Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

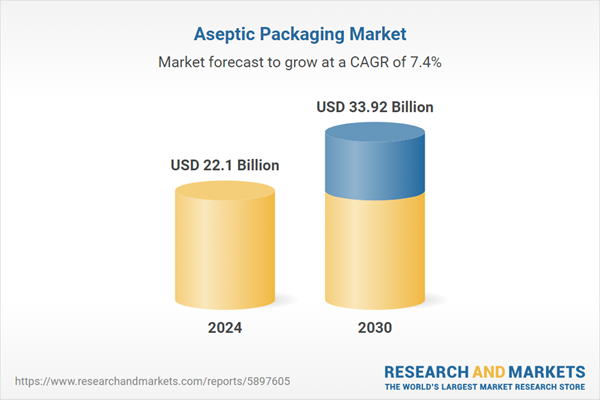

The market is positioned for long-term, innovation-led growth, underpinned by the intersection of several key drivers: the global shift toward health-conscious consumption, rapid adoption of advanced sterile packaging systems, and a heightened industry focus on sustainable, regulation-compliant solutions. As companies across sectors elevate their packaging strategies to meet stricter standards and evolving consumer expectations, aseptic packaging will continue to play a pivotal role in product differentiation, operational efficiency, and competitive positioning.

Key Market Drivers

Growing Demand of Aseptic Packaging in Food and Beverage Industry

The growing demand for aseptic packaging in the food and beverage industry is one of the most significant drivers propelling the expansion of the global aseptic packaging market. As consumer expectations evolve and supply chain efficiency becomes critical, aseptic packaging offers a modern solution that addresses safety, shelf life, sustainability, and convenience key requirements for food and beverage producers globally.Aseptic packaging enables the safe storage of perishable food and beverages for extended periods without refrigeration or chemical preservatives. This is particularly valuable for products such as milk, fruit juices, soups, sauces, and ready-to-drink beverages. The aseptic process sterilizes both the product and the packaging separately before filling and sealing under sterile conditions, preventing microbial contamination. This prolonged shelf life not only improves product accessibility in regions with limited cold chain infrastructure but also reduces food waste across the supply chain, making it an economically and environmentally favorable option for producers and retailers alike.

Modern consumers especially in urban and emerging markets are increasingly leaning toward on-the-go, ready-to-consume, and easy-to-store food and beverage options. Aseptic packaging supports this trend by offering lightweight, compact, and portable packaging formats that maintain product freshness and safety over time. This demand is particularly prominent among working professionals, students, and health-conscious individuals who prioritize hygiene, nutritional value, and convenience. The ability to deliver clean-label, additive-free food and beverages that are still shelf-stable makes aseptic packaging an ideal solution for food manufacturers looking to capture this growing market segment.

With increasing awareness of health and nutrition, consumers are shifting away from carbonated and sugary drinks toward functional beverages like plant-based milk, protein drinks, probiotic juices, and fortified waters. These products are often sensitive to heat and contamination, requiring advanced packaging that ensures safety while preserving nutrients. Aseptic packaging, which minimizes thermal exposure and eliminates the need for preservatives, allows manufacturers to retain the natural flavor, color, and nutritional content of these beverages. This makes it a preferred choice for brands catering to the health and wellness segment, further driving market demand.

Aseptic packaging allows food and beverage products to be transported and stored without refrigeration, significantly reducing cold chain logistics costs. This leads to lower energy consumption, simplified transportation, and greater geographical reach, especially into remote or rural areas. Manufacturers and distributors benefit from reduced spoilage rates, longer stock-keeping units (SKUs), and improved inventory management, resulting in enhanced profitability and supply chain resilience. These operational efficiencies are pushing more food and beverage companies toward aseptic solutions.

Key Market Challenges

Limited Infrastructure and Awareness in Developing Economies

In many developing countries, the lack of supporting infrastructure such as sterile supply chains, aseptic-compatible logistics, and recycling systems for multilayer packaging materials poses a serious challenge. While the technology itself is advanced, its effectiveness relies heavily on the end-to-end supply chain being able to maintain aseptic conditions. Additionally, there is still limited awareness among small and regional manufacturers about the long-term benefits of aseptic packaging. The perception that aseptic systems are overly complex or unnecessary for local markets prevents broader market penetration. Without targeted education and infrastructure development, adoption in these regions is likely to remain slow.Key Market Trends

Rising Demand for Sustainable and Eco-Friendly Packaging Solutions

Sustainability is becoming a core focus across industries, and aseptic packaging is evolving rapidly to meet environmental expectations. Companies are under pressure from consumers, governments, and investors to reduce their carbon footprint, minimize plastic use, and promote recyclable materials. Aseptic packaging - particularly in the form of paper-based cartons offers significant advantages due to its renewable raw materials, lower energy consumption, and reduced need for refrigeration, which decreases emissions throughout the supply chain. Packaging leaders are investing in plant-based polymers, biodegradable coatings, and closed-loop recycling systems to further enhance the sustainability profile of aseptic formats. As regulatory frameworks tighten and eco-conscious consumers demand cleaner alternatives, the shift toward green aseptic packaging solutions is expected to remain a powerful driver of long-term market growth.Key Market Players

- AMCOR PLC

- DS SMITH PLC

- MONDI PLC

- REYNOLDS GROUP HOLDINGS LIMITED

- SIG COMBIBLOC GROUP AG

- SONOCO PRODUCTS COMPANY

- SMURFIT KAPPA GROUP PLC

- STORA ENSO OYJ

- TETRA LAVAL INTERNATIONAL S.A.

- UFLEX LIMITED

Report Scope:

In this report, the Global Aseptic Packaging Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Aseptic Packaging Market, By Type:

- Cartons

- Bottles & Cans

- Bags & Pouches

- Others

Aseptic Packaging Market, By Material:

- Plastic

- Metal

- Glass & Wood

- Paper

Aseptic Packaging Market, By Application:

- Food

- Beverage

- Others

Aseptic Packaging Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aseptic Packaging Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- AMCOR PLC

- DS SMITH PLC

- MONDI PLC

- REYNOLDS GROUP HOLDINGS LIMITED

- SIG COMBIBLOC GROUP AG

- SONOCO PRODUCTS COMPANY

- SMURFIT KAPPA GROUP PLC

- STORA ENSO OYJ

- TETRA LAVAL INTERNATIONAL S.A.

- UFLEX LIMITED

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 22.1 Billion |

| Forecasted Market Value ( USD | $ 33.92 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |