Alcohol Wipes Market Overview

Alcohol wipes are moist cloths containing isopropyl alcohol or ethanol used for disinfection. Their antiseptic properties make them commonly used in medical and everyday situations. These wipes can be used to sanitize skin, before medical procedures, or as a disinfect surfaces in healthcare settings. Containing 60-70% alcohol, they efficiently eliminate bacteria, viruses, and fungi, helping to control infections and maintain hygiene.Alcohol wipes are easy to use, taken out from the packaging and used on skin or surfaces for sanitization. In medical environments, the skin is cleaned before injections to lower the risk of infection while in households and public areas, people use these wipes for clean hands, mobile phones, and door handles to stop the spread of germs. Hospital-grade wipes contain significant amounts of alcohol for them to be suitable for medical facilities so they are packaged in a sterile manner, whereas wipes designed for everyday use may contain additional ingredients such as aloe vera to maintain skin moisture.

Alcohol wipes are essential for maintaining cleanliness and preventing the spread of infection in both healthcare and everyday environments. Improvements in alcohol wipe technology aim to enhance efficacy and user satisfaction with gentle ingredients for skin and upgraded packaging. Manufacturers are also working on preparing eco-friendly alternatives such as decomposable wipes and packaging that can be recycled to decrease negative effects on the environment. In general, alcohol wipes are a flexible and necessary tool for sanitizing, with continuous enhancements guaranteeing they stay a crucial asset for health and hygiene.

Alcohol Wipes Market Growth Drivers

Innovative Packaging Solutions Drive Market Expansion

Innovative packaging solutions play a crucial role in driving the growth of alcohol wipes market by improving product attractiveness and ease of use. Re-sealable packaging preserves moisture and effectiveness, favored in consumer goods for its convenience and durability whereas single-serving packets are becoming popular due to their convenience and ability to be used while on the move. Environmentally friendly packaging is increasingly used as it fulfills consumer expectations for eco-consciousness and reduces environmental impacts. High-tech materials such as anti-bacterial packaging enhance product safety and cleanliness, attracting both consumers and medical professionals. These packaging ideas set products apart in a tough market, impacting consumer choice and growing the market.In January 2024, Ginni Filaments Limited introduced eco-friendly wipes created from recycled PET bottles, in line with their dedication to sustainability.

Increasing Incidence of Infectious Diseases Boosts Global Alcohol Wipes Market Demand

Growing infectious diseases are propelling the global market for alcohol wipes. Infectious diseases such as influenza, hepatitis, tuberculosis, and hospital-acquired infections (HAIs) drive the demand for efficient disinfection. According to the WHO's 2024 Global Hepatitis Report, there is a growing number of deaths due to viral hepatitis, making it the second most common infectious cause of death globally, with 1.3 million deaths annually, equivalent to tuberculosis. The fast-acting antimicrobial qualities of alcohol wipes are essential for both healthcare settings and households as the infectious diseases require strict cleanliness. Rising understanding of such disease’s drives need for alcohol wipes in controlling infections.Alcohol Wipes Market Trends

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:

Demand from Healthcare Sector

Alcohol wipes are witnessing high demand as the healthcare industry depends on them to uphold cleanliness and prevent infections in medical facilities. Their widespread utilization for disinfecting medical equipment, surfaces, and the skin aids in reducing the chances of hospital-acquired infections. The growing number of surgeries and outpatient procedures continues to support the necessity for efficient disinfection methods, guaranteeing a steady requirement for alcohol wipes.COVID-19 Impact

The COVID-19 pandemic led to an increase in the need for alcohol wipes, crucial for sanitizing surfaces and hands to lower the spread of the virus. Manufacturers ramped up production to fulfill this unparalleled demand, adjusting supply chains and creating new formulae and packaging designs. The increased emphasis on cleanliness due to the pandemic has established alcohol wipes as a fundamental part of daily routines and public health measures.Rising Awareness of Hygiene

Public awareness regarding cleanliness has increased, leading to a higher need for alcohol wipes. There is a widespread recognition of the significance of sanitizing surfaces to prevent sickness, resulting in its common use in healthcare, homes, offices, and public spaces. Alcohol wipes are commonly used because they are efficient at eliminating germs. Education and health initiatives have encouraged the utilization of them, showcasing society's emphasis on well-being and hygiene.Convenience and Ease of Use

The convenience of alcohol wipes is attractive to busy people and families, guaranteeing their ongoing use in homes and companies. Consumers frequently choose alcohol wipes because they are convenient and effective for disinfecting. They provide a fast and effective alternative to conventional cleaning techniques. They are portable and come pre-moistened, making them suitable for cleaning different surfaces while on the move. Their disposable nature prevents the spread of germs, ensuring good hygiene. This convenience is attractive to those with hectic schedules, guaranteeing their ongoing utilization in homes and workplaces.Alcohol Wipes Market Segmentation

Market Breakup by Product Form

- Pre-Moistened Wipes

- Dry Wipes

Market Breakup by Packaging Type

- Soft Packs

- Canisters/Tubes

- Single-Use Packets

Market Breakup by Distribution Channel

- Online Retail

- Offline Retail

- Institutional Supply

Market Breakup by End User

- Healthcare Providers

- Consumers

- Business/Commercial

- Industrial Facilities

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Alcohol Wipes Market Share

Segmentation Based on Product Form to Undergo Substantial Growth

Based on product form, the market is divided into pre-moistened wipes and dry wipes based on the form of the product. Pre moistened wipes are expected to lead the market because of their convenience and efficiency.Pre moistened wipes are ready for immediate use. These wipes come with a predetermined amount of moisture and alcohol to effectively disinfect surfaces and hands. In addition, their ease of application, portability boosts its market share.

Market Share Based on Packaging Type

Based on the packaging type, the market is segmented into soft packs, canisters/tubes, and single-use packets. Among them, canisters/tubes are expected to dominate the market during the forecast period.Canisters/tubes are commonly used to package alcohol wipes because they are convenient and practical, making it easy to dispense one wipe at a time and keep the others moist. They are popular in places such as hospitals and clinics for regular cleaning, providing a clean way to use wipes. Robust packaging also safeguards wipes from getting contaminated and drying up.

Alcohol Wipes Market Analysis by Region

Based on region, the market report covers North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. North America is expected to dominate the market, propelled by stringent hygiene regulations and increased infection control awareness particularly in healthcare settings. The presence of key players and government regulations are driving the market. The strong retail and healthcare infrastructure in both the U.S. and Canada contribute to dominate the market.Focus on personal hygiene, and strict regulations contribute to the thriving alcohol wipes market in Europe. The market in the Asia-Pacific region is rapidly expanding due to increasing healthcare awareness. China, Japan, and India are significant contributors with vast populations and well-developed healthcare systems.

Leading Players in the Global Alcohol Wipes Market

The key features of the market report include patent analysis, grant analysis, funding, and investment analysis as well as strategic initiatives including recent partnerships and collaborations by the leading players. The major companies in the market are as follows:Clorox Company

Clorox Co produces and sells various consumer and professional products such as grilling items, digestive health supplements, cat litter, dressings, cleaning supplies, and home care products. They market products using names like Clorox, Hidden Valley, Kingsford, and Brita. Their Clorox Healthcare ® Multi-Surface Quat Alcohol Cleaner Disinfectant Wipes are specifically made for healthcare environments and are efficient in eliminating Norovirus and bacteria that cause Healthcare-Associated Infections (HAIs).Gojo Industries, Inc.

GOJO Industries, Inc. offers a wide range of skin health and hygiene products, including sanitizer, soaps, shampoo, handwash, towels. Founded in 1946 and based in Akron, Ohio, the company ensures cleanliness and germ-free hands with its flagship product Purell Hand Sanitizing Wipes. These alcohol-based wipes kill 99.99% of common germs, are non-linting and textured for easy use, and meet FDA requirements for Food Code compliance. The fragrance-free formula leaves no sticky residue.Ecolab Inc.

Established in 1923 and headquartered in Minnesota, USA, Ecolab Inc. provides water, hygiene, and infection prevention solutions to several industries. They offer services related to food safety, sanitation, water and energy efficiency, and operational efficiency. Incidin ™ Alcohol Wipe is a disinfectant for medical equipment that has a wide range of effectiveness and leaves no active residues.Hardy Diagnostics, Inc.

Hardy Diagnostics is a firm that produces medical items like culture media, reagents, and rapid identification kits for microbiological examinations. It was established in 1980 and headquartered in Ohio, United States. The company also have a role in the alcohol wipes such as Bio-Pure™ Alcohol wipes. These are biodegradable wipes which are efficient in combating viruses and bacteria. The wipes are long-lasting, do not leave lint, and are gentle on surfaces.Other players in the market Berkshire Corporation, Johnson & Johnson Services Inc., Kimberly-Clark Corporation, Medline Industries, Inc., Procter & Gamble Co., Sani Professional.

Key Questions Answered in the Alcohol Wipes Market Report

- What was the global alcohol wipes market value in 2024?

- What is the global alcohol wipes market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is market segmentation based on product form?

- What is market segmentation based on packaging type?

- What is the market breakup based on end users?

- What are the major distribution channels in the market?

- What are the major factors aiding the global alcohol wipes market demand?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the major drivers, opportunities, and restraints in the market?

- What are the major trends influencing the market?

- Which regional market is expected to dominate the market share in the forecast period?

- Which country is likely to experience elevated growth during the forecast period?

- Who are the key players involved in the global alcohol wipes market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers, and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Clorox Company

- Gojo Industries, Inc.

- Ecolab Inc.

- Hardy Diagnostics, Inc.

Table Information

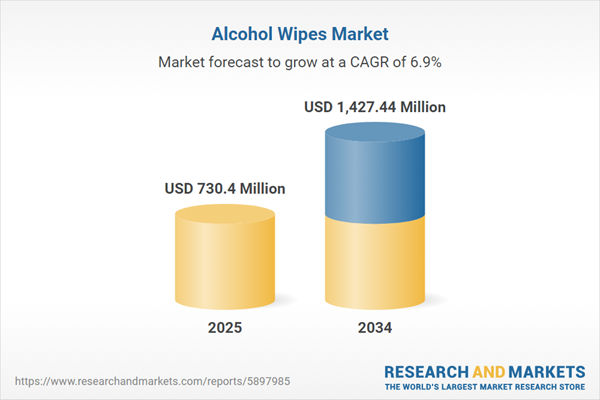

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 730.4 Million |

| Forecasted Market Value ( USD | $ 1427.44 Million |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |