Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The increasing global prevalence of anemia, especially in vulnerable populations such as pregnant women, children, and individuals with chronic illnesses, is driving demand for ESA therapies. According to WHO 2025, anemia remains a significant global health issue, disproportionately affecting low-income and rural populations. Furthermore, the aging global population, which is more susceptible to conditions leading to anemia, is expected to contribute to sustained growth in ESA usage. ESAs play a crucial role in improving patient quality of life, making them a vital component in managing chronic and acute medical conditions associated with anemia.

Key Market Drivers

Advancements in Oncology

The rising incidence of chemotherapy-induced anemia (CIA) has led to a growing reliance on ESAs such as Epoetin Alfa and Darbepoetin Alfa to mitigate fatigue and enhance patient well-being during cancer treatment. Recent advancements in oncology have introduced more effective and targeted therapies, which may reduce the severity of anemia but also require precise supportive treatments like ESAs.Oncology research has also improved the understanding of ESA safety profiles, enabling better identification of patient subgroups that can safely benefit from these therapies. Personalized medicine and oncogenomics have further contributed to tailored ESA administration based on genetic markers and cancer types, optimizing outcomes while minimizing adverse effects. These developments have bolstered ESA integration into oncology protocols, enhancing their clinical utility and market demand.

Key Market Challenges

Patent Expirations

Patent expirations pose a significant challenge to the growth and profitability of the ESA market. As patents for key ESA drugs expire, it paves the way for the introduction of generic and biosimilar versions, intensifying market competition and driving down prices. These lower-cost alternatives often capture a substantial market share, particularly in price-sensitive healthcare systems.While this may improve patient access, it also leads to revenue declines for original ESA manufacturers. The market may become fragmented, with multiple players offering comparable products, increasing pricing pressures and reducing the incentive for continued innovation. Manufacturers are compelled to revise their pricing and market strategies to remain competitive. Although cost savings benefit healthcare systems, the shift can create challenges in ensuring consistent quality, safety, and patient trust in biosimilar products.

Key Market Trends

Shift Toward Epoetin Biosimilars

The emergence and growing acceptance of Epoetin biosimilars are significantly transforming the ESA market landscape. Biosimilars, developed to be highly similar to already approved biologics, offer equivalent safety and efficacy at a lower cost. This price advantage makes biosimilars appealing to healthcare systems and providers aiming to reduce expenditure without compromising treatment quality. The availability of Epoetin biosimilars has increased competition, expanded patient access, and driven broader adoption of ESA therapies, especially in budget-constrained regions. Regulatory approvals from agencies like the FDA and EMA have reinforced confidence in biosimilars, encouraging uptake among physicians and patients. As real-world evidence continues to support their reliability, the shift toward biosimilars is expected to further strengthen, offering substantial cost savings while maintaining treatment standards in managing anemia.Report Scope:

In this report, the Global Erythropoietin Stimulating Agents Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Erythropoietin Stimulating Agents Market, By Type:

- Epoetin Alfa

- Epoetin Beta

- Darbepoetin Alfa

- Other Types

Erythropoietin Stimulating Agents Market, By Application:

- Cancer

- Renal Disorders

- Anti-retroviral Treatment

- Neural Diseases

- Other Applications

Erythropoietin Stimulating Agents Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Erythropoietin Stimulating Agents Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Amgen Inc.

- Biocon Limited

- Celltrion Inc.

- F. Hoffmann-La Roche Ltd

- Intas Pharmaceuticals Ltd

- Johnson and Johnson

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd

- Thermo Fisher Scientific

- LG Lifesciences, Ltd

- Novartis AG(Sandoz)

- Panacea Biotec Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | July 2025 |

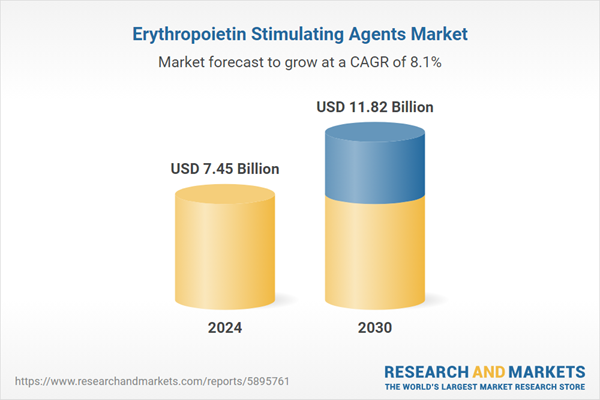

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.45 Billion |

| Forecasted Market Value ( USD | $ 11.82 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |