Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this upward momentum, the market contends with several structural challenges. These include volatile raw material prices, occupational health and safety concerns linked to certain diluent types, and the slow commercialization of bio-based alternatives. These factors can impact production costs, regulatory compliance, and product adoption rates in sensitive end-use sectors.

The outlook remains positive. Industry players are actively investing in formulation innovation, sustainable chemistries, and strategic R&D partnerships to overcome these barriers. This includes the development of low-VOC, high-performance, and environmentally compliant solutions that meet evolving regulatory and application demands. The global reactive diluents market is on a trajectory of sustainable expansion, supported by its pivotal role in enabling the next generation of high-performance materials and its alignment with long-term environmental and industrial transformation trends.

Key Market Drivers

Growing Demand of Reactive Diluents in Paints and Coatings Industry

The increasing utilization of reactive diluents in the paints and coatings industry has emerged as a major growth engine for the global reactive diluents market. This trend is fueled by rising demand for high-performance, durable, and environmentally compliant coating solutions across a wide range of sectors, including construction, automotive, aerospace, marine, and industrial manufacturing. Modern paints and coatings are expected to deliver more than just surface aesthetics they must offer chemical resistance, UV stability, corrosion protection, abrasion resistance, and mechanical durability.Reactive diluents, which chemically integrate into the coating film during curing, enhance these performance attributes by improving crosslink density, reducing brittleness, and optimizing the overall viscosity of the formulation. Their ability to reduce viscosity without the use of volatile solvents enables the production of high-solids and solvent-free coatings. This is particularly important in industrial settings, where strong film properties and long-term reliability are essential for asset protection and lifecycle cost savings.

As part of its commitment to modernizing core infrastructure, the government has introduced a series of large-scale initiatives aimed at overhauling transportation networks, enhancing urban infrastructure, and accelerating the rollout of digital connectivity. For the fiscal year 2025-26, a capital expenditure allocation of ₹11.21 lakh crore equivalent to 3.1% of GDP has been earmarked to support these transformative projects, signaling a strategic push toward long-term economic growth and structural modernization.

The global construction boom especially in Asia Pacific, the Middle East, and parts of Africa is significantly amplifying demand for architectural coatings, concrete sealers, and corrosion-resistant paints. Reactive diluents are widely used in epoxy-based floor coatings, waterproofing systems, and protective coatings for steel and concrete structures. As countries continue to invest in urban infrastructure, transportation, and housing, the need for long-lasting, weather-resistant coatings has grown substantially. Reactive diluents contribute to better adhesion, improved flow characteristics, and reduced shrinkage making them essential components in modern construction coatings.

With growing pressure to reduce environmental impact, the paints and coatings industry is rapidly transitioning to low-VOC and eco-friendly alternatives. Regulatory frameworks such as the U.S. EPA’s Clean Air Act, Europe’s REACH regulation, and global green building standards are pushing manufacturers to minimize the use of traditional solvents. Reactive diluents offer a direct solution by acting as both diluents and reactive components, eliminating the need for high-VOC solvents. Their ability to become part of the polymer matrix during curing reduces emissions while maintaining, or even enhancing, performance making them an ideal fit for sustainable coating technologies.

Beyond traditional architectural and industrial applications, reactive diluents are being increasingly adopted in high-value niche segments such as automotive refinishing, aerospace coatings, electronics encapsulation, and wind turbine blade coatings. These sectors demand precision-engineered formulations with specific curing profiles, mechanical strength, and resistance properties all of which can be fine-tuned using different types of reactive diluents (e.g., aliphatic, cycloaliphatic, glycidyl ethers). The versatility of reactive diluents allows formulators to customize coating behavior, enabling the development of UV-curable, heat-resistant, or rapid-cure coatings that meet the evolving needs of advanced manufacturing industries.

Key Market Challenges

Fluctuating Raw Material Prices and Supply Chain Instability

The foremost challenges impacting the reactive diluents market is the volatility in raw material prices, particularly those derived from petrochemical feedstocks such as epichlorohydrin, glycidyl ethers, and other epoxies. These fluctuations are often influenced by crude oil price movements, geopolitical uncertainties, and production disruptions factors largely beyond the control of manufacturers. In addition to cost unpredictability, supply chain disruptions such as port congestion, transportation bottlenecks, and inconsistent availability of specialty chemicals pose serious risks to timely production and delivery. This is especially critical in global operations where manufacturers depend on multiple regions for raw material sourcing. The lack of supply chain resilience can delay product launches, inflate costs, and ultimately hinder competitiveness in both emerging and mature markets.Key Market Trends

Rising Demand for Eco-Friendly and Low-VOC Formulations

The most significant trends driving the reactive diluents market is the global shift toward sustainable, low-emission chemical products. With increasingly stringent environmental regulations such as REACH in Europe and EPA guidelines in the U.S. manufacturers are under pressure to reduce volatile organic compound (VOC) emissions from coatings, adhesives, and composite systems. Reactive diluents, particularly aliphatic and cycloaliphatic types, play a pivotal role in formulating low-VOC and solvent-free systems, making them critical to achieving regulatory compliance while maintaining product performance. Additionally, growing environmental consciousness among end users is encouraging the adoption of green chemistry principles, pushing manufacturers to innovate cleaner, safer, and more sustainable formulations using reactive diluents.Key Market Players

- Arkema SA

- Cardolite Corp.

- Epoxy Division Aditya Birla Chemicals (Thailand) Limited

- Evonik Industries AG

- Huntsman International LLC

- King Industries, Inc

- KUKDO CHEMICAL CO., LTD

- Olin Corporation

- Hubei Phoenix Chemical Company

- Hexion Inc.

Report Scope:

In this report, the Global Reactive Diluents Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Reactive Diluents Market, By Type:

- Aliphatic

- Aromatic

- Cycloaliphatic

Reactive Diluents Market, By Application:

- Paints & Coatings

- Adhesives & Sealants

- Composites

- Others

Reactive Diluents Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Reactive Diluents Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Arkema SA

- Cardolite Corp.

- Epoxy Division Aditya Birla Chemicals (Thailand) Limited

- Evonik Industries AG

- Huntsman International LLC

- King Industries, Inc

- KUKDO CHEMICAL CO., LTD

- Olin Corporation

- Hubei Phoenix Chemical Company

- Hexion Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

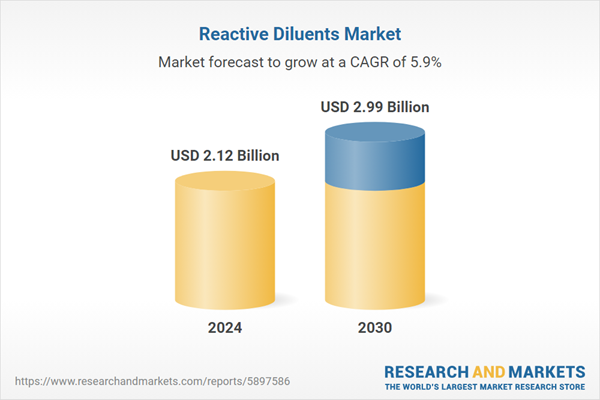

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.12 Billion |

| Forecasted Market Value ( USD | $ 2.99 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |