Pin Headers is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The escalating miniaturization of electronic devices significantly influences the board-to-board connectors market. As consumer electronics, medical equipment, and industrial control systems increasingly demand smaller form factors, internal components must reduce in size and increase in density. This necessitates board-to-board connectors that occupy minimal space while maintaining robust electrical performance. This ongoing drive for compact designs is evident in the printed circuit board sector. According to IPC, in its October 2023 PCB Technology Trends Report, High-Density Interconnect (HDI) usage and fabrication increased from 37.5% to just over 49% over five years. This trend directly drives the need for fine-pitch, low-profile, and high-density connector solutions, enabling greater component integration within confined enclosures without compromising functionality.Key Market Challenges

A significant challenge impeding expansion of the Global Board-to-Board Connectors Market stems from vulnerabilities within the global supply chain, notably raw material price volatility and geopolitical disruptions. These issues directly impact manufacturing costs for board-to-board connectors, which rely on materials like copper. According to the Global Electronics Association’s August 2025 Sentiment of the Global Electronics Manufacturing Supply Chain Report, 61% of firms reported higher material costs. Such increases can erode profit margins for manufacturers or necessitate higher selling prices, potentially affecting product affordability and demand within key end-use sectors.Key Market Trends

Advancements in connector material science for enhanced performance represent a critical trajectory in the Global Board-to-Board Connectors Market. This trend focuses on developing and integrating novel materials that significantly improve electrical conductivity, thermal management, mechanical durability, and signal integrity within connectors. Such innovations are crucial for enabling devices to operate reliably in increasingly demanding environments while supporting higher frequencies and greater power densities.The adoption of advanced material formulations, including specialized alloys and engineered plastics, allows for the creation of smaller, more robust connectors capable of withstanding extreme temperatures, vibrations, and corrosive conditions without compromising performance. SEMI's Global Semiconductor Packaging Materials Outlook (2024 Edition) reported that advancements in packaging materials technology offer the potential for significant improvements in semiconductor performance, reliability, and cost. The global market for these materials is projected to exceed $26 billion by 2025. These material improvements directly contribute to the longevity and efficiency required across diverse applications, from compact consumer electronics to sophisticated industrial and automotive systems.

Key Market Players Profiled:

- ANSYS, Inc.

- Amphenol Corporation

- Koch Industries, Inc.

- Hon Hai Precision Industry Co. Ltd.

- Japan Aviation Electronics Industry, Ltd.

- PHINIA Inc.

- SAMTEC, Inc.

- JST Corporation

- HIROSE ELECTRIC CO., LTD.

- HARTING, Inc.

Report Scope:

In this report, the Global Board-to-Board Connectors Market has been segmented into the following categories:By Type:

- Pin Headers

- Sockets

By Pitch:

- Less Than 1 mm

- 1 mm to 2mm

- Greater Than 2 mm

By Application:

- Consumer Electronics

- Industrial Automation

By Region:

- North America

- Asia-Pacific

- Europe

- South America

- MEA

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Board-to-Board Connectors Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Board-to-Board Connectors market report include:- ANSYS, Inc.

- Amphenol Corporation

- Koch Industries, Inc.

- Hon Hai Precision Industry Co. Ltd.

- Japan Aviation Electronics Industry, Ltd.

- PHINIA Inc.

- SAMTEC, Inc.

- JST Corporation

- HIROSE ELECTRIC CO., LTD.

- HARTING, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

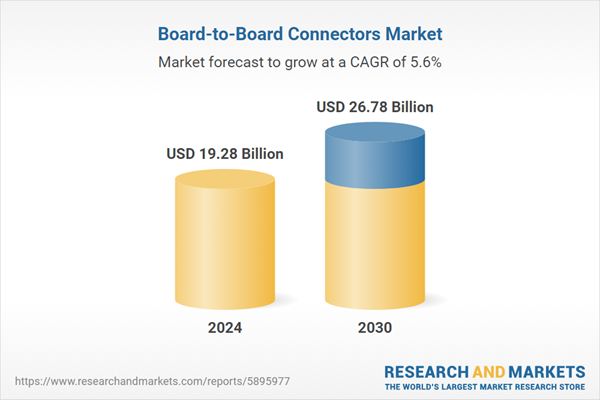

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19.28 Billion |

| Forecasted Market Value ( USD | $ 26.78 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |