Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this expansion, the market confronts a notable obstacle involving the elevated cost of components, which restricts broader acceptance within mass-market vehicle categories. The significant expenses linked to manufacturing automotive-grade sensors impose financial strain on suppliers, effectively confining current integration to high-end models and commercial fleets. As a result, balancing cost reduction with the maintenance of high performance stands as a crucial challenge for manufacturers seeking to extend their reach beyond specialized applications.

Market Drivers

Rigorous government mandates regarding improved vehicle safety standards act as a major driver for market expansion. With regulatory agencies implementing tougher rules for collision avoidance, automotive manufacturers must adopt high-fidelity sensors that function reliably across various lighting and weather scenarios where traditional cameras and radar might fail.This legislative momentum is clear in key automotive regions striving to lower traffic fatalities via advanced technological solutions. For instance, the National Highway Traffic Safety Administration’s April 2024 'Final Rule for Automatic Emergency Braking' stipulates that by 2029, all passenger cars and light trucks must possess the capability to stop and prevent frontal collisions at speeds up to 62 miles per hour. These requirements essentially demand the accuracy provided by LiDAR, promoting its integration into ADAS configurations across a wider array of vehicle types.

Simultaneously, substantial decreases in manufacturing costs and effective scaling are facilitating the spread of LiDAR technology beyond just luxury segments. By ramping up production volumes and shifting towards solid-state architectures, which minimize mechanical complexity and associated costs, manufacturers are realizing economies of scale. This industrial growth enables suppliers to reduce unit prices, prompting OEMs to incorporate these sensors into consumer-level electric and internal combustion engine vehicles. Hesai Group's 'First Quarter 2024 Unaudited Financial Results' from May 2024 noted that total LiDAR shipments hit 59,101 units, a 69.7% year-over-year rise, signaling a move toward mass market availability. Furthermore, RoboSense confirmed in 2024 that its cumulative LiDAR sensor sales had surpassed 450,000 units by the close of the prior fiscal year.

Market Challenges

A major impediment to the wider growth of the Global Automotive LiDAR Sensors Market is the prohibitive cost of components. The production of these sensors involves complex manufacturing techniques and costly materials necessary to satisfy strict automotive safety benchmarks, resulting in high unit prices. As a result, car manufacturers find it difficult to rationalize the addition of this technology to economy or mid-range vehicles, restricting LiDAR usage mainly to luxury cars and commercial fleets. This gap in pricing stops the industry from reaching the production volumes needed for economies of scale, delaying the technology's acceptance in the broader market.Furthermore, this expense structure imposes significant stress on the supply chain, where manufacturers must juggle the need for high performance against the market's call for lower prices. The consequent financial constraints reduce the capital available for expanding production capabilities. This strain is evident in recent industry evaluations of supplier health; the 'European Association of Automotive Suppliers' (CLEPA) indicated in 2025 that 70% of automotive suppliers anticipated profit margins under 5% because of escalating structural cost burdens. Such limited profitability restricts manufacturers' capacity to cover development expenses, sustaining a cycle of elevated pricing that directly hinders market expansion.

Market Trends

The increasing uptake of Frequency-Modulated Continuous Wave (FMCW) technology is transforming the market direction by delivering performance superior to traditional time-of-flight approaches. While older systems depend exclusively on light pulses for distance measurement, FMCW systems identify the instantaneous velocity of objects to achieve 4D perception, supplying essential data for high-speed highway autonomy and successfully blocking interference from sunlight or external sensors. This advancement is securing commercial interest as producers look for reliable solutions in challenging driving conditions; for example, Optics.org reported in May 2025 within the article 'Aeva reports improved Q1 2025 results and announces collaborations' that the firm secured initial orders for more than 1,000 units of its advanced sensors, signaling growing industry endorsement of this velocity-sensing technology for future mobility.Simultaneously, the spread of LiDAR from luxury tiers to mid-range passenger vehicles is altering the competitive environment, transitioning the technology from an exclusive add-on to a standard safety provision. Car manufacturers are increasingly utilizing these sensors to distinguish their products in the fierce electric vehicle market, standardizing the hardware across wider model ranges to ensure consistent advanced driver-assistance features. This approach to democratization is visible in the strategic plans of key automotive OEMs focusing on extensive safety packages to appeal to mass-market buyers. As noted by Investing.com in April 2025 in the piece 'Hesai retains top spot in automotive lidar market', Chinese manufacturer Li Auto pledged to equip its full 2025 vehicle range with LiDAR sensors, highlighting the strategic move towards mass-market implementation beyond just flagship vehicles.

Key Players Profiled in the Automotive LiDAR Sensors Market

- Velodyne Lidar, Inc.

- Luminar Technologies, Inc.

- Innoviz Technologies, Ltd.

- Quanergy Systems, Inc.

- LeddarTech Inc.

- Ouster, Inc.

- AEye, Inc.

- Blackmore Sensors and Analytics, Inc.

- Hesai Technology Co., Ltd.

- Phantom Intelligence, Inc.

Report Scope

In this report, the Global Automotive LiDAR Sensors Market has been segmented into the following categories:Automotive LiDAR Sensors Market, by Vehicle Type:

- ICE

- Hybrid

- Battery Electric Vehicles

Automotive LiDAR Sensors Market, by Application:

- Semi-Autonomous Vehicle

- Autonomous Vehicle

Automotive LiDAR Sensors Market, by Technology:

- Solid-State LiDAR

- Mechanical/Scanning LiDAR

Automotive LiDAR Sensors Market, by Image Type:

- 2D Image

- 3D Image

Automotive LiDAR Sensors Market, by Location:

- Bumper & Grill

- Roofs & Upper Pillars

- Headlight & Taillight

- Others

Automotive LiDAR Sensors Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive LiDAR Sensors Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive LiDAR Sensors market report include:- Velodyne Lidar, Inc.

- Luminar Technologies, Inc.

- Innoviz Technologies, Ltd.

- Quanergy Systems, Inc.

- LeddarTech Inc.

- Ouster, Inc.

- AEye, Inc.

- Blackmore Sensors and Analytics, Inc.

- Hesai Technology Co., Ltd.

- Phantom Intelligence, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

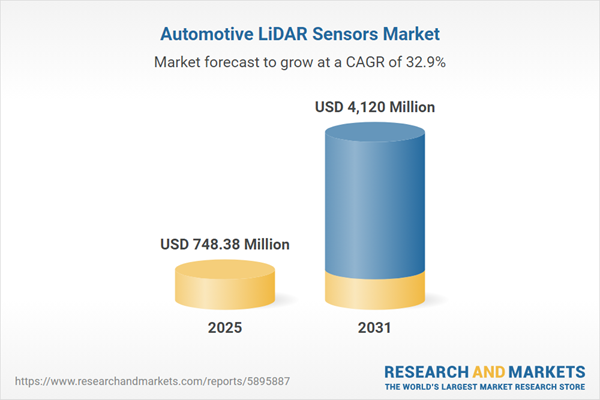

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 748.38 Million |

| Forecasted Market Value ( USD | $ 4120 Million |

| Compound Annual Growth Rate | 32.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |