Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The growing global burden of neurological disorders, coupled with an aging population and increasing incidence of chronic diseases, is driving demand for non-invasive and repeatable diagnostic tools like MRI. Although open MRI systems typically offer lower magnetic field strengths than closed systems, ongoing advancements in imaging technology are narrowing this performance gap. Their adaptability and focus on patient experience position open MRI units as an increasingly vital component in modern diagnostic healthcare.

Key Market Drivers

Advancements in MRI Technology

Technological innovations continue to enhance the performance and versatility of open MRI systems. Higher magnetic field strengths such as 3T and 7T are improving image resolution and diagnostic accuracy. Faster imaging techniques, including compressed sensing and parallel imaging, reduce scan time - benefiting children, elderly, and claustrophobic patients.Developments like functional MRI (fMRI), Diffusion-Weighted Imaging (DWI), and Magnetic Resonance Angiography (MRA) have expanded the scope of clinical applications, while MR spectroscopy allows metabolic analysis of tissues. The increasing geriatric population, especially those managing chronic illnesses like cancer, drives demand for frequent imaging. Additionally, advancements in radiofrequency coils, digital interfaces, and real-time imaging contribute to improved workflow, patient comfort, and clinical outcomes.

Key Market Challenges

Market Saturation

Market saturation in developed regions presents a barrier to further growth. Many hospitals and imaging centers in North America and Europe already have established MRI infrastructure, leading to limited opportunities for new installations. Growth in these regions is primarily driven by system upgrades or replacements rather than new acquisitions. This saturation results in heightened competition among manufacturers, which pressures pricing and profit margins. Furthermore, in capital-constrained environments, healthcare providers may hesitate to invest in new systems unless substantial improvements in imaging capability or patient outcomes can be demonstrated. However, untapped markets in emerging economies offer growth potential where diagnostic imaging capacity remains underdeveloped.Key Market Trends

Wide-Bore Open MRI

The adoption of wide-bore open MRI systems is accelerating, driven by their patient-centric design. These systems offer a more spacious bore, alleviating anxiety and discomfort, especially for claustrophobic, pediatric, and bariatric patients. Their ergonomic design facilitates better access and positioning, enabling functional and musculoskeletal imaging in varied postures. Caregiver presence during pediatric scans is an added advantage. Wide-bore systems are now equipped with high-performance imaging capabilities, closing the gap with traditional MRI in terms of diagnostic accuracy. Their broad clinical utility spans neuroimaging, cardiovascular studies, oncology, and orthopedic assessments, making them increasingly popular in both outpatient and hospital settings.Key Market Players

- GE Healthcare

- Hitachi Medical Corporation

- Philips Healthcare

- Siemens Healthcare

- ESAOTE SA

- Canon Medical Systems Corporation

- Hologic Inc.

- Nordion Inc.

- Onex Corporation (Carestream Health)

- Shimadzu Corporation

- Toshiba Corporation

- Barco N.V.

Report Scope:

In this report, the Global Open System MRI Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Open System MRI Market, By Resolution:

- Low-field scanner

- Mid-field scanner

- High-field scanner

Open System MRI Market, By Application:

- Neurology

- Gastroenterology

- Oncology

- Cardiology

- Other applications

Open System MRI Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Open System MRI Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- GE Healthcare

- Hitachi Medical Corporation

- Philips Healthcare

- Siemens Healthcare

- ESAOTE SA

- Canon Medical Systems Corporation

- Hologic Inc.

- Nordion Inc.

- Onex Corporation (Carestream Health)

- Shimadzu Corporation

- Toshiba Corporation

- Barco N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | May 2025 |

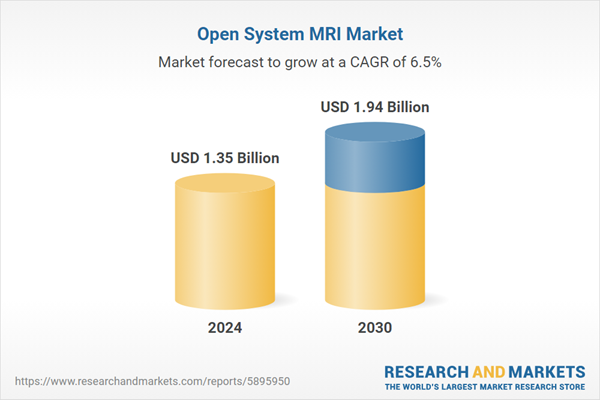

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.35 Billion |

| Forecasted Market Value ( USD | $ 1.94 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |