Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Several key drivers are fueling the growth of this market. Firstly, the increasing adoption of minimally invasive surgical techniques is a significant factor. Powered surgical instruments play a pivotal role in these procedures by enabling precision, control, and access through smaller incisions. This results in quicker recovery times and reduced hospital stays, aligning with the evolving preference for less invasive surgical approaches.

Secondly, the global aging population is contributing to a higher prevalence of chronic and age-related conditions that often necessitate surgical interventions. This demographic shift is generating a heightened demand for powered surgical instruments tailored to meet the unique requirements of older patients.

Thirdly, ongoing advancements in surgical instrument technology, encompassing innovations such as robotics, digital imaging, and ergonomic design, are fostering progress and prompting healthcare providers to invest in the latest instruments. These innovations are aimed at enhancing patient outcomes, making them an attractive option for healthcare facilities looking to stay at the forefront of medical technology.

Moreover, the overall volume of surgical procedures conducted worldwide continues to rise due to population growth, improved healthcare access, and a higher incidence of chronic illnesses. This increased surgical volume directly translates into a greater demand for powered surgical instruments to support these procedures effectively.

Lastly, patient expectations are evolving, with a growing emphasis on less invasive procedures, reduced postoperative discomfort, and expedited recovery times. Powered instruments empower healthcare providers to offer patient-centric care that aligns with these evolving expectations, contributing to the market's growth.

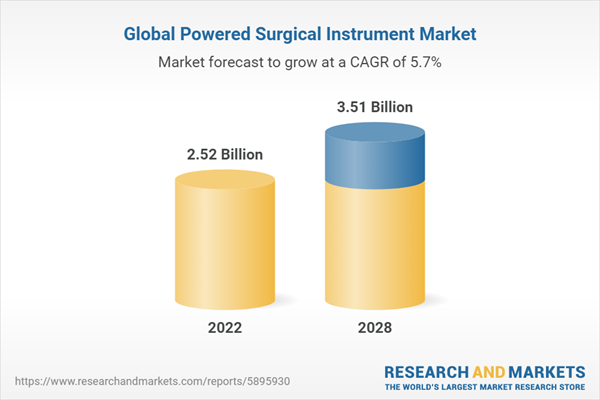

In conclusion, the Global Powered Surgical Instrument Market is set to experience substantial expansion, driven by the rising adoption of minimally invasive techniques, the aging global population, technological advancements, increased surgical volumes, and evolving patient preferences for less invasive and patient-centric care.

Key Market Drivers

Technological Advancements

Technological advancements in powered surgical instruments have been transformative in improving the precision, safety, and outcomes of surgical procedures. These advancements encompass a wide range of innovations across various surgical specialties. Robotic-assisted surgery has revolutionized the field by enhancing the surgeon's control and precision. Surgeons use robotic systems to perform minimally invasive procedures with smaller incisions and better maneuverability, resulting in reduced patient trauma and quicker recovery. Integration of advanced imaging technologies, such as 3D visualization and augmented reality, enables surgeons to have a more detailed view of the surgical area in real-time. This improves accuracy and reduces the risk of complications. Ultrasonic and laser-powered surgical instruments are used for cutting, coagulating, and dissecting tissues with greater precision and minimal damage to surrounding structures. These instruments have found applications in various surgical specialties. Electrosurgical instruments have evolved with improved safety features, precision, and control. They are used for cutting and coagulating tissues and play a crucial role in many surgeries. Powered staplers have become more sophisticated, allowing surgeons to perform complex tissue stapling in a controlled and efficient manner. These devices are often used in gastrointestinal and thoracic surgeries. Energy-based devices, such as harmonic scalpel and radiofrequency ablation tools, offer precise cutting and coagulation capabilities. They are particularly useful in delicate procedures where preserving tissue integrity is critical.Manufacturers are designing powered instruments with ergonomic considerations to reduce surgeon fatigue during long procedures. Some instruments can be customized to suit the specific needs of surgeons and procedures. Some powered instruments are equipped with wireless technology, enabling data exchange, remote monitoring, and integration with other surgical equipment. This enhances surgical precision and safety. Smart surgical instruments can provide real-time feedback on parameters like pressure, temperature, and tissue characteristics. Surgeons can use this information to make informed decisions during surgery. Powered instruments can be integrated into surgical navigation systems, allowing for real-time tracking and guidance during complex procedures. This improves accuracy and reduces the risk of errors. Advancements in instrument design have led to single-port and flexible instruments for minimally invasive procedures. These instruments allow for access to difficult-to-reach areas with improved dexterity. 3D printing technology is being used to create customized surgical instruments, particularly for patient-specific procedures. Surgeons can have instruments tailored to the patient's anatomy, improving precision. Enhanced safety features, including audible and visual alerts, ensure that surgeons and surgical staff can work with confidence, reducing the risk of accidents during surgery. Some manufacturers are incorporating sustainable materials and designs into powered instruments, aligning with the healthcare industry's growing focus on environmental responsibility. This factor will help in the development of the Global Powered Surgical Instrument Market.

Increased Surgical Volume

As the global population continues to grow, there is a natural increase in the number of people requiring surgical procedures. A larger population base leads to more patients seeking surgical treatment for various medical conditions. In many regions, improved access to healthcare facilities and services has made surgical care more accessible to a larger portion of the population. This increased access leads to more individuals seeking surgical treatment. Advances in surgical techniques, including minimally invasive procedures, have expanded the range of conditions that can be treated surgically. These techniques often rely on powered surgical instruments for their precision and effectiveness. In addition to treating medical conditions, an increasing number of individuals are opting for preventive and elective surgeries. These may include cosmetic surgeries, weight loss surgeries, and procedures to reduce the risk of future health issues.The healthcare infrastructure in emerging markets is improving, leading to a higher demand for surgical services. As healthcare systems expand and develop, there is a growing need for surgical equipment, including powered instruments. Advancements in medical knowledge and technology have led to the development of specialized surgical procedures. These procedures often require specialized powered instruments tailored to the specific surgery, further driving demand. The increasing prevalence of non-communicable diseases, such as diabetes, cardiovascular diseases, and cancer, contributes to a higher demand for surgical interventions to manage or treat these conditions. Breakthroughs in medical research have resulted in innovative treatments that rely on surgical procedures, such as organ transplants, complex oncological surgeries, and neurosurgical interventions. Patients and healthcare providers are increasingly focused on improving healthcare quality and outcomes. Surgical procedures, when performed with precision using powered instruments, can lead to better patient outcomes. This factor will pace up the demand of the Global Powered Surgical Instrument Market.

Rising Aging Population

As individuals age, they become more susceptible to age-related medical conditions such as osteoarthritis, degenerative spine disorders, cardiovascular diseases, and cancer. These conditions often require surgical interventions, and powered surgical instruments are essential for performing these procedures with precision. Joint replacement surgeries, such as hip and knee replacements, are commonly performed on elderly individuals to alleviate pain and improve mobility. These procedures heavily rely on powered instruments like drills and saws for bone preparation and implant placement. Degenerative spine conditions, spinal stenosis, and herniated discs are more prevalent among the aging population. Spinal surgeries often require powered instruments for tasks like bone removal and spinal fusion. Older adults are at a higher risk of cardiovascular diseases, necessitating procedures like coronary artery bypass grafting (CABG) and heart valve replacements. Powered instruments are used for intricate tasks in cardiac surgeries. Cancer incidence increases with age, and surgical procedures, such as tumor resections and lymph node dissections, are often part of cancer treatment. Powered instruments play a critical role in oncological surgeries.Elderly patients may require general and abdominal surgeries for various reasons, including gastrointestinal conditions, hernias, and gallbladder diseases. Powered instruments aid in these procedures. The desire to maintain a high quality of life and independence drives many older adults to seek surgical treatments. Procedures like cataract removal and joint arthroscopy use powered instruments to enhance patient outcomes. Minimally invasive surgical techniques, which are gentler on older patients, have gained popularity. Powered instruments are vital for these procedures, allowing for smaller incisions and reduced trauma. Surgical precision is crucial when operating on elderly patients, as their bodies may be more fragile. Powered instruments provide the precision required to minimize tissue damage and reduce the risk of complications. Advances in healthcare have increased life expectancy. Older adults are living longer and healthier lives, but they may require surgical interventions to address age-related conditions, which further boosts the demand for powered surgical instruments. This factor will accelerate the demand of the Global Powered Surgical Instrument Market.

Key Market Challenges

Cost Pressures

Healthcare providers, including hospitals and surgical centers, are highly price-sensitive due to budget constraints. They often seek cost-effective solutions for their equipment needs, including powered surgical instruments. In many healthcare systems, reimbursement rates for medical procedures, including surgeries that use powered instruments, are subject to scrutiny and potential reductions. This can affect affordability and adoption of advanced instruments. Healthcare institutions are increasingly adopting cost-effective procurement strategies. They may negotiate for lower prices, explore bulk purchasing agreements, or lease equipment rather than making outright purchases. Economic downturns, such as recessions or financial crises, can lead to reduced healthcare budgets and delayed capital expenditures. This can impact the demand for expensive powered surgical instruments. Healthcare providers must allocate their resources judiciously to address various healthcare needs. The cost of powered surgical instruments competes with other healthcare expenditures, including personnel and facility maintenance. The shift toward value-based healthcare models emphasizes outcomes and cost-effectiveness. Healthcare providers are under pressure to demonstrate that investments in powered instruments yield better patient outcomes and cost savings in the long run.Global Supply Chain Disruptions

Supply chain disruptions can lead to delays in the manufacturing of powered surgical instruments. This can result from disruptions in the supply of raw materials, components, and manufacturing equipment. Shutdowns or reduced capacity at manufacturing facilities due to supply chain disruptions can lead to a decreased supply of powered surgical instruments. This, in turn, can affect the availability of these instruments in the market. Sourcing materials from alternative suppliers or expediting shipments to overcome disruptions can increase production costs. These increased costs may be passed on to customers in the form of higher instrument prices. Disruptions in the supply chain can lead to inventory shortages, making it challenging for healthcare providers to access the powered surgical instruments they need for procedures. Supply chain disruptions can result in price volatility for raw materials and components. Manufacturers may face increased costs, which could impact pricing strategies. Transportation and logistics disruptions can affect the timely delivery of powered surgical instruments to healthcare facilities. This can lead to delays in surgeries and impact patient care. In some cases, manufacturers may need to source materials or components from alternative suppliers that may not meet the same quality standards. This can lead to concerns about the quality and reliability of the final products.Key Market Trends

Customization and Ergonomics

Manufacturers are developing powered surgical instruments tailored to specific surgical procedures and specialties. These instruments are designed to optimize performance, precision, and ease of use for a particular type of surgery. Surgeons have varying preferences when it comes to the feel and function of surgical instruments. Customizable features, such as adjustable grips, instrument heads, and power settings, allow surgeons to personalize their instruments for optimal comfort and control. Ergonomics plays a crucial role in powered surgical instruments' design. Manufacturers are focusing on creating instruments with ergonomic handles, weight distribution, and button placements to reduce surgeon fatigue and discomfort during long procedures. User-friendly interfaces and intuitive controls are becoming standard features in powered instruments. Surgeons can easily adjust settings and monitor instrument performance in real time, enhancing their experience and efficiency. Powered surgical instruments with ergonomic grips and reduced vibration help minimize hand fatigue, allowing surgeons to maintain precision and control throughout lengthy procedures. Noise reduction features in powered instruments contribute to a quieter and more comfortable operating room environment, benefiting both surgical staff and patients. Manufacturers are paying attention to the weight and balance of powered instruments. Instruments are being designed to be lighter and better balanced to reduce the strain on surgeons' wrists and hands.Segmental Insights

Type of Power Source Insights

In 2022, the Global Powered Surgical Instrument Market largest share was held by Electric Instruments segment in the forecast period and is predicted to continue expanding over the coming years. Electric instruments are known for their versatility. They can be used in various surgical specialties, from general surgery to orthopaedics and neurosurgery. Surgeons can use them for a wide range of procedures, making them an asset in the operating room. Many electric instruments come with adjustable settings, allowing surgeons to customize the tool's performance to match the specific requirements of a procedure. This flexibility can be a significant advantage in surgery.The Battery-powered Instruments segment is expected to have the fastest growth in the forecast period. Battery-powered instruments offer greater portability and mobility compared to instruments that require a direct power source. Surgeons can use these instruments without being tethered to a power outlet, allowing for greater flexibility during procedures, especially in minimally invasive and laparoscopic surgeries. Minimally invasive surgical techniques, which often require smaller incisions and specialized instruments, are on the rise. Battery-powered instruments are well-suited for MIS procedures, as they can be easily maneuvered through small incisions and provide the necessary precision for delicate tasks.

Product Type Insights

In 2022, the Global Powered Surgical Instrument Market largest share was held by Handpiece instruments segment in the forecast period and is predicted to continue expanding over the coming years. Because of characteristics including greater power, better efficiency, lighter frames, and ease of use compared to other instruments, the market sector is expected to maintain its lead during the projection period. The several types of handpiece tools include drill systems, reamers, saws, staplers, shavers, and others. The batteries, electric instruments, and pneumatic instruments categories make up the power source & control sector. Electric and surgical accessories make up the accessories market.The Power disposable segment is expected to have the fastest growth in the forecast period. This market is anticipated to increase because of factors like government backing in some nations, advantageous reimbursement systems, technological advancements, and a rising preference for minimally invasive surgical treatments. The rise in sports injury incidents and the number of reconstructive procedures has further increased demand for disposable items.

Application Insights

In 2022, the Global Powered Surgical Instrument Market largest share was held by Orthopaedic segment and is predicted to continue expanding over the coming years. The global population was aging, leading to an increased prevalence of orthopaedic conditions such as osteoarthritis and fractures. Older individuals often require orthopaedic surgeries, including joint replacements and fracture repairs, which utilize powered instruments for precision and efficiency. Powered instruments designed for orthopaedic procedures, such as drills, saws, and bone reamers, became more advanced, offering greater precision and control during surgeries.The plastic surgery segment to have the fastest growth in the forecast period. Due to increased knowledge of these choices, social media influence in favour of cosmetic procedures, an increase in traffic accidents, and an ageing population. Additionally, advances in diagnosis techniques and imaging technology, new product launches, mergers and acquisitions, and favourable reimbursement policies are predicted to promote market expansion.

Regional Insights

The North America region dominates the Global Powered Surgical Instrument Market in 2022. Favorable reimbursement regulations, the local presence of major market participants, and government program that enhance access to sophisticated power equipment for surgical procedures & training sessions for physicians are important drivers of the region's growth.Asia-Pacific region witnessed the fastest growth in the forecast period. This is because of the region's increased investment from governments and other entities worldwide. Major contributors to APAC include China and Japan. Other factors that are projected to boost market expansion over the forecast period include increased awareness and government initiatives to integrate changes in reimbursement rules.

Key Market Players

- Johnson & Johnson

- Braun Melsungen Ag

- Stryker Corporation

- Medtronic PLC

- Smith & Nephew PLC

- Zimmer Biomet Holdings Inc.

- ConMed Corp.

- Desoutter Medical Ltd

- Adeor Medical AG

- Panther Healthcare

- AlloTech Co. Ltd

Report Scope

In this report, the Global Powered Surgical Instrument Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Powered Surgical Instrument Market, by Type of Power Source:

- Electric Instruments

- Battery-powered Instruments

- Pneumatic Instruments

Powered Surgical Instrument Market, by Product Type:

- Handpiece

- Disposables

- Accessories

Powered Surgical Instrument Market, by Application:

- Orthopedics

- Dental

- Neurosurgery

- Cardiothoracic Surgery

- Other Applications

Global Powered Surgical Instrument Market, by region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Powered Surgical Instrument Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Johnson & Johnson

- Braun Melsungen AG

- Stryker Corporation

- Medtronic PLC

- Smith & Nephew PLC

- Zimmer Biomet Holdings Inc.

- ConMed Corp.

- Desoutter Medical Ltd.

- Adeor Medical AG

- Panther Healthcare

- AlloTech Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 2.52 Billion |

| Forecasted Market Value ( USD | $ 3.51 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |