Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

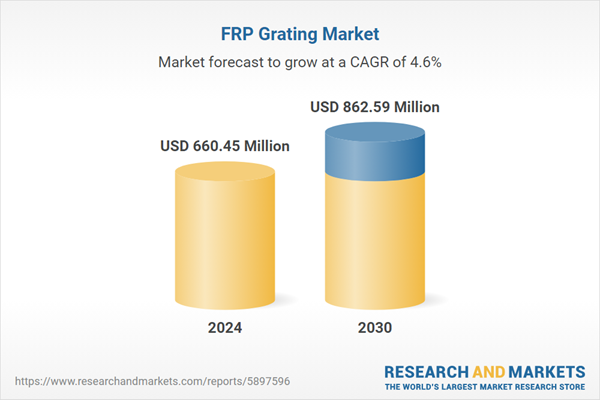

The market for fiberglass reinforced plastic (FRP) gratings is experiencing significant growth due to the increasing demand for sustainable and environmentally friendly products over iron and steel gratings. The beneficial properties of FRP gratings, such as low life cycle cost, high durability, strength, fatigue resistance, and low maintenance cost, are expected to drive the market's growth. However, challenges such as the disposal and recyclability costs of FRP grating and the need for re-gel coating every five years, which may result in airborne fibers and pose issues for asthma sufferers, could impede market growth.

FRP gratings are an excellent alternative to steel, aluminum, or molded fiberglass gratings, creating numerous opportunities for the market. However, the sudden impact of the COVID-19 outbreak poses a major challenge to the growth of the fiberglass reinforced plastic (FRP) grating market.

Key Market Drivers

Growing Demand of FRP Grating in Water Management

The growing demand for FRP (Fiber Reinforced Plastic) grating in water management is playing a pivotal role in accelerating the growth of the global FRP grating market. The global water infrastructure landscape faces significant strain, with critical gaps in access and resource availability. More than 2 billion people currently lack access to safe drinking water within their homes, underscoring systemic deficiencies in municipal and rural water systems.Looking ahead, the situation is expected to intensify by 2025, an estimated 1.8 billion people will be living in regions experiencing absolute water scarcity, rising urbanization, stricter environmental regulations, and climate-induced stress on resources there is a significant shift toward modern, corrosion-resistant, and low-maintenance materials. FRP gratings are emerging as a strategic solution, offering exceptional performance benefits across water treatment plants, desalination facilities, drainage systems, and wastewater management units.

Water management systems especially sewage treatment plants, desalination plants, and stormwater drainage networks are exposed to high humidity, corrosive chemicals, biological contaminants, and fluctuating pH levels. In such conditions, traditional materials like steel rapidly degrade, leading to frequent maintenance and system downtime. FRP gratings, made with advanced resins such as vinyl ester or phenolic, offer superior resistance to corrosion, rust, and biological attack, ensuring long-term structural integrity. Their performance in wet, submerged, and chemically aggressive environments makes them ideal for wet wells, aeration tanks, chemical dosing areas, and sludge handling zones.

Governments and municipalities across both developed and developing nations are scaling up investments in water and wastewater infrastructure, driven by rapid urbanization as of now, approximately 56% of the global population resides in urban areas, marking a notable demographic transition from historically rural-based societies. This trend reflects accelerated urban expansion driven by economic development, infrastructure growth, and industrialization.

Forward-looking projections suggest this momentum will persist, with urban populations expected to account for 68% of the global total by 2050, population growth, and the need for sustainable resource management. This includes the construction and modernization of: Sewage treatment plants (STPs), Effluent treatment plants (ETPs), Rainwater harvesting systems, Flood control and drainage systems. FRP gratings are increasingly being specified for these applications due to their non-conductive, anti-slip, lightweight, and maintenance-free properties, which reduce operational costs and enhance workplace safety.

In water-scarce regions such as the Middle East, North Africa, and parts of Asia-Pacific, desalination has become a critical strategy for ensuring water security. Desalination plants require materials that can withstand high salinity, chemical exposure, and humid marine environments. FRP gratings are widely used in these facilities for walkways, trench covers, equipment platforms, and maintenance access areas because they maintain mechanical strength and dimensional stability under saltwater exposure. Their non-metallic and non-corrosive nature significantly reduces lifecycle costs in desalination applications.

Environmental compliance is becoming increasingly stringent, especially in the water sector where pollution control, safety, and sustainable design are priorities. FRP gratings support green building initiatives and environmental standards by reducing the frequency of repairs, lowering energy requirements for maintenance, and offering recyclability depending on the resin used. In water treatment and discharge zones, where spill containment, anti-slip surfaces, and chemical resilience are required, FRP gratings meet both operational and environmental standards. Their role in helping facilities meet OSHA, EPA, and ISO certifications is reinforcing their adoption globally.

Key Market Challenges

Volatility in Prices of Raw Materials

FRP (Fiber-Reinforced Polymer) Grating is a robust and corrosion-resistant product, manufactured using a combination of fiber-reinforced polymers and other materials. This lightweight grating has gained increasing adoption across various sectors, including construction, transportation, and utilities. The production of FRP Grating is heavily dependent on the availability and pricing of raw materials. Fluctuations in raw material prices can have a significant impact on the cost of production, ultimately affecting the final pricing of FRP Grating products.The market for raw materials used in FRP Grating production frequently experiences volatility due to various factors such as supply disruptions, pent-up demand, or significant price fluctuations. This volatility poses a considerable challenge for the FRP Grating Market. The introduction of new tariffs on steel has led to a 25% increase in the cost of imported steel products, further exacerbating the already volatile market. As steel is a critical raw material in FRP Grating production, this cost increase directly impacts the manufacturing process.

Key Market Trends

Focus on Lightweight and Corrosion-Resistant Materials

FRP Grating, also known as Fiberglass Reinforced Plastic Grating, has emerged as a popular choice in various industries due to its exceptional properties. One of its key advantages is its high strength-to-weight ratio, which means it provides a strong and durable solution while being lightweight. This not only makes it easier to handle and install but also contributes to cost savings during the installation process. Another notable attribute of FRP Grating is its excellent corrosion resistance. This makes it highly suitable for applications where regular exposure to chemicals or water is expected. Unlike traditional materials, FRP Grating remains unaffected by corrosion, ensuring long-lasting performance and reducing maintenance requirements.The demand for FRP Grating has been particularly high in the construction, transportation, and utilities sectors. In construction, the durability and low maintenance nature of FRP Grating make it an ideal choice for applications such as walkways, platforms, and stair treads. In the transportation sector, FRP Grating finds applications in areas such as bridges, decks, and ramps, where its lightweight and corrosion-resistant properties are highly valued. Additionally, the utilities sector benefits from FRP Grating in applications like wastewater treatment plants and chemical processing facilities, where its corrosion resistance is essential.

Within the FRP Grating market, the Polyester-Based FRP Gratings segment is expected to witness the highest growth. This is primarily driven by the increasing demand for strong, lightweight, and corrosion-resistant materials in various industries. Likewise, the Pultruded FRP Grating market is also experiencing significant growth due to the rising need for durable grating materials in diverse applications. The trend of using FRP Grating is expected to continue, further driving the growth of the market. This is because these materials offer a significantly higher strength-to-weight ratio and corrosion resistance compared to traditional materials, making them a preferred choice for industries seeking long-lasting and cost-effective solutions. By leveraging the superior properties of FRP Grating, industries can benefit from enhanced performance, reduced maintenance, and overall cost savings.

Key Market Players

- Fibergrate Composite Structures Ltd

- Ferrotech International FZE

- Bedford Reinforced Plastics Inc.

- Creative Pultrusions Inc.

- Delta Composites, LLC

- AGC Matex Co. Ltd.

- Fibrolux GmbH

- Strongwell Corporation

- Techno Composites Domine GmbH

- AIMS International

Report Scope:

In this report, the Global FRP Grating Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:FRP Grating Market, By Resin Type:

- Polyester Resin

- Vinyl Ester Resin

- Phenolic Resin

- Others

FRP Grating Market, By Application:

- Stair Treads

- Walkways

- Platforms

- Others

FRP Grating Market, By End User:

- Industrial

- Water Management

- Cooling Towers

- Marine

- Others

FRP Grating Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global FRP Grating Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Fibergrate Composite Structures Ltd

- Ferrotech International FZE

- Bedford Reinforced Plastics Inc.

- Creative Pultrusions Inc.

- Delta Composites, LLC

- AGC Matex Co. Ltd.

- Fibrolux GmbH

- Strongwell Corporation

- Techno Composites Domine GmbH

- AIMS International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 660.45 Million |

| Forecasted Market Value ( USD | $ 862.59 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |