Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Recent advancements in on-purpose production technologies particularly metallocene catalysis and enhanced oligomerization methods are improving yield efficiency and product uniformity. These innovations are prompting industry leaders to pursue capacity expansions and make targeted investments to solidify their competitive positioning. The market is being shaped by strong application growth in performance polymers and specialty chemicals, coupled with continuous process innovation and favorable macroeconomic and regulatory trends across key regions.

Key Market Drivers

Growing Demand of Alpha Olefins in Chemical Industry

The rising demand for alpha olefins within the chemical industry is a major catalyst driving the expansion of the global alpha olefins market. As fundamental intermediates in the synthesis of a broad range of downstream chemical products, alpha olefins particularly 1-butene, 1-hexene, and 1-octene have become increasingly indispensable across multiple chemical manufacturing applications.One of the most significant growth drivers is the extensive use of alpha olefins in polyethylene production, especially in linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE). These polymers are integral to the packaging, consumer goods, and industrial sectors due to their strength, flexibility, and resistance to environmental stress. As global demand for packaging materials, films, containers, and molded products accelerates particularly in emerging economies the need for alpha olefin co-monomers continues to rise sharply.

Alpha olefins are vital in the formulation of specialty chemicals, such as plasticizers, surfactants, synthetic lubricants, and oilfield additives. The expanding use of these chemicals in automotive, construction, personal care, and oil & gas industries further amplifies market demand. For instance, alpha olefins are used in the production of biodegradable detergents and high-performance lubricants, responding to global sustainability and efficiency trends.

In addition, regulatory shifts toward eco-friendly chemical formulations are reinforcing the adoption of alpha olefin-based alternatives in several chemical applications. These materials offer low volatility, thermal stability, and compatibility with various industrial resins, making them suitable for high-performance, environmentally responsible formulations.

The chemical industry’s growing focus on innovation and performance-driven solutions also contributes to the market’s expansion. With increasing R&D efforts, manufacturers are developing tailored alpha olefin grades that meet evolving performance specifications across diverse applications, thereby unlocking new market segments and revenue streams.

Key Market Challenges

Volatility in Prices of Raw Materials

Alpha olefins are versatile organic compounds that are derived from olefins or alkenes, which are primarily obtained from crude oil and natural gas. These compounds play a crucial role in various industries, including the production of plastics, detergents, lubricants, and synthetic oils.The prices of alpha olefins are highly influenced by the volatile nature of global oil and gas markets. Fluctuations in these markets can have a significant impact on the profitability and strategic planning of manufacturers. This unpredictability makes budgeting and forecasting challenging, adding a layer of complexity to an already demanding market.

Market participants face additional hurdles in the form of stringent environmental regulations. These regulations often require manufacturers to implement additional processes or make alterations to their production methods, which can lead to increased production costs. This compounds the challenges posed by fluctuating raw material prices, making it even more crucial for companies to navigate this intricate landscape.

The market for alpha olefins is shaped by the interplay of volatile commodity prices, stringent environmental regulations, and the ever-increasing demand for their applications in various industries. Navigating these complexities requires a keen understanding of market dynamics and a proactive approach to mitigate risks while maximizing opportunities.

Key Market Trends

Growing Demand for Renewable and Bio-Based Alpha Olefins

Alpha olefins, which are organic compounds derived from olefins or alkenes, have historically been produced using fossil fuels like crude oil and natural gas. However, in response to the growing emphasis on sustainability and the need to reduce carbon emissions, there has been a significant surge in demand for renewable and bio-based alternatives.Bio-based alpha olefins are obtained from plant-based feedstocks such as vegetable oils or animal fats, making them an environmentally friendly and sustainable alternative to their fossil-based counterparts. This shift towards renewable and bio-based alpha olefins is being driven by stringent environmental regulations and policies aimed at reducing carbon emissions. Companies across various industries are actively seeking greener alternatives to comply with these regulations and minimize their carbon footprint.

The rise in consumer demand for sustainable and eco-friendly products has also played a crucial role in encouraging manufacturers to adopt renewable and bio-based alpha olefins in their production processes. This trend reflects a broader shift towards more environmentally conscious consumption patterns and is reshaping the way industries approach their manufacturing practices.

The global alpha olefins market is witnessing a notable trend towards the growing demand for renewable and bio-based alpha olefins. As industries continue to transition towards more sustainable practices, this trend is expected to play a pivotal role in shaping the future of the alpha olefins market, driving innovation, and driving the adoption of greener alternatives.

Key Market Players

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Evonik Industries AG

- Idemitsu Kosan Co., Ltd.

- Ineos Group Ltd

- Kemipex FZE

- LANXESS AG

- Qatar Chemical Company Ltd

- Shell plc

- SABIC

Report Scope:

In this report, the Global Alpha Olefins Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Alpha Olefins Market, By Type:

- 1-Butene

- 1-Hexene

- 1-Octene

- Others

Alpha Olefins Market, By Application:

- Polyolefins Comonomers

- Surfactants & Intermediates

- Lubricants

- Plasticizers

- Fine Chemicals

- Oil Field Chemicals

- Others

Alpha Olefins Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Alpha Olefins Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Evonik Industries AG

- Idemitsu Kosan Co., Ltd.

- Ineos Group Ltd

- Kemipex FZE

- LANXESS AG

- Qatar Chemical Company Ltd

- Shell plc

- SABIC

Table Information

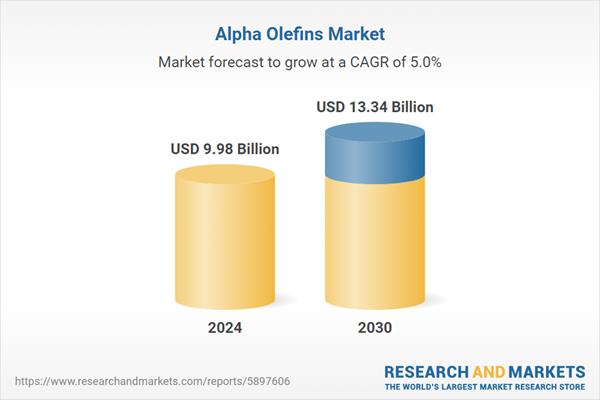

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.98 Billion |

| Forecasted Market Value ( USD | $ 13.34 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |