Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces significant challenges due to restrictive aviation regulatory frameworks. In many regions, strict regulations regarding Beyond Visual Line of Sight operations constrain operators from utilizing fully autonomous, long-range flights. These limitations hinder the operational efficiency necessary for inspecting vast offshore wind farms effectively. Consequently, the inability to deploy autonomous systems over long distances impedes the seamless monitoring of expansive energy projects, presenting a substantial obstacle to broader market advancement.

Market Drivers

The rapid growth of global wind energy capacity acts as a major catalyst for the inspection drones market, particularly as the sector strategically shifts toward offshore developments. As wind turbines increase in size and are situated further offshore to utilize stronger winds, traditional manual maintenance becomes both prohibitively costly and dangerous, creating a strong need for unmanned aerial systems for scalable asset management. This upward trajectory is supported by a strong pipeline of upcoming projects; according to the 'Global Offshore Wind Report' by the Global Wind Energy Council in April 2025, government auctions awarded a record 56 GW of new offshore capacity worldwide in 2024, indicating a looming surge in maintenance requirements. Additionally, infrastructure density regionally boosts the demand for efficient monitoring, with WindEurope’s 'Wind Energy in Europe: 2024 Statistics' report from February 2025 noting that Europe installed 16.4 GW of new wind capacity in 2024, widening the market for drone services.Simultaneously, the incorporation of Artificial Intelligence and advanced sensor technologies is revolutionizing the market by facilitating a transition to predictive maintenance. Operators are increasingly deploying drones fitted with high-resolution visual and thermal sensors to gather data that is analyzed by AI algorithms, enabling the identification of blade defects before they develop into critical failures. This adoption leads to considerable operational efficiencies and allows for the execution of large-scale inspection campaigns that would be unfeasible manually. Demonstrating the scalability of these automated solutions, Sulzer Schmid announced in an April 2025 press release, 'Sulzer Schmid completes massive European rotor blade inspection campaign for Vestas,' that it had finished a digital inspection campaign covering 4,000 wind turbines across seven countries, proving that data-driven decision-making is essential for optimizing the performance of both new and aging infrastructure.

Market Challenges

Stringent aviation regulations pose a major constraint on the Global Wind Turbine Inspection Drones Market, specifically regarding restrictions on Beyond Visual Line of Sight (BVLOS) operations. In numerous regions, current rules mandate that operators must maintain direct visual contact with the drone at all times, effectively preventing service providers from leveraging the full autonomous potential of aerial systems. This requirement undermines the efficiency gains typically offered by aerial monitoring, as inspection teams are forced to frequently reposition ground crews or support vessels to remain within range. Consequently, the time and labor necessary to survey large-scale energy infrastructure are significantly increased, negating many of the benefits of automation.The impact of these regulatory limitations is felt most acutely in the offshore sector, where assets are spread across vast expanses of the ocean. The inability to execute long-range, fully autonomous flights results in extended inspection cycles and contributes to elevated ongoing operational costs for energy developers. According to WindEurope data from 2024, operations and maintenance expenses constituted roughly 30 percent of the total levelized cost of electricity for offshore wind projects. These high costs, maintained in part by the regulatory barriers preventing fully autonomous inspection methods, act as a deterrent to wider adoption and restrict the potential expansion of the market.

Market Trends

The adoption of Internal Blade Inspection Technologies is becoming increasingly prominent as operators realize that external visual checks are insufficient for ensuring complete structural health. While conventional drones address surface erosion, advanced robotic solutions are now being utilized to navigate inside turbine blades to detect critical internal flaws, such as spar bond failures and delamination, which are invisible from the exterior. This movement toward holistic structural analysis is fueling the rapid uptake of specialized internal inspection robotics, deemed crucial for prolonging the life of aging assets. The commercial success of key innovators highlights this segment's growth; according to a December 2024 press release titled 'Aerones Attracting Industry Talent with its Rapid Expansion and Novel Technology,' Aerones experienced record-breaking growth in 2024, doubling its revenue as global demand for its robotic inspection and maintenance services surged.Concurrently, the rise of Drones-as-a-Service (DaaS) business models is transforming procurement strategies, with asset owners increasingly choosing outsourced expertise over capital-heavy in-house programs. Operating sophisticated aerial systems, especially for data-intensive or complex offshore campaigns, demands specialized data processing capabilities and pilot certifications that often lie outside the core expertise of energy developers. By utilizing DaaS, wind farm operators can convert fixed capital costs into flexible operational expenses while accessing cutting-edge technology without the risk of hardware obsolescence. This shift is supported by the financial results of leading providers; for instance, in an August 2024 press release, 'Cyberhawk Announces Record-Breaking 55 Percent Revenue Growth in FY 2024,' Cyberhawk reported a 55 percent rise in annual revenue to $28.7 million, driven largely by the growing demand for its managed inspection services within the energy sector.

Key Players Profiled in the Wind Turbine Inspection Drones Market

- SZ DJI Technology Co., Ltd.

- Cyberhawk Innovations Limited

- AeroVironment Inc.

- SkySpecs Inc.

- Delair SAS

- Aibotix GmbH

- Flyability

- Kespry

- Skyward

- Matternet

Report Scope

In this report, the Global Wind Turbine Inspection Drones Market has been segmented into the following categories:Wind Turbine Inspection Drones Market, by Drone Type:

- Fixed-wing Drones

- Rotary-wing Drones

- Multirotor Drones

- Others

Wind Turbine Inspection Drones Market, by Application:

- Blade Inspection

- Tower Inspection

- Nacelle Inspection

- Others

Wind Turbine Inspection Drones Market, by End User:

- Wind Farm Operators

- Service Providers

- Original Equipment Manufacturers

- Others

Wind Turbine Inspection Drones Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wind Turbine Inspection Drones Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Wind Turbine Inspection Drones market report include:- SZ DJI Technology Co., Ltd.

- Cyberhawk Innovations Limited

- AeroVironment Inc

- SkySpecs Inc

- Delair SAS

- Aibotix GmbH

- Flyability

- Kespry

- Skyward

- Matternet

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

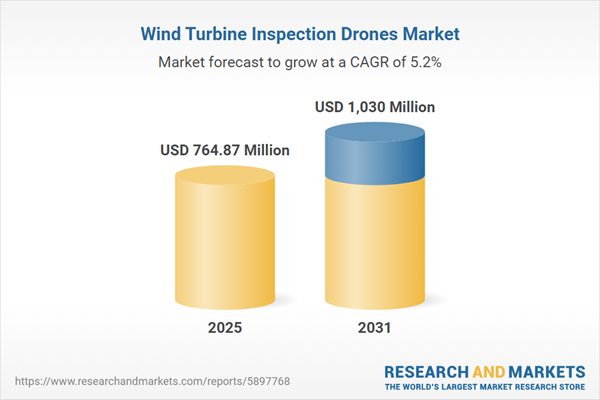

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 764.87 Million |

| Forecasted Market Value ( USD | $ 1030 Million |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |