Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Recloser Control market refers to the industry segment focused on the design, production, and distribution of specialized electrical control devices known as"recloser controls." These controls are essential components within electrical distribution systems, primarily in the context of power grids and utility networks. Recloser controls are responsible for the automatic operation of reclosers, which are circuit breakers specifically designed to interrupt and restore electrical power flow when faults or disruptions occur in the grid. These devices play a pivotal role in enhancing grid reliability and minimizing downtime by isolating faulty sections and automatically restoring power without manual intervention. The Recloser Control market encompasses various technologies, including hardware and software solutions, that enable utilities and grid operators to monitor, protect, and control their distribution networks more effectively. This market is driven by factors such as grid modernization, renewable energy integration, and the need for improved grid resilience. It plays a vital role in ensuring the efficient and reliable distribution of electricity to homes, businesses, and industries, contributing to the overall stability of the electrical infrastructure. As the energy sector continues to evolve and face new challenges, the Recloser Control market adapts and innovates to meet the demands of an increasingly complex and dynamic electrical grid landscape.

Key Market Drivers

Grid Modernization Initiatives

Grid modernization initiatives are a significant driver of the global Recloser Control market. As power grids age and become increasingly outdated, utilities and governments worldwide are recognizing the need for transformation. The aim is to make grids more resilient, efficient, and capable of accommodating new technologies and renewable energy sources. Recloser control devices are integral to grid modernization efforts. They enable utilities to enhance grid automation and self-healing capabilities, ensuring rapid fault detection and isolation. This, in turn, minimizes service interruptions and improves the overall reliability of the electrical grid. With governments and utilities investing heavily in grid modernization projects, the demand for advanced recloser control solutions is on the rise. These solutions help utilities adapt to evolving energy landscapes and meet the growing expectations for a more robust and sustainable power grid.Renewable Energy Integration

The global push for renewable energy sources, such as solar and wind power, is another significant driver of the Recloser Control market. As more renewable energy installations are integrated into the grid, grid stability becomes a paramount concern. Renewable sources are inherently variable and intermittent, causing fluctuations in grid voltage and frequency. Recloser control devices play a crucial role in managing these fluctuations, ensuring a smooth integration process. They help maintain grid stability and reduce the risk of power outages when renewable energy generation is affected by weather conditions or other factors. As countries continue to transition toward sustainable energy generation, the demand for recloser control systems that can effectively manage the challenges of renewable energy integration is poised to grow substantially.Increasing Power Demand

The ever-increasing global population and industrialization are driving up the demand for electricity. This surge in power consumption necessitates the expansion and optimization of existing power distribution networks. Recloser control devices assist utilities in maintaining grid reliability and minimizing downtime. They can swiftly isolate faulty sections of the grid, reducing the impact of outages. As utilities work to meet the escalating power requirements of residential, commercial, and industrial sectors, the demand for recloser control systems that enhance grid efficiency and reliability continues to rise.Aging Infrastructure Replacement

Many countries are grappling with aging power distribution infrastructure that is prone to frequent faults and outages. To address this issue, utilities are actively replacing outdated equipment with modern and technologically advanced solutions, including recloser control systems. Recloser control devices help extend the lifespan of existing infrastructure by improving its performance, reducing maintenance costs, and enhancing grid resilience. Their ability to detect and mitigate faults makes them a valuable asset in infrastructure renewal projects.Focus on Grid Resilience

Grid resilience has become a critical concern in an era of climate change and extreme weather events. Recloser control devices play a pivotal role in enhancing grid resilience by isolating and restoring power automatically when faults occur. During storms or other adverse conditions, recloser control systems can minimize the impact of disruptions, ensuring a more reliable electrical supply. As governments, utilities, and communities increasingly prioritize grid resilience, the demand for recloser control solutions that can mitigate the effects of extreme events continues to grow.Regulatory Mandates and Safety Standards

Governments and regulatory bodies worldwide are imposing stricter safety standards and regulations for power distribution systems. Compliance with these mandates often requires the installation of advanced recloser control systems that can monitor, protect, and control distribution networks more effectively. Recloser control devices help utilities meet these stringent requirements by providing advanced fault detection and isolation capabilities. They contribute to safer and more reliable electrical distribution, making them essential components for utilities seeking to adhere to regulatory mandates and safety standards.In conclusion, the global Recloser Control market is being driven by a confluence of factors, including grid modernization, renewable energy integration, increasing power demand, infrastructure replacement, grid resilience concerns, and regulatory compliance. These drivers are shaping the industry's growth as utilities and industries seek reliable, efficient, and technologically advanced solutions for managing their power distribution networks.

Government Policies are Likely to Propel the Market

Grid Modernization and Smart Grid Initiatives

One of the most significant government policies driving the global Recloser Control market is the promotion of grid modernization and smart grid initiatives. Governments around the world recognize the need to upgrade aging power infrastructure and make grids more resilient, efficient, and adaptable to emerging technologies. These policies often involve substantial investments in grid modernization projects, with a focus on incorporating advanced automation and control systems like recloser controls. Governments may provide financial incentives, tax breaks, or grants to utilities and companies that adopt smart grid technologies. Additionally, they may establish regulatory frameworks that encourage the integration of recloser control devices into the grid. These policies aim to improve grid reliability, reduce energy waste, and enhance the overall performance of electrical distribution systems. As a result, the demand for recloser control systems that support smart grid objectives is likely to grow in response to these government initiatives.Renewable Energy Integration and Incentives

Governments worldwide are actively promoting the integration of renewable energy sources into their energy mix as part of broader climate change mitigation efforts. This policy involves various incentives and regulations designed to accelerate the adoption of renewable energy technologies, such as solar and wind power. To ensure the reliable integration of intermittent renewable energy sources into the grid, governments may require utilities to invest in advanced grid management technologies, including recloser control systems. Incentives such as feed-in tariffs, tax credits, or subsidies may be offered to utilities and renewable energy producers that deploy these technologies. As governments continue to prioritize renewable energy, the demand for recloser control solutions capable of managing the challenges associated with variable energy generation is expected to rise in response to these policies.Energy Efficiency and Conservation Regulations

Energy efficiency and conservation policies play a critical role in shaping the Recloser Control market. Governments often establish energy efficiency standards and regulations for various industries and sectors. These policies aim to reduce energy consumption, minimize energy waste, and lower greenhouse gas emissions. Recloser control devices contribute to energy efficiency by enabling utilities to quickly identify and respond to faults in the electrical grid. by reducing the duration and scope of power outages, these technologies help minimize energy loss and optimize grid performance. Government policies that promote energy efficiency may require utilities to implement recloser control systems as part of their compliance strategies. In some cases, financial incentives or rebates may be provided to encourage the adoption of energy-efficient technologies, further driving demand in the Recloser Control market.Grid Resilience and Disaster Preparedness

Governments recognize the importance of grid resilience in the face of increasing climate-related disasters and other unforeseen events. Policies related to grid resilience and disaster preparedness often include requirements for utilities to invest in technologies that enhance grid reliability and reduce downtime during extreme events. Recloser control devices are critical in this context, as they can automatically detect and isolate faults, minimizing the impact of disruptions on the electrical grid. Governments may establish guidelines, regulations, or funding programs to support the deployment of these technologies by utilities. by prioritizing grid resilience, governments aim to ensure that power distribution remains reliable even during adverse conditions. This focus on disaster preparedness contributes to the growth of the Recloser Control market, as utilities seek solutions that align with government policies aimed at enhancing grid resiliency.Environmental Regulations and Emission Reduction Targets

Governments worldwide are increasingly concerned about environmental sustainability and carbon emissions reduction. To meet international climate agreements and reduce greenhouse gas emissions, governments implement policies that encourage cleaner and more sustainable energy practices. Recloser control devices indirectly support these policies by improving the efficiency and reliability of power distribution. by reducing the frequency and duration of power outages, recloser controls help avoid the need for backup generators and temporary power sources, which may rely on fossil fuels. Government regulations related to emissions reduction may require utilities to invest in technologies that improve grid performance, reduce energy waste, and enhance the overall sustainability of the electrical grid. As a result, the Recloser Control market benefits from these environmental policies that align with broader sustainability goals.Safety and Regulatory Compliance

Government policies related to safety and regulatory compliance are crucial drivers of the Recloser Control market. These policies aim to ensure the safe and reliable operation of power distribution systems while adhering to industry standards and best practices. Recloser control devices play a significant role in meeting these safety and compliance requirements. They can automatically detect and isolate faults, reducing the risk of electrical accidents and improving overall grid safety. Governments may establish regulations, certification standards, or inspection requirements that mandate the use of recloser control systems in power distribution networks. Compliance with these policies becomes a priority for utilities and grid operators, driving the adoption of recloser control technologies.In conclusion, government policies have a substantial impact on the global Recloser Control market. Grid modernization, renewable energy integration, energy efficiency, grid resilience, environmental regulations, safety, and compliance policies all contribute to the growing demand for recloser control devices. As governments continue to prioritize these policy objectives, the Recloser Control market is expected to expand to meet the evolving needs of the energy sector.

Key Market Challenges

Interoperability and Standardization Challenges

One of the key challenges in the global Recloser Control market is interoperability and the lack of standardized communication protocols. Recloser control devices are essential components of modern smart grids, where various grid assets and equipment need to communicate seamlessly to optimize grid performance and respond to faults effectively. However, the market features a multitude of manufacturers and vendors offering different recloser control solutions with proprietary communication protocols and technologies. This lack of standardization can pose significant challenges for utilities and grid operators. When integrating multiple recloser control devices from different manufacturers into their grid infrastructure, they may encounter compatibility issues. These issues can hinder interoperability and create complexities in managing and monitoring the grid effectively. To address these challenges, industry stakeholders and regulatory bodies are working toward the development and adoption of common communication protocols and standards for recloser control devices. Standards like IEC 61850 and DNP3 (Distributed Network Protocol 3) are gaining prominence, aiming to provide a common language for various grid assets. However, achieving widespread standardization across the global Recloser Control market remains a complex and ongoing process. Different regions and utilities may have varying requirements and legacy systems, making it challenging to implement standardized solutions universally. The industry must continue its efforts to establish common communication standards to enhance interoperability and facilitate the seamless integration of recloser control devices into modern grid systems.Cybersecurity and Data Privacy Concerns

As the Recloser Control market increasingly adopts digital technologies and becomes an integral part of smart grids, it faces significant cybersecurity and data privacy challenges. Recloser control devices are vulnerable to cyberattacks that can disrupt grid operations, compromise data integrity, and pose serious security risks. Utilities and grid operators must ensure the cybersecurity of their recloser control systems to protect critical infrastructure from cyber threats. This entails safeguarding against unauthorized access, data breaches, and potential manipulation of control systems by malicious actors. Ensuring the confidentiality, integrity, and availability of data transmitted between recloser control devices is paramount. Moreover, data privacy concerns arise as recloser control devices collect and transmit sensitive information about grid performance and customer usage patterns. This data can be susceptible to privacy breaches, raising concerns among regulators and consumers about the protection of personal and grid-related data. Addressing these challenges requires a multi-faceted approach. Utilities and manufacturers must invest in robust cybersecurity measures, including intrusion detection systems, encryption, and regular security audits. They should also establish comprehensive data privacy policies and adhere to relevant regulations, such as the General Data Protection Regulation (GDPR) in Europe. Furthermore, industry collaboration is crucial in sharing best practices and threat intelligence to stay ahead of emerging cybersecurity threats. Government agencies and regulatory bodies can play a pivotal role by enforcing cybersecurity standards and regulations specific to the Recloser Control market.In summary, the global Recloser Control market faces significant challenges related to interoperability and standardization, as well as cybersecurity and data privacy concerns. Overcoming these challenges requires concerted efforts from industry stakeholders, regulatory bodies, and cybersecurity experts to ensure the reliability, security, and resilience of modern grid systems.

Segmental Insights

Electric Control Insights

The Electric Control segment had the largest market share in 2022 & expected to maintain it in the forecast period. Electric control systems typically offer faster response times compared to hydraulic control systems. This rapid response is critical for modern electrical grids, where minimizing downtime and quickly isolating faults is essential to maintaining grid reliability. Electric recloser controls can detect and respond to faults within milliseconds, helping utilities restore power more efficiently. The global push for smart grid technology, which enhances grid automation and communication, aligns well with electric control systems. Electric recloser controls can be integrated seamlessly into smart grid networks, allowing utilities to remotely monitor and manage distribution systems. This integration supports advanced features such as fault location, isolation, and service restoration (FLISR), improving overall grid efficiency. Electric control systems provide precise control over recloser operations. Utilities can program and adjust settings with a high degree of accuracy, allowing for customized fault detection and response strategies. This level of control enables utilities to fine-tune their distribution networks to specific grid conditions and optimize grid performance. Electric recloser controls often require less maintenance compared to hydraulic systems. They have fewer moving parts, reducing the risk of mechanical failures and the need for frequent servicing. This results in lower maintenance costs and increased reliability, making them an attractive choice for utilities. Electric control systems are often considered more environmentally friendly than hydraulic systems. They don't rely on hydraulic fluids, which can pose environmental risks if leaks or spills occur. As environmental regulations and sustainability concerns grow, electric controls align with the trend toward cleaner and safer technologies. Electric recloser control systems tend to have a more compact and lightweight design compared to their hydraulic counterparts. This compactness allows for easier installation and integration into existing grid infrastructure, making them a convenient choice for utilities looking to upgrade their systems. Ongoing advancements in electronics and control technologies have led to the development of highly sophisticated electric recloser controls. These advancements have improved their reliability, functionality, and adaptability to various grid scenarios.Three-phase Insights

The Three-phase segment had the largest market share in 2022 and is projected to experience rapid growth during the forecast period. Three-phase recloser controls are designed to provide comprehensive protection for all three phases of a power distribution system simultaneously. This capability is essential for ensuring the stability and reliability of medium and high-voltage distribution networks. They can detect and respond to faults in all phases, helping utilities maintain grid reliability. In three-phase power distribution systems, it's crucial to maintain balanced power across all phases to prevent voltage and current imbalances. Three-phase recloser controls are well-suited for this purpose, as they can monitor and control each phase to ensure that the load is evenly distributed. Three-phase recloser controls are often preferred for industrial and utility-scale applications, where the reliability and stability of all three phases are critical. These controls are commonly used in substations and distribution systems that serve large industrial facilities, commercial complexes, and critical infrastructure. High-voltage distribution networks, such as those used by utilities for long-distance power transmission, often rely on three-phase recloser controls due to their ability to handle the higher voltages associated with these systems. This makes them essential for maintaining grid reliability in large-scale power distribution. Three-phase recloser controls offer versatility in managing various types of faults, including phase-to-phase and phase-to-ground faults. They can quickly isolate faulty sections and restore power to unaffected areas, minimizing downtime and improving overall grid performance.Regional Insights

North America had the largest market for recloser control in 2022. This is due to the increasing investment in distribution automation and the growth of renewable power generation in the region. The United States is the major driver of the market in North America.Europe had the second-largest market for recloser control in 2022. This is due to the increasing investment in smart grids and the growth of renewable power generation in the region. Germany, France, and the United Kingdom are the major drivers of the market in Europe.

Asia Pacific is projected to be the fastest-growing market for recloser control, registering a CAGR of over 6% during the forecast period. This is due to the increasing investment in distribution automation and the growth of renewable power generation in the region. China, India, and Japan are the major drivers of the market in Asia Pacific.

Key Market Players

- ABB Ltd

- Eaton Corporation plc

- Schneider Electric SE

- Siemens AG

- S&C Electric Company

- G&W Electric Co.

- NOJA Power Switchgear Pty Ltd

- ENTEC Electric & Electronic Co. Ltd

- Tavrida Electric Global

- Arteche Group

Report Scope

In this report, the Global Recloser Control Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Recloser Control Market, by Type:

- Electric Control

- Hydraulic Control

Recloser Control Market, by Phase:

- Three-phase

- Single-phase

- Triple-single Phase

Recloser Control Market, by Voltage Rating:

- Up to 15kv

- 16-27kv

- 28-38kv

Recloser Control Market, by Industry Vertical:

- Utilities

- Industrial

- Commercial

- Infrastructure

Recloser Control Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Recloser Control Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ABB Ltd.

- Eaton Corporation PLC

- Schneider Electric SE

- Siemens AG

- S&C Electric Company

- G&W Electric Co.

- NOJA Power Switchgear Pty Ltd.

- ENTEC Electric & Electronic Co. Ltd.

- Tavrida Electric Global

- Arteche Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | October 2023 |

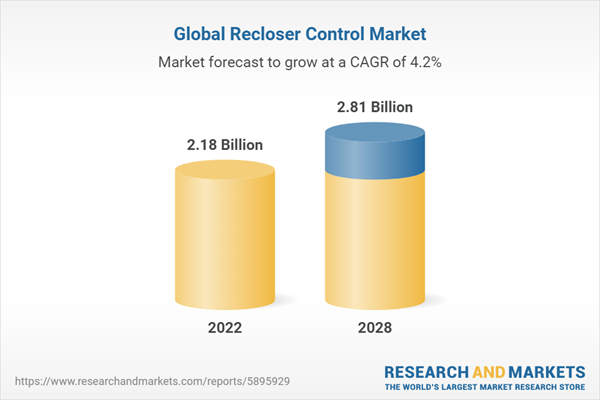

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 2.18 Billion |

| Forecasted Market Value ( USD | $ 2.81 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |