Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

What was once a volume-centric market is now rapidly becoming a value-oriented industry, where growth is increasingly tied to innovation in packaging formats, use of recycled content (rPET), regulatory alignment, and consumer engagement. Packaging converters and global CPG brands are investing heavily in lightweighting, circular economy solutions, digital customization, and functional enhancements, all of which are expanding PET’s application scope well beyond traditional use cases.

As demand intensifies across both mature and emerging economies, and with global supply chains aligning toward sustainable packaging mandates, PET is not only maintaining relevance it is becoming a strategic material platform at the center of next-generation packaging innovation.

Key Market Drivers

Rising Demand from the Beverage Industry

The rising demand from the beverage industry plays a pivotal role in driving the growth of the global PET (Polyethylene Terephthalate) packaging market, as it represents the largest and most consistent application sector for PET containers. This demand is shaped by evolving consumer preferences, supply chain efficiencies, product innovation, and sustainability objectives.PET bottles have become the preferred packaging format for non-alcoholic beverages, including bottled water, carbonated soft drinks, fruit juices, flavored milk, sports and energy drinks, iced teas, and functional beverages. This preference is driven by several material advantages: Lightweight and shatterproof compared to glass, Highly transparent for strong shelf visibility, Resealable and portable, suitable for on-the-go consumption, Cost-effective for high-volume production and distribution. As beverage producers prioritize efficiency and consumer convenience, PET remains the most scalable and commercially viable solution.

PET (Polyethylene Terephthalate) bottles and jars have become the preferred packaging solution across the global beverage and food sectors due to their lightweight structure, durability, and recyclability. By 2021, PET packaging commanded a dominant position in the beverage industry, representing nearly 66% of all beverage containers sold worldwide. Bottled water continues to outpace other beverage segments globally, especially as health-conscious consumers move away from sugary soft drinks. PET bottles dominate this category due to its low production costs and logistical advantages, Safety and hygiene during transport and retail, Ability to use rPET (recycled PET) to meet sustainability goals.

Markets such as North America, Western Europe, and Asia-Pacific are witnessing rapid growth in bottled water consumption directly translating to high demand for PET packaging. The global shift toward functional beverages such as vitamin-infused drinks, probiotics, herbal teas, and protein shakes is accelerating PET bottle usage. These beverages require protective, tamper-evident, and visually appealing packaging that ensures product integrity and consumer trust. PET packaging supports hot-fill processes, UV protection (with additives), and multi-layer structures, making it suitable for these health-driven applications. As wellness becomes a core purchasing driver, the beverage industry’s innovation pipeline directly increases the volume and variety of PET formats in circulation.

Key Market Challenges

Environmental and Regulatory Pressures Regarding Plastic Waste

One of the most significant challenges facing the PET packaging market is the growing global scrutiny over plastic pollution, especially single-use plastics. Despite PET being recyclable, a substantial proportion of PET waste still ends up in landfills, oceans, or incineration plants due to inadequate collection and recycling systems.Government bans, taxes, and restrictions on single-use plastic packaging in countries across Europe, North America, and Asia are directly impacting demand, particularly for non-recyclable or poorly recycled PET formats. Environmental advocacy groups and consumer watchdogs are pressuring brands to phase out plastic packaging, including PET, in favor of biodegradable or compostable alternatives. Negative public perception of plastics even recyclable ones has led to increased demand for paper-based, glass, and bio-based alternatives, creating a reputational risk for brands heavily reliant on PET. As global sustainability standards tighten and the circular economy gains momentum, PET manufacturers are under increasing pressure to invest in closed-loop recycling systems and demonstrate end-of-life responsibility posing both financial and operational hurdles.

Key Market Trends

Rise of Smart and Functional PET Packaging

One of the most significant trends impacting the future of the PET packaging market is the integration of intelligent, interactive, and functional technologies into PET containers. Smart packaging once limited to niche applications is now becoming mainstream, particularly in healthcare, food safety, premium beverages, and cosmetics.QR codes, NFC tags, and augmented reality (AR) features are increasingly being embedded into PET labels and closures, enabling consumers to verify authenticity, check product information, track sustainability credentials, or engage with immersive brand content. In the food and beverage sector, PET containers with embedded time-temperature indicators (TTIs), freshness sensors, or color-change coatings are helping improve quality assurance and reduce food waste. In pharmaceutical and nutraceutical applications, tamper-evident PET bottles with digital verification tools help enhance safety, especially in regulated markets. This trend is elevating PET packaging from a passive container to a value-adding component of the product experience, creating opportunities for brand differentiation, traceability, and consumer engagement.

Key Market Players

- Amcor Ltd

- Resilux NV

- Gerresheimer AG

- Berry Global Group Inc.

- Silgan Holdings Inc.

- Graham Packaging Company

- GTX Hanex Plastic Sp. z.o.o.

- Dunmore Corporation

- Comar LLC

- Sonoco Products Company

Report Scope:

In this report, the Global PET Packaging Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:PET Packaging Market, By Type:

- Rigid

- Flexible

PET Packaging Market, By Pack Type:

- Bottles & Jars

- Trays

- Bags & Pouches

- Lids/Caps & Closures

- Others

PET Packaging Market, By End User:

- Food & Beverages

- Pharmaceuticals

- Household Products

- Personal Care & Cosmetics

- Others

PET Packaging Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global PET Packaging Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Amcor Ltd

- Resilux NV

- Gerresheimer AG

- Berry Global Group Inc.

- Silgan Holdings Inc.

- Graham Packaging Company

- GTX Hanex Plastic Sp. z.o.o.

- Dunmore Corporation

- Comar LLC

- Sonoco Products Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

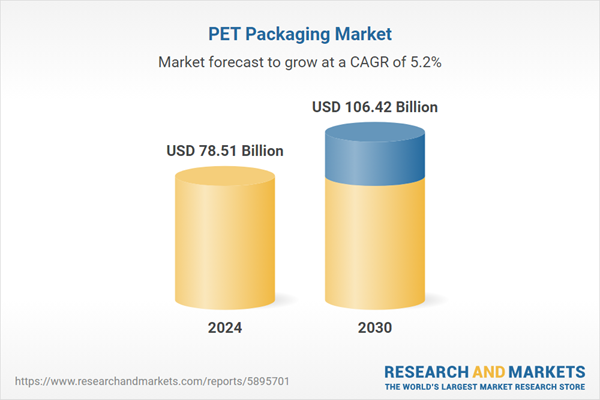

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 78.51 Billion |

| Forecasted Market Value ( USD | $ 106.42 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |