Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Widely used in poultry and swine nutrition, feed acidifiers contribute to better feed conversion, gut health, and disease resistance, particularly during stress periods like weaning. They help stabilize gut pH and mitigate digestive issues, thereby reducing the need for antibiotic interventions. Advancements in feed formulations and increasing concerns over food safety and sustainable livestock practices are fueling their demand. As producers aim to improve animal performance and comply with regulatory and consumer expectations, feed acidifiers are becoming an integral part of modern animal production systems.

Key Market Drivers

Technological Advancements

Technological innovation is significantly enhancing the performance and application of feed acidifiers. Microencapsulation, a key advancement, involves coating active ingredients like organic acids to protect them from degradation during feed processing and ensure their targeted release within the digestive tract. This improves shelf life, stability, and dosing precision. In 2024, microencapsulation gained momentum as a method to boost gut health and feed efficiency by enabling controlled delivery of not only acids but also essential oils and probiotics. These technologies enhance nutrient absorption, lower pathogen loads, and improve overall animal performance.Additionally, gradual-release coating systems have been developed to maintain consistent pH levels in the gastrointestinal tract, supporting digestive health. Blended formulations that combine multiple acids are increasingly being designed to address specific nutritional challenges such as pathogen control or gut health improvement. Liquid acidifiers have also become popular due to their convenience in dosing and compatibility with large-scale operations. These advancements are driving efficiency and sustainability in livestock farming.

Key Market Challenges

Consumer and Retailer Demands

Evolving consumer and retailer expectations around food safety, transparency, and sustainability are posing challenges for feed acidifier manufacturers. Consumers demand high-quality animal products that meet strict safety standards, requiring feed additives to comply with regulatory residue limits and be accurately labeled. The trend toward clean-label foods raises concerns about the presence of additives, compelling manufacturers to clearly communicate the safety and function of feed acidifiers.Additionally, growing interest in ethical and sustainable animal production prompts scrutiny of additive use, with calls for responsible farming practices. As plant-based and cultured meat alternatives gain traction, the livestock sector must innovate to maintain competitiveness while addressing concerns about feed additives. Regulatory agencies may also tighten standards to reflect consumer priorities, necessitating strict compliance and detailed traceability in ingredient sourcing and usage. Meeting these expectations requires increased investment in quality control, marketing, and transparency initiatives, along with clear scientific validation to support product safety and efficacy claims.

Key Market Trends

Rising Awareness of Food Safety

Heightened awareness of food safety is a key factor influencing the feed acidifiers market. Consumers and regulators are demanding higher standards for animal-derived products, which must be free from spoilage, contaminants, and pathogens. Feed acidifiers contribute significantly by creating an acidic environment that inhibits microbial growth in feed, thereby reducing risks such as Salmonella, E. coli, and mycotoxin contamination. This proactive approach not only improves feed hygiene but also protects the food chain from potential outbreaks.Mycotoxins, produced by molds in feed, are a critical safety concern; acidifiers help mitigate these risks by suppressing mold growth and toxin production. Compliance with international safety regulations is crucial for market players, as it ensures product integrity from farm to fork. Consumers increasingly prefer traceable and contaminant-free food sources, encouraging producers to adopt feed additives that enhance animal health and product quality. As retailers also enforce strict sourcing standards, acidifiers are becoming essential tools for producers to demonstrate food safety compliance and earn consumer trust.

Key Market Players

- Adisseo Espana SA

- Alltech, Inc.

- BASF SE

- Borregaard AS

- Cargill Inc.

- DSM Nutritional Products AG

- Impextraco NV

- Kemin Industries

- SHV (Nutreco NV)

- Yara International ASA

Report Scope:

In this report, the Global Feed Acidifiers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Feed Acidifiers Market, By Sub Additive:

- Fumaric Acid

- Lactic Acid

- Propionic Acid

- Others

Feed Acidifiers Market, By Animal:

- Aquaculture

- Fish

- Shrimp

- Other Aquaculture Species

- Poultry

- Broiler

- Layer

- Other Poultry Birds

- Ruminants

- Beef Cattle

- Dairy Cattle

- Other Ruminants

- Swine

- Others

Feed Acidifiers Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Feed Acidifiers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Adisseo Espana SA

- Alltech, Inc.

- BASF SE

- Borregaard AS

- Cargill Inc.

- DSM Nutritional Products AG

- Impextraco NV

- Kemin Industries

- SHV (Nutreco NV)

- Yara International ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | July 2025 |

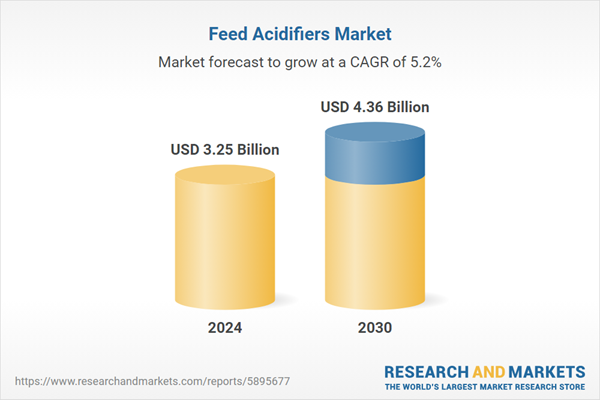

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.25 Billion |

| Forecasted Market Value ( USD | $ 4.36 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |