Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A significant obstacle potentially hindering market growth is the elevated cost of catalysts and processing for metallocene resins compared to conventional Ziegler-Natta based polyethylene, which can discourage adoption in price-sensitive applications. However, the market remains supported by a robust supply of the base polymer; according to the Gulf Petrochemicals and Chemicals Association, polyethylene and its derivatives comprised 56.4% of the total polymer production share in the GCC region in 2024. This substantial production volume guarantees a consistent feedstock baseline necessary for the continued scalability and development of advanced metallocene grades.

Market Drivers

The surging demand for high-performance flexible packaging serves as the primary catalyst for the Global Metallocene Polyethylene Market, fundamentally driven by the industry's transition toward film down-gauging. Converters are increasingly adopting metallocene resins to manufacture thinner, tougher films that decrease material usage without compromising barrier properties or optical clarity. This push for material efficiency is economically significant; the Flexible Packaging Association projected in February 2025 that the U.S. flexible packaging industry would reach $43.8 billion in 2024, highlighting the vast scale of this consumption channel, while Dow reported that its Packaging & Specialty Plastics segment generated $21.78 billion in revenue for the fiscal year 2024, demonstrating the robust financial volume supporting these advanced applications.A second critical driver is the growing application of metallocene-based polyolefin elastomers (POE) in solar photovoltaic encapsulation materials, which are essential for ensuring module efficiency and longevity. These resins offer superior electrical insulation and moisture resistance compared to traditional materials, making them indispensable for modern solar panel manufacturing. The growth of this segment is heavily influenced by the aggressive expansion of renewable energy capacity; according to the China Photovoltaic Industry Association in December 2024, China was expected to install between 230 and 260 gigawatts of solar capacity in 2024, creating a direct and rapidly expanding revenue stream for metallocene-grade polymers in encapsulation films.

Market Challenges

The high production expenses associated with metallocene polyethylene constitute a significant barrier to widespread adoption, impeding the expansion of the Global Metallocene Polyethylene Market. Unlike conventional polyethylene made with Ziegler-Natta catalysts, metallocene resins utilize specialized catalysts that are considerably more expensive to develop, and their conversion often requires specific processing adjustments to manage unique flow characteristics, leading to higher operational costs. This creates a price premium that discourages buyers in low-margin industries, such as basic agricultural films or commoditized packaging, where raw material costs heavily influence profitability, causing many manufacturers to continue relying on traditional polyethylene grades.This sensitivity to cost is further reinforced by tightening financial performance in key regions. According to Plastics Europe, the European plastics sector generated €398 billion in turnover in 2024, representing a 13% decline from 2022 levels. Such a contraction in industry revenue highlights the financial pressure on processors, limiting their ability to absorb the additional costs associated with premium metallocene grades.

Market Trends

The adoption of Recyclable Mono-Material Packaging Structures represents a structural paradigm shift, compelling manufacturers to replace non-recyclable multi-polymer laminates with all-polyethylene solutions. This transition relies on the superior stiffness and toughness of metallocene polyethylene to compensate for the removal of rigid substrates like polyester, facilitating compatibility with existing recycling streams without sacrificing line speeds. The scale of this reconfiguration is evident; according to Constantia Flexibles' 'ESG Report 2024' released in September 2025, more than 92% of the company's product portfolio was designed for recycling or had a recyclable alternative by the end of 2024, confirming the accelerated industrial pivot toward mono-material architectures.Concurrently, the Commercialization of Bio-Attributed and Circular mPE Grades is reshaping the feedstock landscape, utilizing mass balance methodologies to decouple polymer production from fossil resources. Producers are rapidly integrating renewable residues and chemically recycled oils into their polymerization processes, yielding resins that maintain the identical virgin-quality performance required for contact-sensitive applications while satisfying stringent sustainability certifications. This feedstock evolution is substantiated by significant volume growth; according to LyondellBasell's '2024 Sustainability Report' from April 2025, the company increased its sales volumes of recycled and renewable-based polymers by 65% year-over-year to over 200,000 metric tons in 2024, underscoring the commercial scalability of these advanced circular grades.

Key Players Profiled in the Metallocene Polyethylene Market

- Braskem SA

- Brentwood Plastics, Inc.

- Chevron Phillips Chemical Company LLC

- INEOS Group, Ltd.

- Mitsui Chemicals, Inc.

- Prime Polymer Co., Ltd.

- SABIC

- TotalEnergies SE

- Univation Technologies, LLC.

- W. R. Grace & Co.-Conn

Report Scope

In this report, the Global Metallocene Polyethylene Market has been segmented into the following categories:Metallocene Polyethylene Market, by Type:

- Metallocene Linear Low-Density Polyethylene (mLLDPE)

- Metallocene High Density Polyethylene (mHDPE)

- Others

Metallocene Polyethylene Market, by Application:

- Films

- Sheets

- Injection Molding

- Extrusion Coating

- Others

Metallocene Polyethylene Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Metallocene Polyethylene Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Metallocene Polyethylene market report include:- Braskem SA

- Brentwood Plastics, Inc.

- Chevron Phillips Chemical Company LLC

- INEOS Group, Ltd.

- Mitsui Chemicals, Inc.

- Prime Polymer Co., Ltd.

- SABIC

- TotalEnergies SE

- Univation Technologies, LLC.

- W. R. Grace & Co.-Conn

Table Information

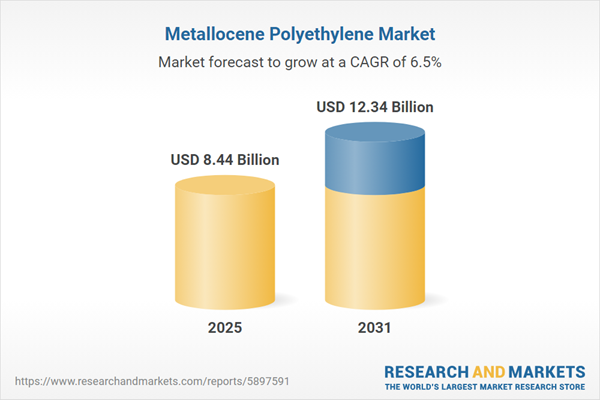

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 8.44 Billion |

| Forecasted Market Value ( USD | $ 12.34 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |