Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As a result, the need for diverse and effective oral treatment options has surged. The market encompasses a wide array of drug classes, including Sulfonylureas, Biguanides, DPP-4 Inhibitors, SGLT2 Inhibitors, and GLP-1 Receptor Agonists, each addressing different mechanisms of glucose control. Competition remains robust, with established pharmaceutical giants and emerging companies striving for innovation and greater market share. The growing demand for improved diabetes management solutions continues to stimulate research and investment across this dynamic and essential healthcare sector.

Key Market Drivers

Increasing Global Diabetes Prevalence

The rapidly growing incidence of diabetes globally is a key force driving the Oral Anti-Diabetic Drugs (OAD) market. According to the International Diabetes Federation (IDF), approximately 589 million adults aged 20-79 are living with diabetes in 2024, representing 11.1% of the global adult population. This number is expected to rise to 643 million by 2030 and 853 million by 2050.A 2024 Lancet study further highlights that around 828 million adults were affected by diabetes as of 2022. This sharp increase is attributed to lifestyle changes including physical inactivity, poor nutrition, and population aging. These factors significantly elevate the risk of type 2 diabetes, prompting a surge in demand for effective oral therapies. As the diabetic population grows, so does the need for accessible and reliable medications, underscoring the crucial role of oral anti-diabetic drugs in modern disease management.

Key Market Challenges

High Healthcare Costs

One of the major challenges in the Oral Anti-Diabetic Drugs market is the high cost associated with comprehensive diabetes care. This includes not only medications but also glucose monitoring devices, routine consultations, and hospitalization in case of complications. For many patients - especially in low- and middle-income countries - the affordability and accessibility of these treatments remain significant concerns. The price of oral anti-diabetic drugs forms a substantial part of diabetes-related expenditures, and for those lacking adequate insurance or financial support, these expenses can be burdensome. This economic pressure can result in reduced adherence to treatment regimens, ultimately impacting health outcomes and exacerbating disease progression. Managing these cost-related challenges is essential to ensure broader access to effective diabetes therapies.Key Market Trends

Personalized Medicine Approaches

Personalized medicine is emerging as a transformative trend in the Oral Anti-Diabetic Drugs market. Recognizing that diabetes is a complex and heterogeneous condition, healthcare providers are moving towards customized treatment strategies tailored to each patient's genetic makeup, comorbidities, and personal preferences. Advances in genetic testing and biomarker analysis now allow for more accurate drug selection and dosing, enhancing treatment efficacy while reducing the risk of adverse effects. The shift away from a "one-size-fits-all" model is improving patient outcomes and safety. Personalized therapies are particularly valuable in complex cases where standard treatments may not deliver optimal results, making this trend a key driver of innovation and patient satisfaction in the market.Key Market Players

- KONINKLIJKE PHILIPS N.V.

- Sanofi S.A.

- Eli Lilly and Company

- AstraZeneca

- Astellas Pharma Inc.

- Johnson & Johnson (Janssen Pharmaceuticals)

- Boehringer Ingelheim

- Merck And Co.

- Bristol Myers Squibb Company

- Novartis AG

Report Scope:

In this report, the Global Oral Anti-Diabetic Drugs Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Oral Anti-Diabetic Drugs Market, By Drugs:

- Biguanides

- Alpha-glucosidase inhibitors

- Dopamine -D2 Receptor Agonist

- Sodium-glucose Cotransport -2 (SGLT-2) inhibitor

- Dipeptidyl Peptidase - 4 (DPP-4) Inhibitors

- Sulfonylureas

- Meglitinides

Oral Anti-Diabetic Drugs Market, By End Users:

- Hospitals

- Homecare

- Speciality Centers

- Others

Oral Anti-Diabetic Drugs Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Oral Anti-Diabetic Drugs Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- KONINKLIJKE PHILIPS N.V.

- Sanofi S.A.

- Eli Lilly and Company

- AstraZeneca

- Astellas Pharma Inc.

- Johnson & Johnson (Janssen Pharmaceuticals)

- Boehringer Ingelheim

- Merck And Co.

- Bristol Myers Squibb Company

- Novartis AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | May 2025 |

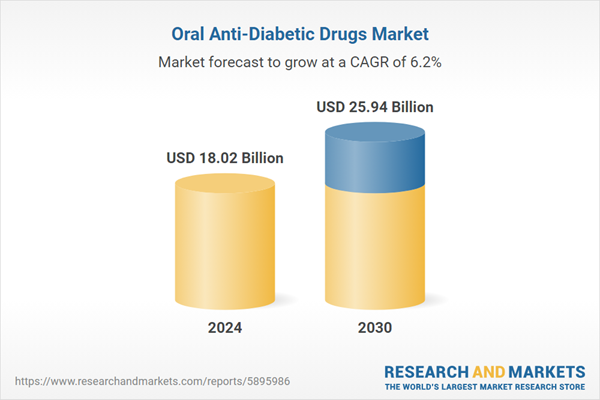

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.02 Billion |

| Forecasted Market Value ( USD | $ 25.94 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |