Market Overview:

There are several treatment options available for hydrocephalus, including:

Shunt Systems: This is a common treatment where a shunt (a thin tube) is implanted to divert excess cerebrospinal fluid from the brain to another part of the body where it can be absorbed. There may have been advancements in shunt technology to improve their effectiveness and reduce complications.

Endoscopic Third Ventriculostomy (ETV): This is a surgical procedure where a small hole is made in the floor of the third ventricle of the brain to allow excess cerebrospinal fluid to flow out and be absorbed. ETV is used in certain cases of non-communicating hydrocephalus.

Ventriculostomy with Catheter: Another surgical option involves inserting a catheter directly into the brain's ventricles to drain excess cerebrospinal fluid.

Intraventricular Endoscopy: Advances in minimally invasive techniques like endoscopy have allowed for more precise diagnosis and treatment of hydrocephalus.

Increasing Partnerships to Treat Hydrocephalus

US hydrocephalus shunts market companies are implementing strategies such as joint ventures and partnerships to extend their market shares. In 2020, Aesculap, Inc., partnered with Christoph Miethke GmbH & Co. KG (MIETHKE), and together they announced the launch of the M.blue hydrocephalus valve in the US. Its unique gravity technology is integrated with a fixed differential pressure unit in a valve, enabling a simple, position-dependent adjustment of the opening pressure during the patient’s most active time. Many market players are focused on developing “smart shunts” that could provide an understanding of flow or volume rates over time. Several industry partners are also developing devices that use thermodilution to estimate flow through a distal catheter to diagnose shunt malfunction. Thus, the increasing number of partnerships to aid in smart functioning of hydrocephalus shunts would lead to new future trends in the US hydrocephalus shunts market.Growing Research to Improve the Quality of Shunts

Researchers have been developing improved shunts materials to reduce the risk of blockages, infections, and other complications.Antibacterial Coatings: Researchers have been investigating coatings for shunts that have antibacterial properties. These coatings can help reduce the risk of infection when the shunt is implanted.

Anti-Blockage Mechanisms: Some shunt designs incorporate features to prevent or mitigate blockages. For example, valves with anti-siphon mechanisms can help maintain proper flow and prevent over-drainage or blockages.

Magnetic Valve Adjustments: Some shunt systems use magnets to adjust valve settings non-invasively, reducing the need for repeated surgeries.

Biocompatible Materials: The use of biocompatible materials in shunt construction can minimize the risk of allergic reactions or other adverse responses from the body.

Remote Monitoring: Advancements in remote monitoring technology have allowed for tracking shunt performance and intracranial pressure, helping healthcare providers identify issues before they become severe.

Nanotechnology: Nanotechnology applications have been explored for creating shunt components that resist bacterial adhesion and improve the overall durability of the shunt.

For instance, in 2021, Penn State researchers have been actively working on a groundbreaking technology called HydroFix. This innovative surgical shunt system is specifically designed to address the numerous risks associated with existing shunt devices available in the market. Its primary aim is to offer a long-lasting treatment solution for patients with Normal Pressure Hydrocephalus (NPH). To advance this technology, the researchers established a startup called Cranial Devices Inc. They are currently in the process of seeking a license for the HydroFix technology from Penn State University.

Similarly, Rhaeos, Inc., a clinical-stage medical device company, is developing FlowSense, a patented technology and a noninvasive wireless, wearable skin patch. FlowSense is a wireless, noninvasive thermal flow sensor that is mounted on a patient’s neck overlying the shunt to detect the presence and magnitude of CSF. With FlowSense, shunt function can be monitored in clinics, in-patient settings, and emergency departments, thereby reducing unnecessary imaging, hospital length of stay, and readmission costs.

US Hydrocephalus Shunts Market: Segmental Overview

The US hydrocephalus shunts market growth is segmented into product, type, age group, and end-user. On the basis of product, the market is segmented into hydrocephalus valves, hydrocephalus catheters, neuronavigation systems, and others. The hydrocephalus valves is further segmented into adjustable pressure valves, and fix pressure valves. In terms of type, the US hydrocephalus shunts market is segmented into ventriculoperitoneal, ventriculoatrial, ventriculopleural, and lumboperitoneal. The ventriculoperitoneal segment led the market in 2022 and is expected to retain its dominance during the forecast period. A ventriculoperitoneal (VP) shunt reduces pressure exerted on the brain by fluid accumulation by diverting CSF from the brain's ventricles into the peritoneal cavity, the slot in the abdomen near digestive organs. Ventriculoperitoneal (VP) shunts are among the most commonly used tools for treating hydrocephalus. According to a research paper published in the National Center for Biotechnology Information (NCBI), a VP shunt has a high impact in advanced neurosurgical patient care. VP shunt can be lifesaving for benign disorders.The US hydrocephalus shunts market, by age group, is segmented into pediatric and adults. The pediatric segment led the market in 2022 and is expected to retain its dominance during the forecast period by 2030. Hydrocephalus is the most common cause of brain surgery in children. A prenatal sonogram or MRI scan is recommended to identify hydrocephalus in a growing fetus. Infants generally show signs of progressive macrocephaly, whereas children older than 2 years show signs and symptoms of intracranial hypertension. Pediatric hydrocephalus can be dangerous if left untreated. Nevertheless, with early diagnosis and treatment, children often lead regular and healthy lives. According to the Hydrocephalus Association, 1-2 of every 1,000 babies have hydrocephalus in the US.

The US hydrocephalus shunts market, by end user, is segmented into hospitals, ambulatory surgical centers, others. The hospitals segment led the market in 2022 and is expected to retain its dominance during the forecast period by 2030. Hospitals provide healthcare to people through complicated but specialized scientific equipment. These facilities are classified into general, specialty, or government organizations. Hospitals serve a significant role by providing medical services to patient populations suffering from various diseases. The growth of the US hydrocephalus shunt market for the hospitals segment is attributed to an increase in the number of neurological surgeries, and a surge in demand for valves and neuronavigation systems in these facilities to treat the condition. Additionally, an increasing number of hospitals providing hydrocephalus surgeries in developed and developing countries is expected to boost the market growth in the future.

US Hydrocephalus Shunts Market: Key Players

B. Braun SE, Sophysa SA, Integra LifeSciences Holdings Corp, KANEKA MEDIX CORP, Medtronic Plc, Natus Medical Inc, Anuncia Inc, Desu Medical are among the leading companies operating in the US hydrocephalus shunts market.A few of the key primary and secondary sources referred to while preparing the report on the US hydrocephalus shunts market are the World Health Organization (WHO), FDA (Food and Drug Administration), Hydrocephalus Association, National Institute of Neurological Disorders and Stroke (NINDS), University of California, Los Angeles Health Organization, National Center for Biotechnology Information, Children's Health Orange County, amongst others.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the hydrocephalus shunts market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the US hydrocephalus shunts market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth US market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhancing the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table of Contents

Companies Mentioned

- B. Braun SE

- Sophysa SA

- Integra LifeSciences Holdings Corp

- KANEKA MEDIX CORP.

- Medtronic Plc

- Natus Medical Inc

- Anuncia Inc.

- Desu Medical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 68 |

| Published | October 2023 |

| Forecast Period | 2022 - 2030 |

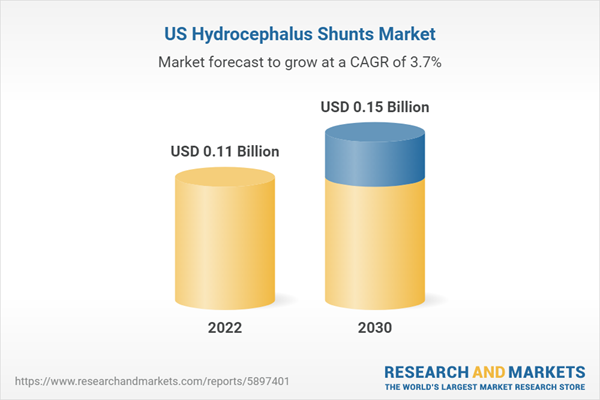

| Estimated Market Value ( USD | $ 0.11 Billion |

| Forecasted Market Value ( USD | $ 0.15 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 8 |