Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, a major obstacle hindering wider market adoption is the high cost and complexity involved in deploying these advanced platforms. Small and medium-sized enterprises frequently face difficulties with the substantial upfront capital and technical resources needed for seamless integration. Furthermore, apprehensions regarding data protection within interconnected cloud ecosystems can discourage risk-averse organizations from embracing these solutions. Despite the evident operational advantages provided by transport management technologies, these financial and technical barriers continue to restrict market penetration in cost-conscious sectors.

Market Drivers

The rapid growth of global e-commerce and the increasing demands of last-mile delivery are fundamentally reshaping the Global Freight Transport Management Market. As consumer preferences shift toward fast, transparent fulfillment, logistics providers are under pressure to digitize operations to manage high-frequency, low-volume shipments across intricate cross-border networks. This surge in digital retail activity directly leads to higher freight volumes, requiring robust management systems to uphold service standards. Data from the International Air Transport Association's November 2024 'Air Cargo Market Analysis' supports this, showing a 10.5% year-on-year rise in international air cargo traffic in September 2024, a growth trajectory largely driven by escalating e-commerce demand in key markets like the US and Europe.Simultaneously, the incorporation of advanced AI, IoT, and cloud-based supply chain analytics has become essential for optimizing these expanding logistics networks. Organizations are utilizing these technologies to secure granular real-time visibility, forecast potential disruptions, and automate decision-making processes, thereby minimizing inefficiencies and operational costs. This move towards technology is evidenced by significant industry commitment to digital transformation; according to the MHI's '2024 MHI Annual Industry Report' released in March 2024, 84% of supply chain leaders intend to adopt artificial intelligence technologies within the next five years. Additionally, Descartes Systems Group reported in 2024 that 40% of surveyed shippers and logistics providers are actively planning to invest in transportation technology to better navigate regulatory changes and market volatility.

Market Challenges

The substantial expense and complexity involved in deploying advanced transport management platforms serve as a formidable barrier to broader market expansion. Small and medium-sized enterprises often lack the necessary capital for the significant initial investment in software, hardware, and staff training. This financial burden compels many cost-sensitive organizations to depend on manual methods or outdated legacy systems, effectively preventing them from participating in the growth of the modern digital freight market.Moreover, integrating these platforms into interconnected cloud-based networks creates significant security risks that discourage adoption. As supply chains become increasingly digitized, the fear of cyber threats paralyzes decision-making for risk-averse companies. According to the National Motor Freight Traffic Association, 60% of logistics organizations surveyed in 2024 reported experiencing data breaches, a statistic that validates industry anxiety regarding digital vulnerability. This high frequency of security incidents reinforces the reluctance of firms to entrust sensitive shipment data to third-party networks, thereby directly limiting the market's reach and stalling the widespread deployment of transport management technologies.

Market Trends

The implementation of Carbon Footprint Analytics for Green Logistics Compliance is emerging as a critical priority as regulatory frameworks and stakeholder expectations for sustainability tighten. Companies are increasingly utilizing advanced telematics and emissions monitoring software to accurately calculate Scope 3 emissions and refine fleet operations for minimized environmental impact. This trend represents a shift from simple reporting to active carbon management, where real-time data guides decisions on vehicle electrification and route planning to meet net-zero targets. According to Geotab's '2024 Sustainability and Impact Report' from March 2025, the number of electric vehicles connected to their telematics network grew by 63% year-over-year, reflecting the increasing reliance on data-driven insights to manage sustainable fleet transitions effectively.The expansion of Autonomous Freight Vehicle and Drone Integration Capabilities is fundamentally altering both long-haul and last-mile delivery dynamics by addressing chronic labor shortages and enhancing operational efficiency. Logistics providers are integrating self-driving trucks into highway freight corridors to maximize uptime and consistency, while simultaneously testing drone networks to speed up urban deliveries. This transition toward autonomy enables continuous 24/7 operations, significantly reducing transit times and human errors associated with fatigue. As noted by the North American Council for Freight Efficiency in their January 2025 'State of Autonomous Trucking in 2025' report, the launch of the first fully autonomous freight corridor in March 2024 resulted in a 25% reduction in transit times, demonstrating the tangible efficiency gains driving this technological adoption.

Key Players Profiled in the Freight Transport Management Market

- Kuehne + Nagel

- DSV

- Schenker Aktiengesellschaft

- Nippon Express Holdings, Inc.

- CEVA Logistics

- Expeditors International of Washington, Inc.

- C.H. Robinson

- Geodis

Report Scope

In this report, the Global Freight Transport Management Market has been segmented into the following categories:Freight Transport Management Market, by Transportation Mode:

- Roadways

- Railways

- Marine

- Airways

Freight Transport Management Market, by Offering:

- Solutions

- Services

Freight Transport Management Market, by Deployment Mode:

- Cloud or Hosted

- On Premise

Freight Transport Management Market, by Organization Size:

- Large Enterprises

- SME'S

Freight Transport Management Market, by Industry:

- Manufacturing

- Retail & E-Commerce

- Transportation

- Fast Moving Consumer Goods (FMCG)

- Healthcare

- Food & Beverages

- Oil & Gas

- Energy & Utility

- Electronics

- Automotive

- IT & Telecom

- Others

Freight Transport Management Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Freight Transport Management Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Freight Transport Management market report include:- Kuehne + Nagel

- DSV

- Schenker Aktiengesellschaft

- Nippon Express Holdings, Inc

- CEVA Logistics

- Expeditors International of Washington, Inc

- C.H. Robinson

- Geodis

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

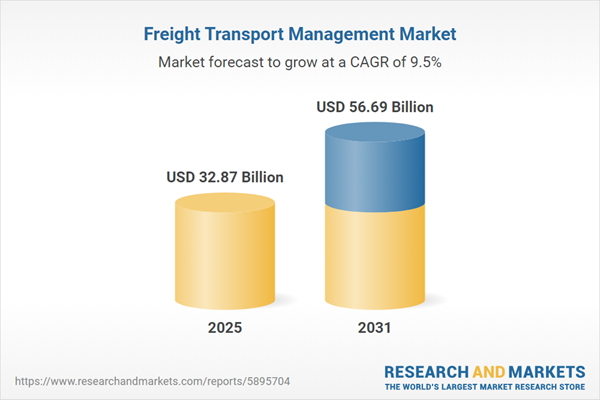

| Estimated Market Value ( USD | $ 32.87 Billion |

| Forecasted Market Value ( USD | $ 56.69 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |