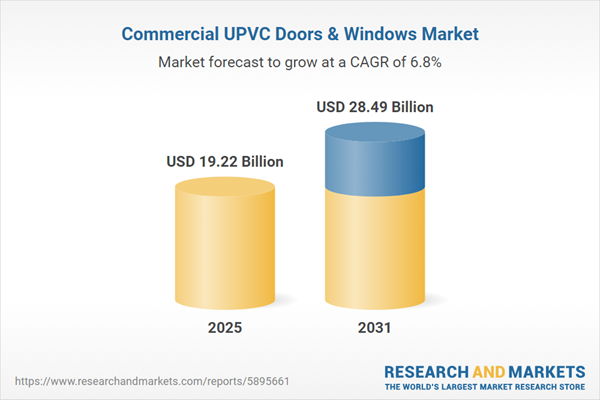

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 19.22 Billion |

| Forecasted Market Value ( USD | $ 28.49 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |