Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Memristor technology has rapidly evolved from theoretical speculation to tangible devices with real-world applications. Pioneered by Dr. Leon Chua's theoretical work, memristors have garnered immense attention due to their potential to transform memory storage, computing architectures, and AI systems. Advancements in materials science, nanotechnology, and semiconductor fabrication techniques have paved the way for the creation of practical memristor devices. Researchers and industry players are continually pushing the boundaries of materials, design, and performance, resulting in the development of various memristor types, each tailored to specific applications.

The versatility of memristors has catalyzed their adoption across a diverse array of industries. In the realm of neuromorphic computing, memristors are driving the creation of brain-inspired architectures that emulate cognitive functions. This has far-reaching implications for AI, enabling energy-efficient parallel processing and pattern recognition. In data-intensive sectors, memristors are emerging as crucial components for high-speed, high-density memory solutions, enhancing data processing capabilities in applications ranging from data centers to edge devices. Furthermore, the potential for memristors in medical devices, brain-computer interfaces, and bioelectronics has opened new frontiers in healthcare and biotechnology.

The rise of neuromorphic and cognitive computing is a defining hallmark of the memristors market. Researchers are fervently exploring the integration of memristor-based devices to emulate synaptic behavior and replicate neural networks. This neuromorphic approach is propelling AI into a new era, where energy-efficient, brain-inspired systems offer unprecedented levels of cognitive processing and adaptability. The ability to process complex patterns and perform parallel computations with minimal energy consumption holds immense promise for industries seeking to leverage AI's transformative potential.

Energy efficiency is a driving force in modern technology, and memristors excel in this regard. The inherent low-power operation of memristors aligns with the demand for sustainable computing solutions. by offering energy-efficient memory storage and processing, memristors contribute to reducing power consumption, extending battery life, and minimizing environmental impact. This attribute resonates strongly with industries seeking to balance technological advancement with ecological responsibility.

While the memristors market holds immense promise, it is not without challenges. Overcoming material complexities, ensuring device reliability, achieving seamless compatibility with existing technologies, and scaling up production are key hurdles that require concerted efforts from researchers and industry stakeholders. Additionally, the market's growth hinges on education and cross-disciplinary collaboration to nurture a skilled workforce capable of harnessing the potential of memristor technology.

Key Market Drivers

Emerging Paradigm of Neuromorphic Computing

One of the foremost drivers propelling the global memristors market is the emerging paradigm of neuromorphic computing. Inspired by the human brain's intricate architecture, neuromorphic computing leverages memristors to mimic synaptic behavior and cognitive processes. This innovative approach holds the potential to revolutionize artificial intelligence (AI) by enabling energy-efficient, parallel, and adaptive computation. The capability to process data in a manner akin to the brain's functioning can lead to breakthroughs in pattern recognition, complex decision-making, and natural language processing. As industries seek advanced AI solutions, the demand for memristors as enablers of neuromorphic computing continues to surge, driving research, development, and commercialization efforts.Demand for Energy-Efficient Computing

In an era where energy efficiency is a paramount concern, memristors stand out as a driving force behind energy-efficient computing solutions. The low-power characteristics of memristor-based devices are well-aligned with the need to reduce power consumption in various applications, ranging from mobile devices and IoT devices to data centers. Memristors' ability to perform computations while consuming minimal energy contributes to extending battery life, reducing operational costs, and minimizing environmental impact. The pursuit of greener and more sustainable computing solutions positions memristors as a key driver in shaping the future of energy-efficient technology.Data Explosion and Memory Innovations

The exponential growth of data in the digital age has fueled the demand for innovative memory solutions. Memristors play a pivotal role in addressing this demand by offering non-volatile memory capabilities with high-speed read and write operations. This trend is driving innovations in memory technologies such as storage-class memory and in-memory computing. The ability to store and process data in a single device has the potential to revolutionize memory hierarchies, enhancing data processing speeds and reducing latency. As industries grapple with the challenges of data-intensive applications, memristors emerge as a crucial enabler of memory innovations.AI Hardware Acceleration

With the rapid proliferation of AI applications, the need for hardware acceleration has grown significantly. Memristors are gaining traction as hardware accelerators for neural networks and AI workloads. Their energy-efficient and parallel processing capabilities align with the demands of AI algorithms that require massive computational power. As AI technologies permeate various industries, the incorporation of memristor-based hardware accelerators offers a compelling solution to meet the computational demands of AI-driven tasks, from image recognition to natural language processing.Cross-Disciplinary Collaborations

Collaboration across diverse disciplines is a driving force behind the growth of the global memristors market. Researchers, engineers, and experts from fields such as material science, electronics, neuroscience, and AI are joining forces to unlock the full potential of memristor technology. These collaborations facilitate the exploration of novel materials, fabrication techniques, and applications. As memristors find applications in brain-computer interfaces, neuromorphic systems, and beyond, interdisciplinary collaborations are catalyzing innovation and expanding the boundaries of what memristors can achieve.Key Market Challenges

Material and Fabrication Complexity

One of the significant challenges facing the global memristors market is the complexity of materials and fabrication processes. Memristors require precise engineering of materials with specific electrical and switching properties. Developing and optimizing these materials for consistent performance and scalability is a formidable task. Additionally, the fabrication of memristor devices involves intricate processes, often at nanoscale dimensions, requiring specialized equipment and expertise. This challenge can lead to production bottlenecks, increased costs, and variability in device performance, hindering the seamless integration of memristors into various applications.Reliability and Endurance

Ensuring the reliability and endurance of memristor devices is a critical challenge that must be addressed for widespread adoption. Over time, repeated switching of memristors can lead to degradation in performance and reliability, impacting the longevity of devices. This phenomenon, known as wear-out, poses challenges for applications requiring long-term stability and data retention. Researchers and manufacturers must develop strategies to enhance the endurance of memristor devices while minimizing wear-out effects, which can limit their suitability for certain high-demand applications.Compatibility and Integration

Integrating memristors into existing computing architectures and systems presents compatibility challenges. Memristors may require adjustments to interface with conventional electronics, memory hierarchies, and software frameworks. Ensuring seamless compatibility and integration is crucial to harnessing their potential without disrupting established workflows. Additionally, memristor-based systems may need specialized programming models and software tools to fully exploit their unique characteristics, creating a learning curve for developers and engineers.Scalability and Manufacturing

As demand for memristor-based solutions grows, achieving scalability in both production and application becomes a pressing challenge. While research has yielded promising results in lab settings, transitioning to large-scale manufacturing presents hurdles. Consistently fabricating memristors with high yields, uniform properties, and cost-effectiveness remains challenging. Scaling up production while maintaining device quality, performance, and cost efficiency is vital to unlocking the full potential of memristors across industries.Technological Complexity and Education

The technical intricacies of memristor technology create a challenge related to education and expertise. To fully harness the capabilities of memristors, researchers, engineers, and developers must possess specialized knowledge in materials science, electronics, and emerging technologies. Educating professionals across disciplines about memristor principles, design considerations, and applications requires concerted efforts. Bridging the knowledge gap and fostering a skilled workforce capable of driving memristor innovation is essential for the market's growth and widespread adoption.Key Market Trends

Rise of Neuromorphic Computing and AI Revolution

The global memristors market is witnessing a transformative trend driven by the rise of neuromorphic computing and the AI revolution. Neuromorphic computing, inspired by the functioning of the human brain, leverages memristors to replicate synaptic behavior and enable cognitive processing. This trend is poised to revolutionize artificial intelligence by enabling energy-efficient, parallel, and adaptive computation. As researchers and industries increasingly explore brain-inspired architectures, memristors are gaining prominence as the fundamental building blocks of neuromorphic systems. This trend holds the potential to reshape industries ranging from healthcare to autonomous vehicles, where cognitive abilities and energy efficiency are paramount.Data-Intensive Applications and Memory Innovations

In the era of big data and IoT, data-intensive applications are fueling the demand for memory solutions that offer high speed, efficiency, and scalability. Memristors are emerging as a solution to address these demands by offering non-volatile memory capabilities with fast read and write speeds. This trend is driving innovations in memory technologies, including storage-class memory and in-memory computing. Memristors' ability to combine storage and computation in a single device is reshaping memory hierarchies and enabling efficient data processing. As data continues to grow exponentially, memristors are poised to play a pivotal role in addressing the challenges of data-intensive applications.Neuromorphic Hardware Acceleration

With the explosive growth of machine learning and AI applications, the demand for hardware acceleration is soaring. Memristors are gaining traction as hardware accelerators for neural networks, offering energy-efficient and fast processing for tasks like pattern recognition and deep learning. This trend is driving the development of specialized memristor-based hardware architectures that optimize AI workloads. As industries seek to deploy AI at scale, memristor-based accelerators are poised to offer a competitive advantage by delivering both performance and efficiency.Cross-Disciplinary Collaborations

The memristors market is witnessing a trend of cross-disciplinary collaborations that bring together researchers, engineers, and experts from diverse fields. From material science and electronics to neuroscience and AI, collaborative efforts are essential to unlock the full potential of memristor technology. This trend is leading to breakthroughs in materials design, fabrication techniques, and application development. As memristors find applications in areas such as brain-computer interfaces, neuromorphic systems, and energy-efficient computing, interdisciplinary collaborations are driving innovation and expanding the boundaries of what memristors can achieve.Sustainable Computing and Energy Efficiency

As concerns about energy consumption and environmental impact grow, the memristors market is aligning with the trend towards sustainable computing and energy efficiency. Memristors inherently offer energy-efficient operation due to their low power consumption and non-volatile nature. This trend is driving the adoption of memristors in applications where energy efficiency is crucial, such as IoT devices, wearable technologies, and edge computing. by enabling devices to operate longer on limited power sources, memristors contribute to reducing the carbon footprint of modern computing systems.Segmental Insights

Application Insights

Neuromorphic and biological systems segment dominates in the global memristors market in 2022. Neuromorphic memristors have captured significant attention due to their ability to emulate the behavior of biological neurons and synapses. This neuromorphic approach to computing aligns with the quest to replicate the brain's cognitive capabilities, potentially revolutionizing artificial intelligence and cognitive computing.The segment's potential extends to biological systems and healthcare, enabling the development of brain-computer interfaces, neural prosthetics, and the exploration of neurological functions. These applications hold promise for enhancing human well-being and expanding the frontiers of scientific understanding. Moreover, neuromorphic memristors offer hardware acceleration for machine learning and pattern recognition tasks. This capability accelerates computations and optimizes the performance of algorithms used in various industries.

Type Insights

Molecular & Ionic Film memristors segment dominates in the global memristors market in 2022. The dominance of the Molecular & Ionic Film memristors segment can be attributed to several key factors such as molecular & ionic film memristors exhibit versatile applications across a wide range of industries, including electronics, energy storage, neuromorphic computing, and bioelectronics. Their ability to store and process information in a compact and energy-efficient manner has attracted attention across various sectors. Additionally, molecular & ionic film memristors offer inherent energy efficiency due to their nanoscale structure and low-power operation. This aligns with the growing demand for energy-efficient solutions in modern electronics and computing systems.Moreover, the segment has garnered substantial research attention and funding, resulting in rapid advancements in materials, fabrication techniques, and performance optimization. Research institutions, universities, and technology companies have dedicated resources to innovate and commercialize molecular and ionic memristor technologies.

Regional Insights

North America dominates in the global memristors market in 2022. North America's dominance in the global memristors market can be attributed to a combination of factors that position the region at the forefront of research, development, and commercialization of this transformative technology. North America boasts a robust ecosystem of research institutions, universities, and technology companies that are pioneers in memristor technology. The region's commitment to cutting-edge research and development, along with substantial investments in emerging technologies, has enabled it to maintain a competitive edge in the memristors market. This has facilitated the creation of innovative memristor-based products and solutions that cater to diverse industries.Moreover, the region is home to some of the world's leading technology companies that are actively engaged in the development and commercialization of memristor-based products. These companies leverage their technological expertise and deep understanding of semiconductor materials to create advanced memristors that exhibit exceptional performance characteristics. This leadership translates into a significant market share as North American companies become global leaders in supplying memristor-based components and devices.

Key Market Players

- Intel Corporation

- Samsung Electronics Co., Ltd.

- International Business Machines Corporation

- Cypress Semiconductor Corporation

- Crossbar, Inc.

- Avalanche Technology, Inc.

- Rohm Company, Ltd.

- Everspin Technologies, Inc.

- GlobalFoundries, Inc.

- Infineon Technologies AG

Report Scope

In this report, the Global Memristors Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Memristors Market, by Type:

- Molecular & Ionic Film memristor

- Spin Based & Magnetic Memristor

Global Memristors Market, by Application:

- Non-volatile Memory

- Neuromorphic and Biological Systems

- Programmable Logic and Signal Processing

Global Memristors Market, by Industry Vertical:

- Electronics

- IT & Telecom

- Industrial

- Aerospace & Defense

- Automotive

- Healthcare

Global Memristors Market, by Region:

- North America

- Europe

- South America

- Asia-Pacific

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Memristors Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Intel Corporation

- Samsung Electronics Co. Ltd.

- International Business Machines Corporation

- Cypress Semiconductor Corporation

- Crossbar, Inc.

- Avalanche Technology, Inc.

- Rohm Company, Ltd.

- Everspin Technologies, Inc.

- GlobalFoundries, Inc.

- Infineon Technologies AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | October 2023 |

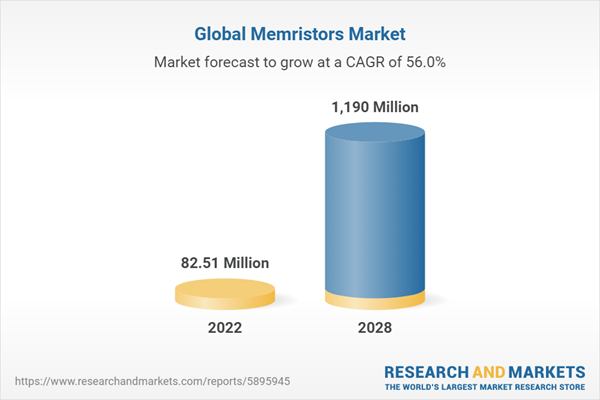

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 82.51 Million |

| Forecasted Market Value ( USD | $ 1190 Million |

| Compound Annual Growth Rate | 55.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |