Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Global Cancer Incidence

The global increase in cancer prevalence is a major factor driving the growth of the fluid biopsy market. With approximately 20 million new cancer cases and 9.7 million related deaths recorded in 2022, and 53.5 million individuals living within five years of a diagnosis, there is a rising need for efficient, non-invasive diagnostic tools. This demand is especially pronounced in aging populations - by 2040, nearly 19.2% of the global population is expected to be over 60, a group disproportionately affected by cancer. Traditional tissue biopsies can be invasive and difficult for certain patients. Fluid biopsy offers a more accessible solution, allowing for early detection through circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs). Furthermore, it supports continuous monitoring, providing insights into disease recurrence and treatment effectiveness. With cancer rates rising globally, fluid biopsy is becoming essential for enhancing early intervention and long-term management, making it a key pillar of modern oncology care.Key Market Challenges

Limited Clinical Validation

A major challenge for the global fluid biopsy market is the limited clinical validation of its diagnostic technologies. Although fluid biopsy shows great potential, especially in cancer detection and monitoring, many of its assays are still undergoing development and require extensive clinical trials to confirm their sensitivity, specificity, and overall reliability.Without well-established clinical data, healthcare providers may be hesitant to adopt these tests, and regulatory agencies may delay approval. The lack of standardized protocols across institutions also adds complexity. These factors can restrict integration into routine clinical practice. Overcoming this barrier will require significant investments in collaborative research, larger-scale validation studies, and regulatory engagement. Building strong clinical evidence is essential to gaining trust from both physicians and patients and ensuring broader adoption of fluid biopsy technologies in the diagnostic landscape.

Key Market Trends

Integration with AI and Machine Learning

The integration of AI and machine learning is a transformative trend in the fluid biopsy market. These technologies are revolutionizing data analysis by enabling rapid, accurate interpretation of complex biomarker data derived from liquid samples. AI algorithms can detect subtle patterns and correlations that may be missed through traditional analysis, enhancing diagnostic precision and expanding clinical utility.These tools are especially beneficial for early cancer detection, treatment response evaluation, and identifying actionable mutations for targeted therapy. As AI continues to evolve, it enables deeper insights into disease progression and therapeutic outcomes, empowering personalized treatment plans. Additionally, AI can facilitate the discovery of new biomarkers, supporting innovation in diagnostics beyond oncology. By streamlining data processing and improving predictive accuracy, AI integration is solidifying fluid biopsy’s role in advancing precision medicine and transforming patient care on a global scale.

Key Market Players

- Bio-Rad Laboratories

- Guardant Health Inc.

- Illumina, Inc.

- Qiagen NV

- Laboratory Corporation of America Holdings

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific Inc.

- Johnson & Johnson

- Biocept Inc.

- Bio-Rad Laboratories, Inc.

Report Scope:

In this report, the Global Fluid Biopsy Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below.Fluid Biopsy Market, By Indication:

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Other

Fluid Biopsy Market, By Type:

- Circulating Tumor Cells

- Circulating Tumor DNA

- Cell-free DNA

Fluid Biopsy Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Fluid Biopsy Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bio-Rad Laboratories

- Guardant Health Inc.

- Illumina, Inc.

- Qiagen NV

- Laboratory Corporation of America Holdings

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific Inc.

- Johnson & Johnso

- Biocept Inc.

- Bio-Rad Laboratories, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | April 2025 |

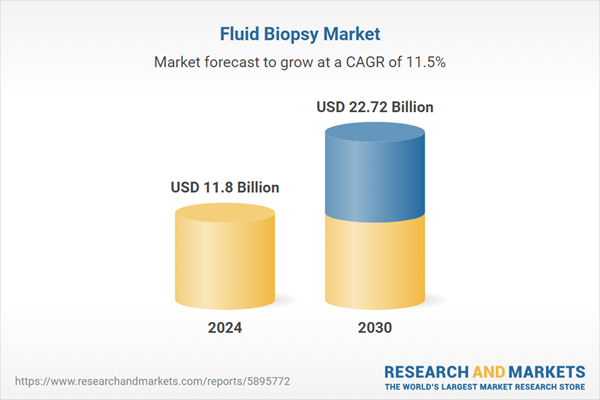

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.8 Billion |

| Forecasted Market Value ( USD | $ 22.72 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |