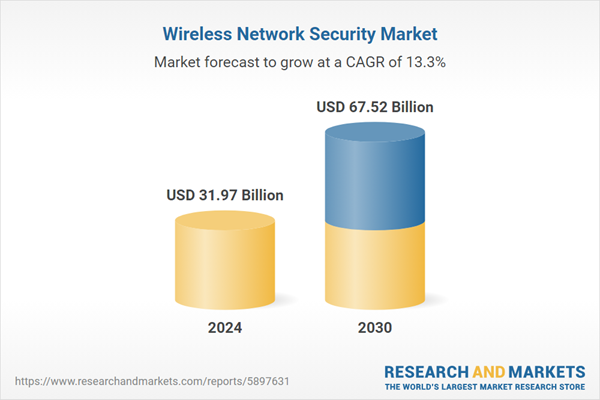

BFSI is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The Global Wireless Network Security Market is significantly propelled by the increasing sophistication of cyber threats and the proliferation of wireless technologies and connected devices. Malicious actors are continuously developing more complex attack vectors, necessitating advanced defense solutions and driving market expansion. According to NordLayer, December 2024, '2024 Cybersecurity Statistics', weekly attacks on healthcare organizations globally averaged 2,018 from January to September 2024, a 32% increase from 2023.Key Market Challenges

The inherent complexity associated with implementing and managing diverse security protocols across varied and continuously evolving wireless infrastructures presents a notable challenge to market expansion. This complexity directly hinders the seamless and comprehensive deployment of security solutions, leading to significant operational challenges for organizations. Enterprises frequently encounter compatibility issues among different security systems and technologies, which can impede effective integration and reduce the overall efficacy of their security posture.This environment also places substantial resource demands on businesses, particularly those with limited IT capabilities. The need for specialized expertise to navigate complex security configurations and constantly update defenses against new threats can overwhelm internal teams. According to the Wireless Infrastructure Association, in 2023, 47% of IT professionals identified upgrading or modifying connectivity and applications to support a flexible workforce as a major challenge. This difficulty in adapting basic network infrastructure underscores the broader struggle with complexity, extending to the advanced security protocols required to protect these evolving wireless environments, thereby slowing the adoption and expansion of advanced wireless network security solutions.

Key Market Trends

This trend marks a significant advancement in modern defence capabilities, enabling wireless networks to detect and respond to threats more proactively and effectively than traditional rule-based security systems. Artificial Intelligence (AI) and Machine Learning (ML) algorithms analyse large volumes of network traffic, user behaviour, and threat intelligence data to uncover anomalies and complex attack patterns that would otherwise remain undetected. This capability is becoming essential in increasingly dynamic wireless environments, where the scale and complexity of data exceed the limits of manual monitoring.Key Market Players Profiled:

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Company

- Juniper Networks, Inc.

- Fortinet, Inc.

- Zebra Technologies Corporation

- Sophos Ltd.

- Broadcom Inc.

- Trend Micro Incorporated

- SonicWall, Inc.

- Honeywell International Inc.

Report Scope:

In this report, the Global Wireless Network Security Market has been segmented into the following categories:By Solution:

- Firewall

- Encryption

- Identity and Access Management

- Unified Threat Management

- Intrusion Prevention System (IPS)/Intrusion Detection System (IDS)

- Others

By Deployment:

- On-premise

- Cloud

By End-User Industry:

- BFSI

- Healthcare

- Retail

- Manufacturing

- IT and Telecom

- Government

- Aerospace & Defense

- Other

By Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia-Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wireless Network Security Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Wireless Network Security market report include:- Cisco Systems, Inc.

- Hewlett Packard Enterprise Company

- Juniper Networks, Inc.

- Fortinet, Inc.

- Zebra Technologies Corporation

- Sophos Ltd.

- Broadcom Inc.

- Trend Micro Incorporated

- SonicWall, Inc.

- Honeywell International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 31.97 Billion |

| Forecasted Market Value ( USD | $ 67.52 Billion |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |