Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Vascular grafts play a crucial role in these surgeries by replacing or bypassing damaged blood vessels. Technological progress and product innovation are also advancing the market. For example, in May 2022, UC Davis received a USD 3 million grant from the California Institute for Regenerative Medicine to develop a next-generation vascular graft for hemodialysis patients. Such developments reflect the ongoing commitment of stakeholders to enhance the performance and longevity of grafts, which is expected to significantly boost market growth in the coming years.

Key Market Drivers

Increasing Prevalence of Cardiovascular Diseases

The global vascular graft market is primarily driven by the escalating incidence of cardiovascular conditions such as coronary artery disease, peripheral arterial disease, and aortic aneurysms. These diseases represent a growing health concern worldwide, largely attributed to sedentary lifestyles, unhealthy diets, and an aging population. As more individuals develop comorbidities like hypertension, diabetes, and obesity, the risk of cardiovascular events increases, fueling the need for surgical interventions involving vascular grafts. This surge in disease burden directly correlates with rising demand for procedures like CABG and EVAR, where vascular grafts are essential for restoring adequate blood flow. As a result, the demand for graft-based solutions is set to grow steadily, supporting overall market expansion.Key Market Challenges

Stringent Regulatory Hurdles

A significant challenge in the vascular graft market lies in the rigorous regulatory landscape governing medical devices. Organizations such as the U.S. FDA and EMA mandate thorough evaluations to ensure the safety and efficacy of vascular grafts, including extensive clinical trials and quality testing. While such standards are crucial for safeguarding public health, they contribute to extended development timelines and higher compliance costs. This can be particularly burdensome for smaller firms with limited resources, ultimately restricting the pace of innovation and delaying patient access to new products. Additionally, the need to navigate varying regulatory frameworks across different countries complicates global product approvals and increases market entry barriers for manufacturers.Key Market Trends

Technological Advancements

Continuous innovation in graft materials and design is a key trend shaping the vascular graft market. Advanced materials, such as bioengineered and tissue-engineered grafts, have significantly enhanced the safety and performance of these products by improving biocompatibility and reducing the risk of complications. Furthermore, grafts featuring anti-thrombogenic and anti-infective coatings are gaining traction, offering better outcomes in terms of long-term patency and infection prevention. These developments not only improve surgical success rates but also enable wider application of vascular grafts in complex procedures. As technologies evolve, next-generation grafts are expected to play a more prominent role in vascular surgeries, encouraging wider clinical adoption and contributing to market growth.Key Players Profiled in this Vascular Graft Market Report

- Abbott Laboratories

- Braun Melsungen AG

- Becton, Dickinson and Company (Bard Peripheral Vascular Inc.)

- Cardinal Health (Cordis Corporation)

- Cook Medical

- Endologix Inc.

- Getinge Group

- LeMaitre Vascular Inc.

- Medtronic PLC

- Terumo Medical Corporation

Report Scope:

In this report, the Global Vascular Graft Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vascular Graft Market, by Product:

- Hemodialysis Access Graft Endovascular Stent Graft

- Peripheral Vascular Graft

- Coronary Artery By-pass Graft

Vascular Graft Market, by Drug Application:

- Aneurysms

- Kidney Failure

- Vascular Occlusion

- Coronary Artery Diseases

- Other Applications

Vascular Graft Market, by Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Vascular Graft Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Vascular Graft market report include:- Abbott Laboratories

- Braun Melsungen AG

- Becton, Dickinson and Company (Bard Peripheral Vascular Inc.)

- Cardinal Health (Cordis Corporation)

- Cook Medical

- Endologix Inc.

- Getinge Group

- LeMaitre Vascular Inc.

- Medtronic PLC

- Terumo Medical Corporation.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | May 2025 |

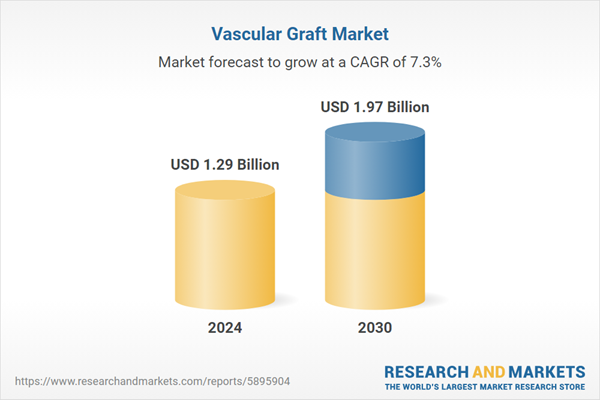

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.29 Billion |

| Forecasted Market Value ( USD | $ 1.97 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |