Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Explosion in Biological Data

The field of biology has entered a new era, one characterized by an unprecedented explosion in biological data. From the sequencing of genomes to the study of complex biological systems, the volume and complexity of data being generated are staggering. This deluge of data has given rise to the field of computational biology, which utilizes advanced algorithms and data analysis techniques to make sense of this wealth of information. The sequencing of genomes has been a driving force behind the surge in biological data. The Human Genome Project, completed in 2003, marked a significant milestone in genomics, but it was just the beginning. Today, high-throughput sequencing technologies have made it possible to rapidly and cost-effectively sequence entire genomes. This has led to a vast repository of genomic data, providing critical insights into genetics, evolution, and disease susceptibility. Genomics is just one facet of the biological data explosion. Transcriptomics, which studies gene expression patterns, and proteomics, which focuses on proteins, have also contributed to the data influx. Researchers can now examine the entire transcriptome or proteome of an organism, offering insights into gene regulation, protein function, and disease mechanisms. Single-cell sequencing technologies have taken biological research to a finer level of granularity. Instead of studying tissues or populations of cells, scientists can now analyze individual cells within a tissue. This technology has revolutionized our understanding of cellular heterogeneity, tissue development, and disease progression. However, it generates massive amounts of data that require sophisticated computational analysis. The integration of multiple omics data sources (genomics, transcriptomics, proteomics, metabolomics, etc.) is a powerful approach for understanding complex biological systems comprehensively. However, it multiplies the volume of data exponentially. Computational biology plays a pivotal role in harmonizing and interpreting these integrated datasets, enabling holistic insights into biological phenomena. The pharmaceutical industry relies on computational biology to accelerate drug discovery. by analyzing vast datasets of chemical compounds and their interactions with biological molecules, researchers can identify potential drug candidates, predict their efficacy, and optimize their properties. This data-driven approach significantly reduces the time and cost of bringing new drugs to market.Advancements in Genomics

The field of genomics has witnessed remarkable advancements over the past few decades, revolutionizing our understanding of genetics, diseases, and the intricacies of life itself. At the heart of this transformation is the synergy between genomics and computational biology. The Human Genome Project, completed in 2003, marked a turning point in genomics. It was a massive collaborative effort to map and sequence all the genes in the human genome. This monumental achievement set the stage for a genomics revolution, catalyzing the rapid development of high-throughput DNA sequencing technologies. Next-generation sequencing (NGS) technologies emerged as game-changers in genomics. These instruments can sequence vast quantities of DNA in a short time, generating terabytes of data in a single run. This exponential increase in data output necessitated advanced computational tools and expertise to process and analyze the data efficiently. The proliferation of high-throughput sequencing has led to an explosion of genomic data. Researchers can now sequence not only human genomes but also the genomes of countless other species, uncovering critical insights into evolution, genetic diversity, and the genetic basis of diseases. This abundance of data fuels the demand for computational biology solutions to extract meaningful information. The advent of affordable direct-to-consumer DNA testing has made genomics accessible to the masses. Individuals can now obtain their genetic information, which can provide insights into ancestry, disease predispositions, and lifestyle recommendations. This growing interest in personal genomics generates a significant need for computational tools that can analyze and interpret these individual genetic profiles. Genomic medicine leverages genomic data to guide clinical decision-making. It enables the identification of genetic mutations linked to diseases, facilitates early diagnosis, and supports personalized treatment plans. As genomic medicine becomes more integrated into healthcare systems, computational biology tools play a central role in translating genomic information into actionable insights. Traditional genomic techniques often analyze populations of cells, masking the diversity within tissues. Single-cell genomics technologies now allow researchers to study individual cells, unveiling intricate cellular heterogeneity. These techniques generate immense datasets, necessitating computational methods to unravel the complex cellular landscapes.Drug Discovery and Development

The realms of drug discovery and computational biology are experiencing an exciting convergence. As the pharmaceutical industry races to develop innovative drugs, computational biology has emerged as an indispensable ally. The need for novel pharmaceutical compounds to treat a wide range of diseases, from cancer to rare genetic disorders, continues to grow. Drug discovery is a lengthy and resource-intensive process, but it's essential for improving healthcare outcomes and patient quality of life. Computational biology provides crucial support by accelerating various stages of drug development. Computational biology allows researchers to conduct in-silico (computer-based) drug screening. This approach involves simulating the interaction between potential drug compounds and target molecules, such as proteins or enzymes. by virtually screening thousands of compounds, researchers can identify potential drug candidates faster and with lower costs. Computational biology plays a pivotal role in predicting drug-target interactions. Algorithms and machine learning models analyze biological data to determine how a drug molecule will interact with specific cellular targets. This predictive capability significantly shortens the drug development timeline and reduces experimental failures. Once potential drug candidates are identified, computational biology aids in optimizing their properties. Researchers can modify the chemical structure of lead compounds to enhance their efficacy, reduce toxicity, and improve bioavailability. This iterative process, known as lead optimization, relies heavily on computational modeling and simulations. Understanding the underlying biological pathways involved in diseases is critical for drug development. Computational biology tools help elucidate these pathways by analyzing complex omics data. This knowledge guides researchers in identifying key targets and developing drugs that modulate specific biological processes.Collaboration and Cross-Industry Partnerships

In today's interconnected world, collaboration and partnerships are powerful catalysts for innovation and progress. The Global Computational Biology Market is no exception, benefiting significantly from cross-industry collaborations. Collaborations in the field of computational biology facilitate the exchange of knowledge and expertise. Academic institutions and research organizations often possess cutting-edge research findings, while pharmaceutical companies bring practical drug development experience. When these entities come together, they combine theoretical insights with real-world applications, driving innovation in the field. One of the primary challenges in computational biology is access to high-quality biological data. Collaboration between research organizations and technology firms can provide valuable data resources. Public-private partnerships, for example, can make large datasets accessible to researchers, enabling them to conduct comprehensive analyses and develop more accurate models. Collaborative efforts allow for the pooling of resources, both human and financial. This resource synergy can accelerate research and development processes. When multiple entities contribute to a project, it becomes possible to tackle more extensive and complex tasks, such as large-scale genomic studies or drug discovery initiatives. Computational biology inherently involves multiple disciplines, including biology, computer science, and statistics. Collaborative projects often involve researchers from these diverse backgrounds. This interdisciplinary approach encourages fresh perspectives and creative problem-solving, leading to breakthroughs that might not have been possible within a single organization. The pharmaceutical industry is increasingly turning to computational biology for drug discovery. Collaborations between pharmaceutical companies and computational biology experts can expedite the identification of potential drug candidates. Cross-industry partnerships facilitate the application of computational tools to predict drug-target interactions and optimize lead compounds.Key Market Challenges

Data Complexity and Volume

The exponential growth of biological data is a double-edged sword. While it provides a wealth of information, it also presents a significant challenge in terms of data complexity and volume. Handling, storing, and analyzing massive datasets require robust computational infrastructure and efficient algorithms.Data Privacy and Security

Biological data, especially genomic information, is sensitive and subject to strict privacy regulations. Ensuring data privacy while allowing for meaningful analysis is a delicate balance. The computational biology market must address these concerns to gain public trust and comply with evolving data protection laws.Interoperability and Standardization

Computational biology tools and platforms often vary in their data formats and analysis methods. This lack of standardization hinders data sharing and collaboration. Establishing common data standards and interoperable tools is essential to overcome this challenge.Shortage of Skilled Workforce

The field of computational biology requires a multidisciplinary skill set, encompassing biology, computer science, mathematics, and statistics. There is a shortage of professionals with expertise in these areas, making it challenging for organizations to find and retain qualified talent.Key Market Trends

Single-Cell Omics Revolution

Single-cell sequencing and omics technologies are rapidly gaining momentum. These techniques allow researchers to dissect the molecular profiles of individual cells within complex tissues. As the resolution of single-cell data improves, computational biology will play a critical role in analyzing and interpreting these intricate datasets. Expect innovations in algorithms and tools tailored for single-cell omics analysis.Spatial Transcriptomics

Spatial transcriptomics is an emerging field that combines genomics with spatial information. It enables researchers to map gene expression within tissues, providing insights into the spatial organization of cells. Computational methods for spatial data analysis will be in high demand, offering new ways to study tissue architecture and disease mechanisms.Multi-Omics Integration

Integrating multiple omics data sources, such as genomics, transcriptomics, proteomics, and metabolomics, provides a holistic view of biological systems. Computational tools that facilitate the integration and analysis of multi-omics data will be in high demand, enabling researchers to uncover intricate interactions and pathways.Blockchain for Data Security

Data security and privacy are paramount in computational biology, particularly when handling sensitive genomic information. Blockchain technology holds promise for secure and transparent data management, ensuring the integrity and privacy of biological data. Expect to see blockchain-based solutions for data security and traceability.Segmental Insights

Service Insights

Based on the category of Service, the Contract segment emerged as the dominant player in the global market for computational biology in 2022. This can be attributed to the cost-effectiveness of contract services compared to the in-house services offered globally. Providers of Contract Research Organization (CRO) services collaborate closely with clients to create tailored plans, thereby acting as a catalyst for market growth.On the other hand, the in-house segment is projected to experience the most rapid growth. In-house services grant companies’ greater control over their internal operations, as they directly employ these services. This approach offers advantages such as cost savings and time efficiency, contributing to its accelerated growth.

End User Insights

The commercial sector is anticipated to be the primary contributor to market revenue. Increased investments in Research and Development (R&D) in genetic engineering and the development of innovative medicines by both government and commercial entities are significant factors contributing to the heightened demand for computational biology.As an example, in May 2021, the World Health Organization (WHO) and the Swiss Confederation inked a Memorandum of Understanding (MoU) to establish the inaugural WHO BioHub Facility as part of the WHO BioHub System. Situated in Spiez, Switzerland, this facility serves as a hub for the secure reception, sequencing, storage, and preparation of biological materials for distribution to other laboratories. It also plays a crucial role in risk assessments and supports global preparedness against pathogens. Similarly, substantial investments from the European Commission into the Horizon 2020 program aim to eliminate innovation barriers and promote improved collaboration between the public and private sectors, fostering innovation. These developments are expected to bolster the rising demand for computational biology, consequently driving revenue growth in this market segment.

Regional Insights

North America presently holds the dominant position in the computational biology market and is expected to maintain its leadership for several more years. The United States, in particular, stands as the frontrunner in the field of synthetic biology, which is an emerging discipline focused on the design, manipulation, and reprogramming of biological systems. The U.S. government has been a substantial supporter of computational biology and synthetic biology since 2005, channeling over USD 1 billion toward their development. The annual average investment by the U.S. government in advancing computational biology is estimated at approximately USD 140 million.The rise of personalized medicine has fostered collaborative initiatives among medical institutions, government bodies, and researchers to expedite the creation of effective treatments. For instance, in 2020, Summit Biolabs Inc. and the Colorado Center for Personalized Medicine (CCPM) established a comprehensive strategic partnership to conduct research, development, and commercialization of saliva liquid-biopsy tests for the early detection of cancer, diagnosis of COVID-19, and other viral infections. Similarly, in April 2020, HealthCare Global Enterprises and Strand Life Sciences introduced the StrandAdvantage500, a Next-Generation Sequencing (NGS) based assay that assesses cancer-related genetic alterations in DNA and RNA extracted from a patient's tumor in a unified workflow. Furthermore, in July 2021, Indivumed GmbH launched"travel," an innovative AI discovery platform designed for oncology and precision medicine. This platform combines IndivuType's extensive multi-omics data with sophisticated disease models, highly advanced automated Machine Learning tools, and a comprehensive suite of advanced analytical capabilities.

The overall computational biology market in the United States is poised for substantial growth in the coming years, primarily due to the significant investments made in drug development, which are the highest worldwide.

Key Market Players

- Dassault Systemes SE

- Certara Inc

- Chemical Computing Group ULC

- Compugen Ltd

- Rosa & Co. LLC

- GeneData AG

- Insilico Biotechnology AG

- Instem PLC

- Strand Life Sciences Pvt Ltd

- Schrodinger Inc

Report Scope

In this report, the Global Computational Biology Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Computational Biology Market, by Application:

- Cellular and Biological Simulation

- Drug Discovery and Disease Modelling

- Preclinical Drug Development

- Clinical Trials

- Human Body Simulation Software

Computational Biology Market, by Tool:

- Databases

- Infrastructure (Hardware)

- Analysis Software and Services

Computational Biology Market, by Service:

- In-house

- Contact

Computational Biology Market, by End User:

- Academics

- Industry and Commercials

Computational Biology Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Computational Biology Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Dassault Systemes SE

- Certara Inc.

- Chemical Computing Group ULC

- Compugen Ltd.

- Rosa & Co. LLC

- GeneData AG

- Insilico Biotechnology AG

- Instem PLC

- Strand Life Sciences Pvt Ltd.

- Schrodinger Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | October 2023 |

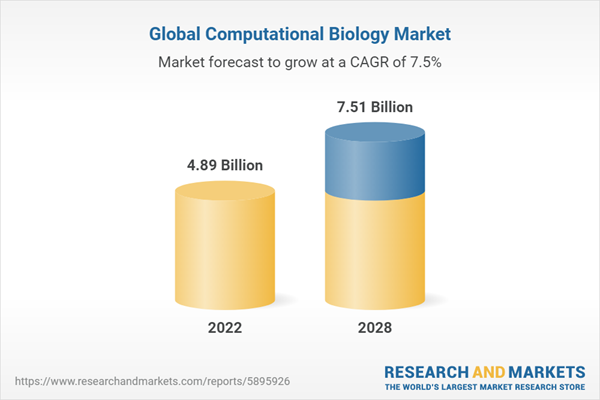

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 4.89 Billion |

| Forecasted Market Value ( USD | $ 7.51 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |