Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Spinal pumps are commonly used to manage chronic and severe pain conditions that are unresponsive to other treatments, such as failed back surgery syndrome, complex regional pain syndrome (CRPS), neuropathic pain, and cancer-related pain. Spinal pumps can help manage severe spasticity in conditions like multiple sclerosis (MS), cerebral palsy, and spinal cord injury by delivering muscle relaxants like baclofen directly to the spinal cord. Spinal pumps are also used to treat conditions such as dystonia, certain movement disorders, bladder, and bowel dysfunction, and, in some cases, psychiatric disorders and refractory epilepsy.

Key Market Drivers

Advancements in Technology

Modern spinal pumps are often programmable, allowing healthcare providers to adjust medication dosages and delivery rates remotely. This flexibility enables personalized pain management plans tailored to each patient's needs. Some spinal pumps offer micro-dosing capabilities, allowing for extremely precise drug delivery. This is particularly beneficial when patients require very low doses of medication or need highly controlled pain management. Advanced spinal pumps are equipped with continuous monitoring and data logging features. These capabilities enable healthcare providers to track the performance of the pump, medication usage, and patient responses over time.Spinal pumps can now be remotely monitored and adjusted using wireless or remote-control devices. Healthcare providers can make real-time adjustments to medication delivery without the need for in-person visits, improving patient convenience. Modern spinal pumps include integrated alarm systems that alert both healthcare providers and patients to any issues or anomalies, such as low medication levels or technical malfunctions. Battery technology has improved, leading to longer-lasting power sources for spinal pumps. This enhances the reliability of these devices and reduces the need for frequent battery replacements. Noise reduction technologies have been integrated into spinal pump designs, making them quieter and less noticeable to patients.

Key Market Challenges

Cost Containment

The upfront cost of acquiring and implanting a spinal pump system can be substantial. This includes the cost of the pump device itself, surgical implantation, hospitalization, and other associated expenses. High initial costs can be a barrier for healthcare facilities and patients. Many spinal pump systems deliver specialized medications that are often more expensive than oral equivalents. The ongoing cost of medications used in spinal pumps can be a financial burden, particularly for long-term therapy. Spinal pump systems require periodic refilling of medication reservoirs, typically every few weeks or months. These refilling procedures come with associated costs for healthcare facilities and patients.Surgical implantation of the spinal pump, as well as follow-up visits for adjustments and monitoring, can add to the overall cost of treatment. The utilization of healthcare resources, including surgical teams, anesthesiologists, pain management specialists, and nurses, contributes to the overall cost of spinal pump therapy. Healthcare facilities must allocate these resources effectively. Ensuring adequate reimbursement for spinal pump therapy is a complex process. It can involve negotiations with insurance providers and adherence to specific criteria for coverage, making it challenging for healthcare facilities and patients to secure financial support. Access to healthcare facilities and providers with expertise in spinal pump therapy may be limited in certain regions, leading to higher costs associated with travel and specialized care.

Key Market Trends

Rising Adoption of Implantable Pumps

Implantable pumps allow for highly precise and controlled drug delivery directly to the cerebrospinal fluid within the spinal cord. This targeted approach minimizes systemic side effects and maximizes the therapeutic effect of medications, making it particularly valuable in pain management and spasticity control. Implantable pumps are highly effective in managing chronic and severe pain conditions that are often refractory to other treatment methods. Patients with conditions like failed back surgery syndrome, complex regional pain syndrome (CRPS), and cancer-related pain benefit from better pain control and improved quality of life.The use of implantable pumps can reduce a patient's reliance on oral or systemic medications, particularly opioids. This is significant in the context of the opioid epidemic and concerns about opioid-related side effects and dependence. Implantable pumps allow for individualized treatment plans. Healthcare providers can adjust medication dosages, delivery rates, and schedules to meet each patient's specific needs, improving the overall quality of care. With implantable pumps, medication waste is minimized because drugs are delivered directly to the target site.

This is an important consideration for healthcare cost containment and sustainability. Implantable pumps can provide long-term therapy for chronic conditions, reducing the need for frequent medication adjustments and improving patient adherence. Once implanted, these devices require less day-to-day attention from patients compared to external devices, such as transdermal patches or oral medications. This can lead to improved patient compliance and quality of life.

Key Market Players

- DePuy Synthes Inc.

- FlowonixMedical, Inc.

- Medtronic Plc

- Teleflex, Inc.

- Tricumed Medizintechnik GmbH

- Smith’s Group Plc

- Johnson & Johnson Private Limited

- Becton & Dickinson Co.

Report Scope:

In this report, the Global Spinal Pumps Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Spinal Pumps Market, By Application:

- Malignant Pain

- Non-Malignant Pain

- Pain Management

- Spasticity Management

Spinal Pumps Market, By End-User:

- Alternate Care Centers

- ASCs

- Clinics

- Hospitals

- Long Term Care Centers

Spinal Pumps Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Spinal Pumps Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- DePuy Synthes Inc.

- FlowonixMedical, Inc.

- Medtronic Plc

- Teleflex, Inc.

- Tricumed Medizintechnik GmbH

- Smith’s Group Plc

- Johnson & Johnson Private Limited

- Becton & Dickinson Co.

Table Information

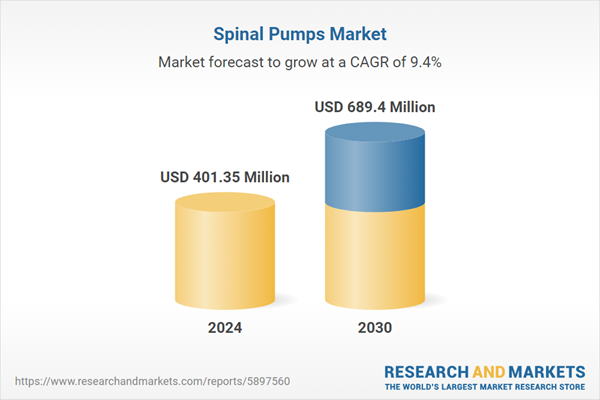

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 401.35 Million |

| Forecasted Market Value ( USD | $ 689.4 Million |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |