Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increased Smartphone Penetration

The United States Virtual Visits Market has witnessed unprecedented growth in recent years, and one of the driving forces behind this surge is the increased penetration of smartphones. With more Americans than ever owning smartphones, the healthcare industry is tapping into this digital revolution to expand the accessibility and convenience of healthcare services. The ubiquity of smartphones ensures that a vast majority of the population has access to a powerful computing device with an internet connection. This accessibility transcends geographical and demographic boundaries, making virtual visits an inclusive option for patients from diverse backgrounds.Whether in urban centers or rural areas, patients can now connect with healthcare providers easily, overcoming the challenges of distance and transportation. Smartphones offer the convenience of on-the-go healthcare. Patients can schedule virtual appointments, consult with healthcare professionals, access medical records, and even receive prescription refills directly through their smartphones. This mobility is especially valuable for individuals with busy schedules, those in need of urgent medical advice, or patients with chronic conditions requiring continuous monitoring. Smartphones facilitate enhanced patient engagement in healthcare. Through dedicated healthcare apps and communication platforms, patients can stay connected with their providers, receive reminders for appointments and medication, and access educational resources.

This increased engagement not only fosters better adherence to treatment plans but also promotes a healthier lifestyle. Increased smartphone penetration has the potential to reduce healthcare disparities. Patients who may have previously faced barriers to healthcare, such as those in underserved communities or with limited mobility, can now access virtual visits with ease. This can help bridge the gap in healthcare access and improve health outcomes for marginalized populations. Smartphones can be integrated with various wearable devices and sensors to provide real-time health monitoring. Patients can track vital signs, such as heart rate, blood pressure, and glucose levels, and share this data with their healthcare providers during virtual visits. This data-driven approach allows for more informed decision-making and personalized care plans.

Healthcare providers have responded to the increased smartphone penetration by developing telehealth apps and platforms. These user-friendly applications enable patients to schedule appointments, communicate securely with their healthcare providers, and access their medical records. This integration of healthcare into the digital realm has made virtual visits a seamless experience. Smartphone-enabled virtual visits are often more cost-effective for both patients and healthcare providers. Patients save on transportation costs and potential time off work, while providers can streamline their operations and reduce overhead expenses. This cost-efficiency is attractive to both sides of the healthcare equation and encourages the adoption of virtual visits.

Changing Technology Landscape

The United States Virtual Visits Market has experienced remarkable growth in recent years, largely due to advancements in technology. As the technology landscape continues to evolve, virtual visits, also known as telehealth or telemedicine, have emerged as a powerful and convenient way to access healthcare services. One of the most significant contributors to the growth of virtual visits is the improvement in video conferencing technology. High-quality video and audio communication enable patients and healthcare providers to have real-time, face-to-face interactions regardless of their physical locations. This technology not only enhances the patient-provider relationship but also aids in accurate diagnoses and treatment planning. The proliferation of wearable devices, such as smartwatches and fitness trackers, has revolutionized healthcare. These devices can collect vital health data, which can be transmitted to healthcare providers for remote monitoring. Patients can share information about their heart rate, blood pressure, activity levels, and more, facilitating proactive healthcare management. The development of healthcare apps and dedicated telehealth platforms has made virtual visits more accessible and user-friendly.Patients can easily schedule appointments, access their medical records, and communicate securely with healthcare providers through these applications. This seamless integration of technology simplifies the virtual visit experience. AI and data analytics are playing an increasingly crucial role in healthcare, including virtual visits. AI-powered algorithms can analyze patient data, identify patterns, and offer personalized treatment recommendations. This not only enhances the efficiency of virtual visits but also improves diagnostic accuracy. The adoption of Electronic Health Records (EHRs) has streamlined the exchange of medical information during virtual visits. Healthcare providers can access patients' medical histories, test results, and treatment plans electronically, ensuring that virtual visits are as informative as in-person consultations. This integration of EHRs enhances the quality of care delivered remotely. The technology landscape has witnessed the development of secure communication platforms specifically designed for healthcare. These platforms prioritize patient privacy and data security, ensuring that sensitive medical information remains confidential during virtual visits. The use of secure communication technology has built trust in virtual healthcare services.

Key Market Challenges

Uneven Access to Technology

While smartphones and high-speed internet are widespread, there are still segments of the population that lack access to the necessary technology. Rural and underserved areas may have limited internet connectivity, and not everyone can afford a smartphone or computer. This digital divide poses a significant challenge as it restricts access to virtual healthcare services for certain demographics.Digital Literacy and Technological Barriers

Even when technology is available, not all patients are equally comfortable or proficient in using digital platforms for healthcare purposes. Elderly populations, in particular, may face challenges navigating virtual visit platforms, which can hinder their ability to access care. Healthcare providers need to offer user-friendly solutions and provide support to bridge the digital literacy gap.Data Security and Privacy Concerns

Patient data security and privacy are paramount in healthcare, and virtual visits are no exception. Ensuring that virtual platforms are secure and compliant with healthcare privacy regulations, such as HIPAA, is a constant challenge. Any breach or lapse in security can erode patient trust and hinder market growth.Integration with Existing Healthcare Systems

Integrating virtual visits seamlessly into existing healthcare systems and electronic health records (EHRs) can be complex. Inefficiencies in data exchange and integration can disrupt patient care and provider workflows. A lack of interoperability between different telehealth platforms can hinder the industry's growth and overall efficiency.Key Market Trends

Hybrid Care Models

A prominent trend on the horizon is the emergence of hybrid care models, where healthcare providers blend virtual and in-person services to create more flexible and patient-centric approaches to care. These models will enable patients to choose between virtual and physical visits, depending on their needs and preferences. Hybrid care will provide a more comprehensive and adaptable healthcare experience.Expansion of Specialty Services

Virtual visits are no longer limited to primary care consultations. Specialty services, including mental health counseling, dermatology, and even surgical consultations, are expanding rapidly in the virtual realm. As technology continues to improve, more specialized healthcare services will become accessible through virtual platforms, meeting the diverse needs of patients.Telehealth in Chronic Disease Management

Managing chronic diseases is a significant challenge in healthcare. Telehealth is expected to play a pivotal role in chronic disease management by enabling continuous monitoring, medication management, and regular virtual check-ups. This trend is expected to reduce healthcare costs and improve the quality of life for individuals with chronic conditions.Telehealth Equity and Inclusivity

Ensuring telehealth equity and inclusivity will remain a top priority. Efforts will be made to bridge the digital divide by providing technological access to underserved populations and addressing disparities in healthcare delivery. Initiatives to offer multilingual virtual healthcare services will also gain prominence.Segmental Insights

Service Type Insights

Based on the category of Service Type, the urgent care sector dominated the market, holding the largest share of revenue in 2023. The surge in demand for virtual visits within urgent care can be attributed to the convenience and accessibility they offer patients. By seamlessly incorporating technology into urgent care, people can now access medical advice and treatment remotely, eliminating the necessity for physical visits to healthcare facilities.The allergies sector is expected to exhibit the most rapid growth in terms of CAGR during the forecast period. Allergies, a prevalent health issue affecting a significant portion of the U.S. population, can range from causing mild discomfort to severe reactions. Virtual visits provide individuals with the option to receive medical guidance and treatment for allergy-related conditions without the need for in-person visits to healthcare facilities. These virtual appointments enable individuals to communicate with licensed healthcare providers through various online platforms, smartphone applications, and telecommunication channels. Those seeking care for allergies have found this increased accessibility to virtual appointments to be highly advantageous.

Commercial Plan Type Insights

Based on the commercial plan types, the self-funded/ASO group plans category emerged as the dominant segment in the market in 2023, holding the largest share of revenue. This can be attributed to the rising prevalence of chronic illnesses, the steep escalation in healthcare costs, and a growing demand for affordable healthcare solutions.The small group commercial plan segment is expected to experience the most rapid CAGR over the forecast period. The demand for virtual healthcare services has been steadily rising, particularly due to the impact of the COVID-19 pandemic. Numerous initiatives, undertaken by both public and private entities, aim to alleviate the healthcare cost burden on small businesses and their employees. This, in turn, is expected to drive the growth of the small group commercial plan segment.

Despite the various advantages offered by telehealth and virtual consultations, it's important to note that Medicare and Medicaid programs do not comprehensively cover all the expenses associated with these services. This coverage gap places a financial burden on patients and their caregivers. However, the implementation of specialized healthcare plans designed to address this issue has led to improved access to healthcare services and greater patient adherence. Consequently, the utilization of such plans has contributed to the expansion of this segment, creating more opportunities for individuals to access essential medical care through telehealth and virtual consultations.

Regional Insights

The North-East region is poised to dominate the United States Virtual Visits Market for several compelling reasons. The North-East is densely populated, with a significant concentration of healthcare providers, making it an ideal region for the proliferation of virtual healthcare services. Secondly, the region has a well-developed healthcare infrastructure and a high level of technological readiness, creating a favorable environment for the adoption of virtual visits.The North-East has a history of being at the forefront of healthcare innovation, with numerous prestigious medical institutions and research centers driving advancements in telehealth and virtual care technologies. The region's urban areas often experience heavy traffic and long commute times, making virtual visits an attractive and convenient alternative for patients seeking medical care. The North-East's proactive approach to healthcare policy and regulations has facilitated the integration of virtual visits into the healthcare ecosystem, further propelling its dominance in the market.

Report Scope:

In this report, the United States Virtual Visits Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Virtual Visits Market, By Service Type:

- Cold and Flu Management

- Allergies

- Urgent Care

- Preventive Care

- Chronic Care Management

- Behavioral Health

United States Virtual Visits Market, By Commercial Plan Type:

- Small Group

- Self-Funded/ASO Group Plans

- Medicaid

- Medicare

United States Virtual Visits Market, By Region:

- North-East

- Mid-West

- West

- South

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Virtual Visits Market.Available Customizations:

United States Virtual Visits market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- American Well Corporation

- MDLIVE Inc

- Doctor on Demand Inc

- Evisit LLC

- Teladoc Health Inc

- MeMD LLC

- HealthTap Inc

- Vidyo Inc

- PlushCare Inc

- Zipnosis Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | May 2024 |

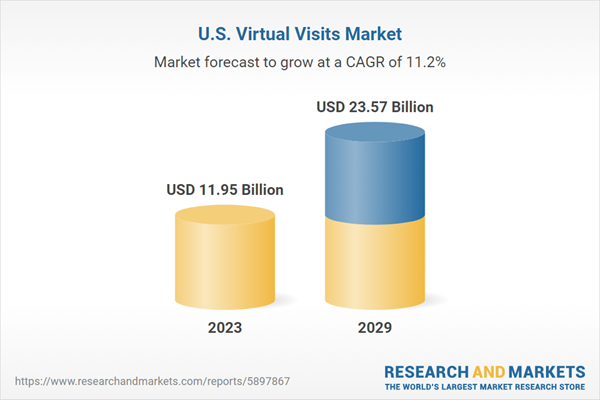

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 11.95 Billion |

| Forecasted Market Value ( USD | $ 23.57 Billion |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |