Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, the sector encounters substantial hurdles related to supply chain limitations arising from stringent environmental regulations that restrict harvest quantities to safeguard the Antarctic ecosystem. These rigid caps can constrain raw material accessibility and disrupt production consistency as market requirements increase. Demonstrating this pressure on supply, the Commission for the Conservation of Antarctic Marine Living Resources reported that during the 2023/24 fishing season, the total industrial catch of Antarctic krill amounted to 498,350 tonnes. This figure nears the precautionary trigger thresholds that necessitate fishery closures, underscoring the conflict between escalating commercial demand and ecological supply boundaries.

Market Drivers

The escalating awareness regarding the cardiovascular and cognitive advantages of omega-3s acts as a major catalyst for the market, driven by consumers prioritizing the enhanced bioavailability found in krill oil’s phospholipid-bound fatty acids. This intensified emphasis on preventative health has accelerated the demand for high-efficiency nutrient delivery over conventional triglyceride-based products, fostering expansion within the human nutrition sector. Highlighting this trend, the Global Organization for EPA and DHA Omega-3s noted in their September 2024 '2024 Global EPA and DHA Omega-3 Ingredient Market Report' that the total global volume of omega-3 ingredients hit 124,480 metric tons in 2023. Furthermore, according to Aker BioMarine’s 'Second quarter and half-year report 2024' released in July 2024, revenue for their Human Health Ingredients division grew to USD 25.4 million, representing a 22% rise year-over-year.Simultaneously, the rise in pet ownership and the requirement for premium animal feed supplements are continually broadening the industry's reach beyond human applications. Pet owners are increasingly humanizing animal nutrition by incorporating high-quality krill meal to improve the joint, heart, and coat health of their companions, while the aquaculture sector depends on these ingredients to support sustainable development. The significant commercial worth attributed to this segment is illustrated by recent corporate maneuvers; as per Aker BioMarine’s July 2024 transaction announcement, their Feed Ingredients unit was divested for an enterprise value of USD 590 million, emphasizing the considerable market valuation and strategic relevance of krill utilization in animal nutrition.

Market Challenges

The principal obstacle hindering the Global Krill Oil Supplements Market is the inflexible supply chain restriction mandated by environmental harvesting limits. Although consumer interest in high-bioavailability omega-3s is rising, the industry is physically precluded from expanding operations due to stringent conservation quotas established to preserve the Antarctic ecosystem. This regulatory cap creates a fundamental disparity between market opportunities and raw material accessibility, preventing manufacturers from legally increasing catch volumes to satisfy growing orders. As a result, companies encounter considerable inventory instability and are unable to assure major retailers of consistent long-term supply levels.This constraint functions as a rigid barrier to market growth, effectively offsetting the advantages of increasing consumer demand. According to the Association of Responsible Krill harvesting companies (ARK), the industry continued to function under a strict precautionary trigger limit of 620,000 tonnes for the main Atlantic sector fishing grounds in 2024. Since the actual harvest volume consistently approaches this immutable cap, the market effectively lacks the elasticity required for expansion. This specific regulatory threshold necessitates a stagnation in production output, which directly halts revenue progression and discourages potential market entrants concerned about supply reliability.

Market Trends

The widespread adoption of innovative delivery formats, particularly flavored liquids and gummies, is transforming the market by resolving consumer issues related to "pill fatigue" and the sensory drawbacks of conventional softgels. Manufacturers are increasingly applying advanced emulsification techniques to infuse krill oil into palatable, chewable bases while maintaining stability, thereby broadening the consumer base to include active individuals and younger adults looking for convenient nutritional options. This diversification is bolstered by a stabilizing raw material supply chain that permits brands to innovate beyond basic encapsulation; reflecting this industrial vigor, the Global Organization for EPA and DHA Omega-3s reported in the '2025 Global EPA and DHA Omega-3 Ingredient Market Report' from September 2025 that the global volume of omega-3 raw materials reached 131,183 metric tons in 2024, facilitating the continued production of these diverse formats.Concurrently, the rise of nutricosmetic and beauty-from-within applications is establishing krill oil as a premium component for hydration and skin health. By capitalizing on the natural content of phospholipids and the antioxidant astaxanthin, brands are promoting these supplements to improve moisture retention and skin barrier function, effectively connecting the fields of nutrition and dermatology. This high-value positioning has stimulated financial expansion within the human nutrition segment as companies obtain specific regulatory validations for skin benefits in major international markets. Confirming the commercial success of these specialized health applications, Aker BioMarine’s 'Third Quarter 2025 Report' from October 2025 indicated that revenue for their Human Health Ingredients segment climbed to USD 30.2 million, propelled by optimized product mix and robust volume growth.

Key Players Profiled in the Krill Oil Supplements Market

- Aker BioMarine ASA

- Neptune Wellness Solutions Inc.

- Rimfrost As

- Schiff Nutrition International Inc.

- Norwegian Fish Oil AS.

- Qingdao New Life Biotechnology Co Ltd.

- NWC Naturals Inc.

- Nutracode LLC

Report Scope

In this report, the Global Krill Oil Supplements Market has been segmented into the following categories:Krill Oil Supplements Market, by Product:

- Liquids

- Softgels

- Capsules

Krill Oil Supplements Market, by Application:

- Dietary Supplements

- Animal Feed

- Functional Food & Beverages

- Pharmaceuticals

- Others

Krill Oil Supplements Market, by Distribution Channel:

- Supermarkets/Hypermarkets

- Drug Stores & Pharmacies

- Online Retailers

- Others

Krill Oil Supplements Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Krill Oil Supplements Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Krill Oil Supplements market report include:- Aker BioMarine ASA

- Neptune Wellness Solutions Inc.

- Rimfrost As

- Schiff Nutrition International Inc

- Norwegian Fish Oil AS.

- Qingdao New Life Biotechnology Co Ltd

- NWC Naturals Inc.

- Nutracode LLC

Table Information

| Report Attribute | Details |

|---|---|

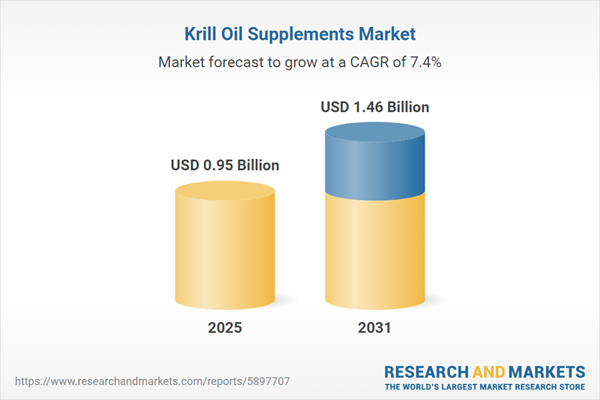

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 0.95 Billion |

| Forecasted Market Value ( USD | $ 1.46 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |