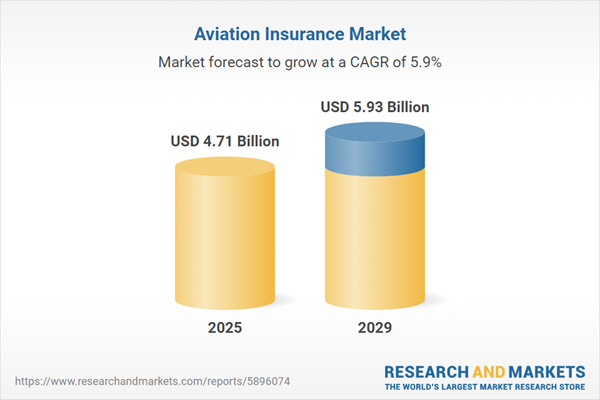

The aviation insurance market size is expected to see strong growth in the next few years. It will grow to $5.93 billion in 2029 at a compound annual growth rate (CAGR) of 5.9%. The growth in the forecast period can be attributed to escalating geopolitical conflicts and tensions, shifting demographics and travel behaviors, increasing use of data analytics and telematics, bomming air travel, emergence of urban air mobility. Major trends in the forecast period include continued advancements in aviation technology, continued developments in insurtech, introduction of blockchain-powered insurance platforms, rise of parametric insurance, incorporation of risk management strategies in aviation insurance.

The forecast of 5.9% growth over the next five years reflects a slight reduction of 0.1% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. This is likely to directly affect the US through elevated underwriting expenses, as risk assessment models and satellite-based flight tracking systems, dependent on specialized software from France and Australia, become costlier to implement. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The anticipated growth in the aviation insurance market is expected to be driven by the increasing volume of air passenger traffic. Air passenger traffic encompasses all individuals using airports, including arrivals and departures, representing the total number of people transported by commercial and private aircraft on both domestic and international flights. As air passenger traffic rises, there is an elevated demand for aviation insurance to safeguard individuals within the aircraft and the owners of the aircraft from potential aviation risks. For example, in March 2023, reports from the Bureau of Transportation Statistics, a US government agency, indicated that US airlines carried 194 million more passengers in 2022 compared to the previous year, marking a 30% year-to-year increase. Over the entire 2022 calendar year, US airlines transported 853 million passengers (unadjusted), a significant rise from the 658 million passengers in 2021. Consequently, the surge in air passenger traffic is a key driver of the aviation insurance market's growth.

The growing demand for aircraft is anticipated to contribute to the expansion of the aviation insurance market. Aircraft, designed for air travel, serve various purposes such as transporting passengers and cargo, military applications, aerial surveillance, and recreational activities. Aviation insurance provides coverage for risks associated with aircraft operation and ownership, including the loss, damage, or theft of cargo during transportation. For instance, according to the Bureau of Infrastructure and Transport Research Economics (BITRE), an Australia-based research agency, there were 50,318 Regular Public Transport (RPT) aircraft trips in June 2023, reflecting a 1.7% increase from June 2022. Therefore, the growing demand for aircraft is a significant factor driving the forward growth of the aviation insurance market.

The aviation insurance market is witnessing a prominent trend towards innovation, with major companies in the sector actively engaged in developing inventive solutions to maintain their market standing. For instance, in March 2023, HDI Global SE, a German insurance company, introduced Aviation IQ, a cutting-edge digital platform catering to general aviation in Canada. This platform offers end-to-end digital automation for general aviation insurance contracts, specifically covering small fixed-wing aircraft utilized for personal or business purposes. This innovative tool ensures quick delivery of policy documents to brokers within minutes, enabling significant time and cost savings. Additionally, it serves as a valuable resource for pilots, allowing them to monitor flight hours and mileage and adjust insurance coverage as needed.

Major companies in the aviation insurance market are focusing on introducing liability-only insurance to offer more affordable coverage options for aircraft owners and operators. Liability-only insurance is a policy that solely covers the legal liabilities of the insured party in the event of an accident or damage to third parties. For instance, in September 2024, SkyWatch Inc., a Canada-based company, launched a liability-only insurance product. This initiative aims to provide a more economical choice for senior pilots, allowing them to maintain essential liability protection without the financial strain typically associated with comprehensive coverage policies. The policy features flexible coverage options, enabling pilots to adjust their liability limits based on their specific needs. Available through SkyWatch's online platform, the service offers instant quotes, making it easier for pilots to quickly understand their options and associated costs.

In December 2022, Arthur J. Gallagher & Co., a US-based insurance brokerage and risk management services company, completed the acquisition of Aviation Insurance Australia for an undisclosed amount. Through this strategic move, Arthur J. Gallagher & Co. aims to enhance its global aviation insurance capabilities by leveraging Aviation Insurance Australia's experienced team and expanding its market share in Australia. Aviation Insurance Australia, based in Australia, specializes in providing aviation insurance policies and insurance brokerage services to clients in the aerospace industry.

Major companies operating in the aviation insurance market include Allianz SE, AXA SA, American International Group Inc., Chubb Ltd., USAA Inc.(United Services Automobile Association), Marsh LLC, Aon plc, Willis Towers Watson Public Limited, Arthur J Gallagher And Co., Tokio Marine HCC, AssuredPartners Inc., BWI (Berkshire Hathaway Specialty Insurance), Great American Insurance Company, Hallmark Financial Services Inc., AIG Aerospace Insurance Services Inc., Global Aerospace Inc., Starr International Company Inc., AOPA Insurance Services, Avion Express Insurance, Avemco Insurance Company, JS Johnson And Co. Ltd., Avion Insurance Agency Inc., JLT Specialty Ltd., Aviation Insurance Resources, Gallagher Aviation LLC, Ace Aviation Private Limited, Aerospace Insurance Managers Inc., Travers And Associates Inc.

Asia-Pacific was the largest region in the aviation insurance market in 2024. The regions covered in the aviation insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the aviation insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sharp rise in U.S. tariffs and the ensuing trade tensions in spring 2025 are having a considerable impact on the financial sector, particularly in the areas of investment strategies and risk management. The increased tariffs have intensified market volatility, leading institutional investors to adopt more cautious approaches and driving greater demand for hedging solutions. Banks and asset managers are encountering higher costs in cross-border transactions as disrupted global supply chains and declining corporate earnings weigh on equity market performance. At the same time, insurance providers are facing elevated claims risks linked to supply chain interruptions and trade-related business losses. Furthermore, reduced consumer spending and weaker export demand are limiting credit growth and dampening investment appetite. In response to these challenges, the sector must focus on diversification, accelerate digital transformation, and strengthen scenario planning to manage the heightened economic uncertainty and safeguard profitability.

Aviation insurance is a policy designed to offer both property and liability protection for aircraft. This coverage extends to damages arising from aviation risks associated with the maintenance and operation of aircraft, encompassing property damage, cargo loss, and personal injuries. It serves as a safeguard against unforeseen losses for both aircraft owners and operators.

The primary categories of aviation insurance include public liability insurance, passenger liability insurance, ground risk hull insurance not-in-motion, ground risk hull insurance in-motion, combined single limit, and in-flight insurance. Public liability insurance is a form of coverage that shields individuals, businesses, or organizations from claims initiated by third parties for bodily injury, property damage, or other losses occurring on their premises or due to their business operations. This insurance finds applications in various sectors such as commercial aviation, business and general aviation, and others, catering to diverse end-user industries such as service providers, airport operators, and more.

The aviation insurance market research report is one of a series of new reports that provides aviation insurance market statistics, including aviation insurance industry global market size, regional shares, competitors with an aviation insurance market share, detailed aviation insurance market segments, market trends and opportunities, and any further data you may need to thrive in the aviation insurance industry. This aviation insurance market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The aviation insurance market includes revenues earned by entities by providing aircraft hull insurance, aviation liability insurance, aviation third-party liability insurance, cargo insurance, aviation product liability insurance, aircraft protection, death benefits, and aircraft and passenger security insurance. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Aviation Insurance Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on aviation insurance market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for aviation insurance? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The aviation insurance market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Insurance Type: Public Liability Insurance; Passenger Liability Insurance; Ground Risk Hull Insurance Not-in-Motion; Ground Risk Hull Insurance in-Motion; Combined Single Limit; in Flight Insurance2) by Application: Commercial Aviation; Business and General Aviation; Other Applications

3) by End User Industry: Service Providers; Airport Operators; Other End User Industries

Subsegments:

1) by Public Liability Insurance: Airport Liability Coverage; Third-Party Liability Coverage2) by Passenger Liability Insurance: Individual Passenger Coverage; Aggregate Passenger Liability Coverage

3) by Ground Risk Hull Insurance Not-in-Motion: Storage and Parking Coverage; Hangar Coverage

4) by Ground Risk Hull Insurance in-Motion: Taxiing Coverage; Ground Handling Coverage

5) by Combined Single Limit: Comprehensive Coverage for Multiple Risks; Tailored Policies for Specific Needs

6) by in Flight Insurance: Passenger Coverage During Flight; Crew Coverage During Flight

Companies Mentioned:Allianz SE; AXA SA; American International Group Inc.; Chubb Ltd.; USAA Inc.(United Services Automobile Association); Marsh LLC; Aon plc; Willis Towers Watson Public Limited; Arthur J Gallagher and Co.; Tokio Marine HCC; AssuredPartners Inc.; BWI (Berkshire Hathaway Specialty Insurance); Great American Insurance Company; Hallmark Financial Services Inc.; AIG Aerospace Insurance Services Inc.; Global Aerospace Inc.; Starr International Company Inc.; AOPA Insurance Services; Avion Express Insurance; Avemco Insurance Company; JS Johnson and Co. Ltd.; Avion Insurance Agency Inc.; JLT Specialty Ltd.; Aviation Insurance Resources; Gallagher Aviation LLC; Ace Aviation Private Limited; Aerospace Insurance Managers Inc.; Travers and Associates Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Aviation Insurance market report include:- Allianz SE

- AXA SA

- American International Group Inc.

- Chubb Ltd.

- USAA Inc.(United Services Automobile Association)

- Marsh LLC

- Aon plc

- Willis Towers Watson Public Limited

- Arthur J Gallagher And Co.

- Tokio Marine HCC

- AssuredPartners Inc.

- BWI (Berkshire Hathaway Specialty Insurance)

- Great American Insurance Company

- Hallmark Financial Services Inc.

- AIG Aerospace Insurance Services Inc.

- Global Aerospace Inc.

- Starr International Company Inc.

- AOPA Insurance Services

- Avion Express Insurance

- Avemco Insurance Company

- JS Johnson And Co. Ltd.

- Avion Insurance Agency Inc.

- JLT Specialty Ltd.

- Aviation Insurance Resources

- Gallagher Aviation LLC

- Ace Aviation Private Limited

- Aerospace Insurance Managers Inc.

- Travers And Associates Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.71 Billion |

| Forecasted Market Value ( USD | $ 5.93 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |