Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global Industrial Battery Recycling market is witnessing significant growth and innovation in recent years, driven by a combination of technological advancements, increasing demand for clean energy solutions, and a growing awareness of the environmental and safety benefits associated with dual carbon batteries. This article explores the key drivers behind the expansion of the Industrial Battery Recycling market and provides insights into the factors contributing to its rapid development.Dual carbon batteries, also known as dual carbon capacitors or dual carbon supercapacitors, are advanced energy storage devices that utilize carbon-based materials for both the anode and cathode. Unlike traditional lithium-ion batteries, which rely on lithium-based materials for one electrode, dual carbon batteries leverage carbon's unique properties to offer several advantages. These advantages have propelled them into the spotlight of the global energy storage market. Key Drivers of the Global Industrial Battery Recycling Market Safety has always been a paramount concern in the battery industry. Dual carbon batteries, with their reduced risk of thermal runaway and fire hazards compared to lithium-ion batteries, are gaining attention as a safer alternative. As safety regulations become more stringent, industries and consumers are looking for safer energy storage options. The increasing global focus on sustainability and environmental protection has accelerated the demand for clean energy solutions. Dual carbon batteries, made primarily of carbon, are considered more eco-friendly compared to lithium-ion batteries, which rely on rare and environmentally intensive materials. This alignment with sustainability goals is a strong driver for their adoption. The expansion of renewable energy Battery Types, such as wind and solar, requires efficient energy storage systems to balance supply and demand. Dual carbon batteries offer fast charging and discharging capabilities, making them ideal for storing renewable energy and addressing grid instability issues. The automotive industry is undergoing a profound transformation towards electric vehicles. Dual carbon batteries' quick charging capabilities, extended lifespan, and safety features make them a promising option for EV manufacturers looking to improve performance and safety while reducing charging times. The demand for longer-lasting and faster-charging batteries in consumer electronics, such as smartphones and laptops, is a significant driver for the Industrial Battery Recycling market. Consumers increasingly value devices that can stay powered for longer periods and recharge rapidly.

Industrial and IoT Battery Types

Industries and the Internet of Things (IoT) sector require reliable and long-lasting energy storage solutions. Dual carbon batteries' durability and power density make them suitable for various industrial Battery Types and the growing network of IoT devices. Ongoing research and development efforts in the field of dual carbon batteries have led to improvements in performance, cost reduction, and scalability. As technology matures, it becomes more commercially viable, further driving market growth. The disruption in the global supply chain for critical materials, particularly in the wake of the COVID-19 pandemic, has prompted industries to explore alternative technologies that are less reliant on scarce or geopolitically sensitive reBattery Types. Dual carbon batteries offer a path to reduce this dependency. As more companies enter the Industrial Battery Recycling market, competition is intensifying. This competition often leads to innovation, cost reductions, and broader market adoption as companies strive to differentiate themselves and capture market share. Governments worldwide are promoting the adoption of clean energy technologies, including energy storage solutions. Subsidies, incentives, and policies aimed at reducing greenhouse gas emissions and promoting energy efficiency create a favorable environment for dual carbon batteries. The global Industrial Battery Recycling market is witnessing rapid growth, driven by a confluence of factors ranging from safety concerns and environmental sustainability to the increasing demand for energy storage solutions across various sectors. As the technology continues to mature and overcome its challenges, dual carbon batteries have the potential to play a pivotal role in the transition to cleaner, more efficient energy systems, benefiting industries, consumers, and the planet as a whole. While challenges remain, ongoing research, innovation, and market competition are likely to drive further advancements and broaden the adoption of dual carbon batteries in the years to come.Key Market Challenges

Scale-Up Challenges

The scalability of Industrial Battery Recycling production remains a challenge. To compete with established technologies like lithium-ion batteries, the manufacturing processes for dual carbon batteries must be optimized for mass production. While dual carbon batteries excel in power density, they have a lower energy density compared to some other energy storage technologies. This limitation may restrict their use in Battery Types requiring high energy storage capacity. Achieving cost parity with existing battery technologies is essential for widespread adoption. Innovations in materials, manufacturing techniques, and economies of scale will be crucial in reducing the cost of dual carbon batteries. The Industrial Battery Recycling market is still relatively niche, and awareness among potential users and investors needs to increase. Education and information dissemination about the benefits and Battery Types of these batteries will play a pivotal role. Regulatory standards and certifications need to be developed and adopted to ensure the safety and quality of dual carbon batteries. This is especially important in industries like automotive and aviation.The global Industrial Battery Recycling market is experiencing rapid growth and innovation, driven by factors like safety concerns, sustainability, and the need for efficient energy storage solutions. However, like any emerging technology, dual carbon batteries face a range of challenges that must be addressed to unlock their full potential. In this article, we'll explore the key challenges facing the global Industrial Battery Recycling market and examine the opportunities for overcoming them. Dual carbon batteries, also known as dual carbon capacitors or dual carbon supercapacitors, are advanced energy storage devices that use carbon-based materials for both the anode and cathode. This technology offers several advantages over traditional lithium-ion batteries, including enhanced safety, environmental sustainability, and faster charging capabilities.

Energy Density & Scalability

One of the primary challenges for dual carbon batteries is their energy density. While they excel in power density, which enables quick charging and discharging, their energy density (the amount of energy stored per unit of weight or volume) is generally lower than that of lithium-ion batteries. This limitation makes dual carbon batteries less suitable for Battery Types requiring high energy storage capacity, such as long-range electric vehicles (EVs). Scalability remains a critical challenge. To compete with well-established battery technologies like lithium-ion, Industrial Battery Recycling manufacturing processes need to be optimized for mass production. Scaling up production while maintaining quality and cost-effectiveness is a complex task that requires substantial investment and innovation.Key Market Trends

Advancements in Materials Science

Researchers and manufacturers are continually exploring advanced carbon materials to improve the performance of dual carbon batteries. This includes the development of new carbon composites, nanostructured materials, and carbon allotropes, which can enhance energy density and charge-discharge efficiency. One of the primary trends in the Industrial Battery Recycling market is focused on increasing energy density. While these batteries excel in power density, efforts are underway to improve their energy storage capacity, making them more suitable for Battery Types requiring longer-range electric vehicles and larger-scale energy storage systems.Fast Charging and High-Power Battery Types

Dual carbon batteries are well-suited for Battery Types requiring rapid charging and discharging, such as electric vehicles and grid stabilization. This trend aligns with the growing demand for quick and efficient energy storage solutions in a variety of sectors. Integrating dual carbon batteries with other energy storage technologies, such as lithium-ion batteries or flow batteries, is gaining traction. This hybrid approach allows for improved energy density and optimized performance for specific Battery Types, providing flexibility and efficiency. Collaboration between research institutions, battery manufacturers, and government agencies is fostering innovation in the Industrial Battery Recycling field. Joint research initiatives are leading to breakthroughs in materials, manufacturing techniques, and cost-effective production.Sustainability and Environmental Concerns

Environmental sustainability is a significant driver in the adoption of dual carbon batteries. These batteries, composed primarily of carbon materials, are considered more eco-friendly compared to traditional lithium-ion batteries, which rely on scarce and potentially harmful reBattery Types. While electric vehicles are a prominent Battery Type, dual carbon batteries are finding use in other sectors as well. These include renewable energy storage, consumer electronics, industrial Battery Types, and even aerospace, where safety and reliability are critical. As sustainability becomes a focal point, the recycling and reuse of battery components are emerging trends. Developing efficient recycling processes for dual carbon batteries can reduce waste, lower production costs, and address environmental concerns.Government Support and Regulations

Governments worldwide are recognizing the potential of dual carbon batteries in achieving clean energy goals. Supportive policies, incentives, and regulations are encouraging research, development, and adoption of this technology. Recent disruptions in global supply chains have underscored the importance of diversification and resilience. Dual carbon batteries, with their reduced reliance on critical materials, offer a more stable supply chain, making them attractive to industries and governments.Segmental Insights

Battery Type Insights

Lithium-ion batteries are the fastest-growing segment, due to the increasing demand for these batteries in electric vehicles and renewable energy storage systems. Lead-acid batteries are the most common type of battery used in the world. They are used in a wide variety of applications, including automotive, industrial, and portable electronics. Lead-acid batteries are also the most recycled type of battery, due to the high demand for lead in the manufacturing of new batteries. Lithium-ion batteries are the fastest-growing type of battery in the world. They are used in a variety of applications, including electric vehicles, renewable energy storage systems, and portable electronics. Lithium-ion batteries are more expensive than lead-acid batteries, but they offer longer lifespans and better performance. Lithium-ion batteries are also recycled in significant quantities, but the recycling process is more complex and expensive than the recycling of lead-acid batteries. The industrial battery recycling market is also segmented by chemistry. The main chemicals recycled from batteries are lead, nickel, cobalt, lithium, and other metals. Lead is the most recycled battery metal, due to the high demand for lead in the manufacturing of new batteries. Nickel and cobalt are also recycled in significant quantities, due to their high value.Chemistry Insights

The market is segmented into lead, nickel, cobalt, lithium, and other metals. Lead is the most recycled battery metal, due to the high demand for lead in the manufacturing of new batteries. Nickel and cobalt are also recycled in significant quantities, due to their high value.Regional Insights

The Asia pacific region has established itself as the leader in the Global Industrial Battery Recycling Market with a significant revenue share in 2022. The Asia-Pacific battery market as a whole is expected to grow significantly over the coming decade due to increased electrification activities in the region. The Industrial Battery Recycling has not yet penetrated the market on a significant level. The battery market in this region is mainly driven by developments in the electronics manufacturing, power generation, communication, and information industries in countries like India, China, Japan, and South Korea. Developing countries, like India, lack a firm grid infrastructure, which causes power cuts and blackouts frequently, mostly in rural areas. Thus, the lack of grid infrastructure, high demand for steady power, and the need for power backup solutions are expected to drive the demand for industrial dual carbon batteries. Moreover, the governments of various countries have taken initiatives to finance energy storage projects to fulfill the energy requirements in their countries. China and a few South Asian countries are coming up with new business models and associated financing instruments to invest capital in battery energy storage projects. In a short-term scenario, however, the region is likely to witness challenges from rising prices of graphite carbon, which is a major raw material used in the Industrial Battery Recycling manufacturing process. Rising prices of graphite carbon are majorly a result of a sharp cut in the supply of graphite electrodes from China. In the present scenario, the demand for graphite electrodes is significantly higher compared to the supply. Research on Industrial Battery Recycling technology is also underway in the region. For instance, in April 2021, researchers at IIT Hyderabad, India, developed a Industrial Battery Recycling that can cut the overall battery cost by as much as 20-25%, along with being environment-friendly. Further research is underway to increase the energy density of the battery. Therefore, based on the above-mentioned factors, Asia-Pacific is expected to witness significant growth during the forecast period.Key Market Players

- Umicore

- Retriev Technologies

- American Battery Technology Company (ABTC)

- Li-Cycle

- Aqua Metals

- Battery Solutions

- Recupyl

- Gopher ReBattery Type

- Glencore Recycling

- Retech Recycling Technology AB.

Report Scope

In this report, the Global Industrial Battery Recycling Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Industrial Battery Recycling Market, by Chemistry :

- Lead

- Nickel

- Cobalt

- Lithium

- Other Metals

Global Industrial Battery Recycling Market, by Battery Type:

- Lead-Acid Batteries

- Nickel-Cadmium Batteries

- Nickel Metal Hydride Batteries

- Lithium-Ion Batteries

Global Industrial Battery Recycling Market, by Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Industrial Battery Recycling Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Umicore

- Retriev Technologies

- American Battery Technology Company (ABTC)

- Li-Cycle

- Aqua Metals

- Battery Solutions

- Recupyl

- Gopher ReBattery Type

- Glencore Recycling

- Retech Recycling Technology AB

Table Information

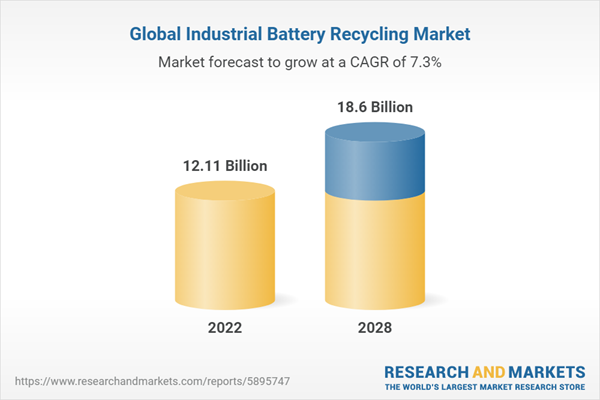

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 12.11 Billion |

| Forecasted Market Value ( USD | $ 18.6 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |